Estate Planning

Estate Planning: A Comprehensive Guide

Kris Kopac

May 17, 2023

Do you have an estate plan?

Estate planning, or end-of-life planning, is one of the most important things you can do for yourself and your family.

Your estate plan is a roadmap for who will take care of your children and/or pets and who will inherit the assets you worked so hard to accumulate when you pass on. Estate plans can also dictate who will make decisions about your medical care if you are unable to make decisions for yourself. Without an estate plan, the laws and courts in your state will make some of those decisions for you, and they may not know your wishes.

End-of-life planning is essential for everyone. However, estate planning is also one of the easiest things to put off, because no one likes thinking about what will happen after they die. In fact, a study by AARP found that nearly 60% of American adults don’t have a will or living trust.

We know that it can be tough to get started on end-of-life planning. That’s why we put together this simple guide for you. We will walk you through the basics of estate planning step-by-step.

What is an estate plan?

Simply put, an estate plan is a guide for your loved ones, trusted professionals, and the courts to make sure that your wishes are fulfilled when you pass away or are incapacitated.Your “estate” is all of your property and assets, including your home, personal property, financial assets, family heirlooms, valuables, and even digital currency.An estate plan consists of multiple different documents that cover how to distribute those assets, who will care for your dependents, and how to manage your healthcare emergencies.The specific documents and pieces of your estate plan will vary according to your family, situation, priorities, finances, and the state you live in.

Do I need an estate plan?

Yes! Every adult should have an estate plan, even if you have no children or assets.

If you die without a will (dying intestate), the state will step in to decide what happens to your assets and who your heirs are. Your assets could be tied up in probate court. This process adds time, stress, and additional costs for your loved ones, and could leave a very different legacy than the one you would choose.

It is particularly important to have an estate plan if you have:

A spouse: In many cases, your spouse will inherit your possessions if you die without a plan, but that is not always guaranteed. Your estate plan makes sure that your spouse receives the support they need.

Kids, pets, or other dependents: you need an estate plan to specify who will be your dependents’ guardian if something happens to you. Your estate plan can also designate funds for their care.

Why do I need an estate plan?

Among many other benefits, your estate plan can:

Allow you to choose who inherits specific assets, possessions, and other valuables.

Reduce the time and cost it takes for the courts to settle your estate.

Name guardian(s) for your dependents.

Reduce family conflicts over your estate.

Help you reduce taxes on your estate for your heirs.

Outline a plan for your funeral to reduce stress on your loved ones while they are grieving.

Designate someone you trust to make medical decisions for you if you cannot make them for yourself.

Assign a loved one or trusted advisor to manage your finances if you cannot manage them independently.

Organize your estate documents in Trustworthy.

How to make an estate plan

Step 1: Decide whether to bring in an expert.

The first step in creating an estate plan is deciding whether to bring in professionals like an estate planning attorney or a financial advisor to help. These experts can help you manage more complex estates and ensure that everything in your plan is airtight.

While everyone would benefit from working with estate planning experts, you would particularly need professional support if you:

Own a vacation home or other property in a different state.

Have a partner with whom you aren’t legally married.

Have a divorce or custody agreement in place.

Remarried or have a blended family — especially if you have children.

Prefer that someone does (or doesn’t) get access to you at the hospital.

Are concerned about state or federal estate and gift taxes.

If you use Trustworthy, you can add your attorney and financial advisor to your Trustworthy account to collaborate on your estate plan. Our expert team can also help you gather paperwork or documents to share with your estate planning attorney.

Add a new collaborator in Trustworthy

Step 2: Make a list of your physical possessions

Before you can decide what will happen to your possessions, you need to make sure that you are accounting for all of them.

You should list everything of value, including your home (if you own it), vehicles, jewelry, art, antiques, family heirlooms, computers, tvs, power tools, and other electronics.

Property category in Trustworthy

Are you overwhelmed by the idea of trying to find all your property and assets? Trustworthy is here to help. Instead of starting with a blank page, our AI creates a customized template for you to inventory your possessions.

Organize property details

Even better, you can add important information that your loved ones will need to know about the property, from account numbers to family stories. Simply sign into Trustworthy, go to the Property tab, and start filling in your template.

Step 3: List your digital possessions

Our lives are increasingly lived in the digital as well as the physical world. As such, estate planning has to take your digital assets and life into account.

Put together a list of all your email and social media accounts, cryptocurrency, money transfer apps (like PayPal and Venmo), and important passwords.

Most of your digital estate plan should be kept out of your will. Your will becomes public after you die, and it would not be good for your important passwords and accounts to end up in the hands of nefarious strangers. The digital world also changes faster than the physical world, and you don’t want to have to update your will every time you change a password or create a new account.

You can list your important digital accounts and passwords in the Passwords section of Trustworthy, or find a secure location where your family members can access the information.

Step 4: List your debts

Next, it is time to inventory all of your debts, from credit cards to mortgages, personal loans, auto loans, and private student loans.

In your list, you should add account numbers, contact information for the companies, and where to find any related documents or agreements.

Connect financial accounts with Plaid

Trustworthy makes this process easy. In the Money tab, you can enter credit cards and loans. With your permission, Trustworthy can automatically pull in your account information with Plaid and add the company’s contact information.

Once you are finished with your list of debts, make copies of your lists of assets and debts for your estate planning experts, your executor, and your partner. You can also invite them as collaborators to your Trustworthy account.

Step 5: Check and update the beneficiaries on your retirement accounts and insurance policies.

An essential part of estate planning is checking and updating the beneficiaries on your financial accounts and insurance policies. If you have designated a beneficiary, the account will pass on to them no matter what your will says about how your assets will be divided.

Many accounts will allow you to update your beneficiaries online. However, if your 401k account or life insurance is provided through work, you may have to contact your company’s plan administrator to check and update your beneficiaries.

Step 6: Choose an executor and guardians (if you have children)

The next step is to choose your executor. An executor is a person who is selected to manage the execution of your last will and testament and make sure that your wishes are carried out.

Executing a will can take dozens of hours of phone calls, paperwork, and diligence and years of work. For that reason, it is important to choose an executor who has the administrative and organizational chops to get things done.

Some people choose not to name a close family member as the executor of their will because they understand the emotional pain this task may cause. Whatever you decide, you should inform your chosen executor of your decision and ask them if they’re able to take on the role, as it is a big commitment on their end.

You can name more than one executor. However, it is important to note that your executors would have to make all decisions unanimously, which might be difficult in such a challenging time. If you name more than one executor, every executor must co-sign paperwork.

It’s also a good idea to name someone as a backup, in case your first choice isn’t able to perform the duties.

Step 7: Create a will.

Once you have your lists of assets and debts and your executor in place, it is time to start creating the documents in your estate plan. We recommend that you start with your will, the centerpiece of your estate plan.

Many lawyers will help you create a will for less than $1,000.

You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Your will should include:

Assets and property - the property and assets you are passing on to your loved ones, from your 401(k) and your house deed to grandpa’s favorite watch.

Beneficiaries - the people who will inherit your property and assets.

Custodian/Trustee - an adult custodian who is named to manage money in a trust account on behalf of a beneficiary who is a minor.

Executor - Someone to manage your will and close your estate. An executor is also called an administrator or personal representative

Guardian - the person/people selected to take care of your kid(s) and pet(s).

Instructions on finances, distribution of money, and paying debts.

Additional funeral or burial instructions.

Gifts to individuals or charities.

Once you have drafted your will with your lawyer or an online service, it is time to sign and notarize it. Although a probate judge may adhere to the instructions of an unsigned will if there is reason to believe it represents your true intentions, an unsigned will is not sufficient proof of your intentions. There is no guarantee that your wishes will be carried out if your will is unsigned.

It is standard procedure to sign your will in the presence of two witnesses. They will also sign your will to validate it.

Signing your will with your two witnesses and a notary present is an additional safeguard to ensure your will is legally binding, although it isn’t required in most states. You can usually find a free notary service at your bank or credit union, and some UPS stores offer notary services for a nominal fee. You could work with a mobile notary who will travel to your office or home for an additional fee.

An increasing number of states have legalized online notary services, but you should check your state’s laws before getting your will notarized online.

Step 8: Complete your estate plan.

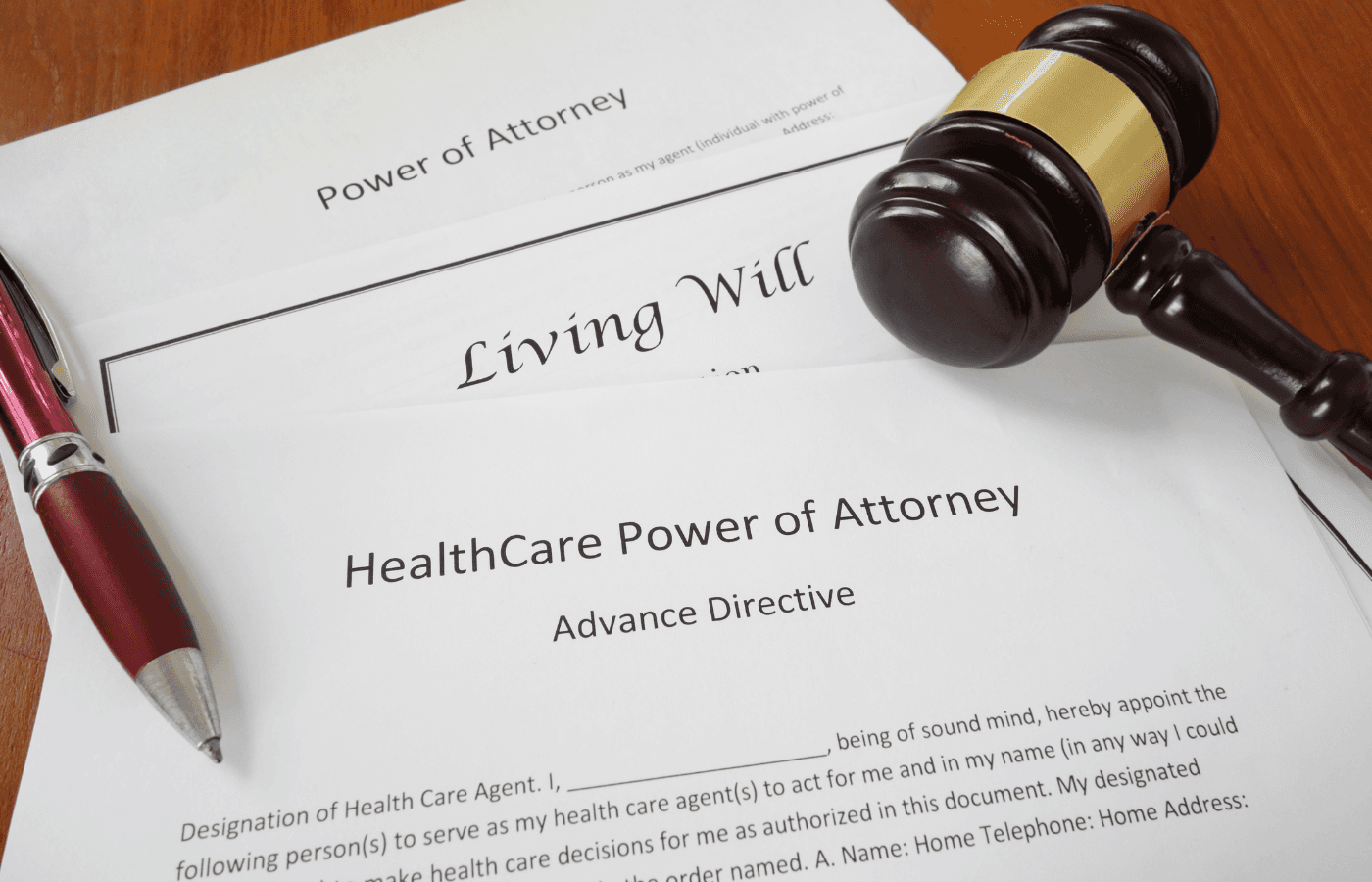

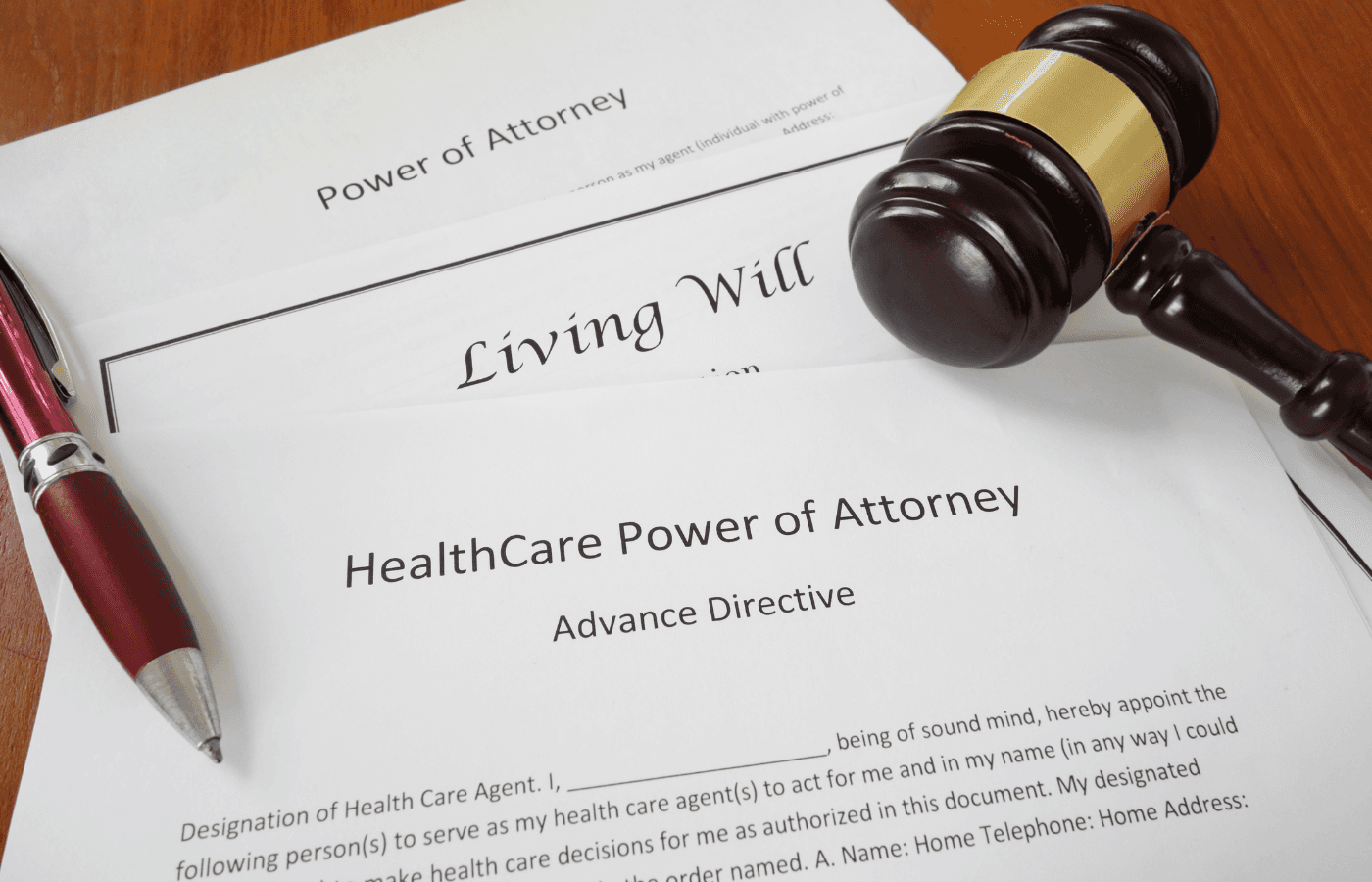

With your will completed, it’s time to finish the other documents in your estate plan.

We will cover how to create two of the most common documents: a power of attorney and a living will (advance healthcare directive). As with your last will and testament, your estate planning attorney can also help you create these documents, or you can work with an online service.

Create a power of attorney (POA)

The power of attorney (POA) document names specific people who will take care of important matters - such as financial and medical decisions - on your behalf while you are alive. After you have passed away, the POA is revoked and your will becomes effective.

In your power of attorney, you do not have to choose only one person to take care of your affairs while you are unable to make decisions for yourself. In fact, you should name a backup person for each role in case your first choice isn’t able to carry out their responsibilities.

The different powers of attorney include:

Executive power of attorney

An executive POA takes the lead in managing big decisions on your behalf. If you have named several different POAs, this person will do their best to ensure your wishes are being carried out by the team you chose. If you don’t name POAs for different roles, the executive POA will cover all these roles. Once you die, the executor of your will takes over managing your wishes.

Medical power of attorney

A medical POA advocates for you when you are unable to communicate your medical preferences or provide consent for procedures. For example, if you are in the hospital with a severe injury that has caused you to lose consciousness, a medical POA will step in to advocate for you. The medical POA does not apply to end-of-life decisions. Designating a medical POA is not the same as completing a living will, which we will discuss in the next section.

Financial power of attorney

A financial POA manages your personal accounts. An accountant can provide an annual review to manage your bank accounts, or your executive POA can hire a professional to manage your bookkeeping, file taxes, and review statements.

Digital power of attorney

For many, our administrative lives now center around digital accounts. A digital POA is granted access to your online and digital accounts to help needed transactions run smoothly.

In order to make your digital POA’s tasks more easy and accessible, consider granting them access to a password manager so they are able to log into the necessary accounts. For example, if your executive POA has access to your Trustworthy account, they can share your password information with your digital POA.

Create a living will (advanced care directive)

A living will (also known as an advance directive, healthcare directive, declaration, or directive to physicians) records your wishes around end-of-life care if you are unable to speak for yourself. It is state-specific and legally binding.

As with your last will and testament, it is important to make a living will in advance. Once you actually need a living will, it is too late to create one.

What to include in your living will

A living will should be as specific as possible because very few medical decisions are cut-and-dried. Clearer guideposts about the types of medical care you do and do not want to receive will help remove some of the uncertainty in end-of-life decisions for your loved ones.

What does your quality of life mean to you? Answering that question in your living will helps your medical POA speak for you. The more specific your answer, the better.

A living will may answer questions around whether you do/do not want to receive:

Antibiotics

Cardiac resuscitation

Invasive diagnostic tests or procedures

Mechanical respiration

Kidney dialysis

Tube feeding

Experimental medical procedures

A living will requires witness signatures and sometimes notarization, depending on the state in which you live. Some states also do not allow the following people to act as your witness:

Someone who may inherit part of your estate

Someone named in your last will and testament

A relative by blood or marriage

You can find a notary at your bank, credit union, library, county clerk’s office, or local UPS store. An increasing number of states will also let you use online notary services, but you should check the law in your home state before working with an online notary.

Step 9: Give your executor a copy of your estate documents

Your estate plan documents are finished; great work! You have made it to the last step. Now, it is time to make sure that the people you have chosen to manage your affairs have the information they need to do so.

Make copies of your estate plan documents and give them to your executor and POAs. You should also tell them and the other people named in your will where your original will is stored.

The location that you choose for your original estate documents should be secure. Keep your original estate documents with your attorney, or in a safe spot with other important information.

Connect financial accounts with Plaid

If you use Trustworthy, you can complete this step with a few clicks of a button. Simply upload your plan into the Estate Documents section of Trustworthy, and invite your executor and POAs as collaborators in your account.

How often to update an estate plan

Now that your estate plan is completed, all the work is done, right?

Not quite. You have finished the most time consuming and difficult part of estate planning, but you still need to make sure that your plan changes as life does. You should review your estate plan at least once every four years to make sure it reflects your current wishes and assets.

You should also update your plan after life-changing events, like getting married or divorced or having a child.

Finally, you should keep an eye on financial legislation and changes to tax laws that could affect your estate and change your plan accordingly. If you have worked with a financial advisor or estate planning attorney, they can help you figure out when these changes might require you to update your estate.

Trustworthy reminders save members time and money.

No need to set a calendar reminder. If you add your estate plan to Trustworthy, we will add an automated reminder for you to review and update your estate plan regularly. We remember so you don’t have to.

What documents are part of an estate plan?

There are three main documents that frequently included in estate planning: a last will and testament, a power of attorney, and a living will (or “advance care directive”).

Depending on your circumstances, you may want or need to make additional documents part of your estate plan. We have included the most common ones.

Adding a will to Trustworthy.

Last will and testament

Who gets which family heirlooms? How will your financial assets be divided? Who will take care of your children or pets? These are all crucial answers that a will provides for those you leave behind.

Your last will and testament, or will, is the centerpiece of your estate plan. Wills are state-specific, legally binding documents that state your wishes and instructions on subjects like who will inherit your possessions and how to care for your dependents.

Many lawyers will help you create a will for less than $1,000. You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Power of attorney (POA)

A power of attorney is a legally binding document that allows you to name people to make key decisions for you if you are incapacitated. You can name several people in your POA document to handle specific situations, such as college funds or childcare.

Living will (advanced care directive)

A living will records your end-of-life wishes about what types of medical care you do (or do not) want if you are unable to speak for yourself.

Healthcare proxy

A document that names someone to make medical decisions for you if you are incapacitated.

Letter of instruction

A document that covers informal estate information that isn’t addressed in your will. The letter could include a last message for your loved ones, details on where to find the possessions in the will, or funeral plans.

Beneficiary designation

Forms that allow you to transfer assets like financial accounts, retirement accounts, or life insurance policies directly to the recipient, regardless of the terms in your will.

Trust

A legal arrangement where a third party (trustee) holds assets on behalf of your beneficiaries. Trusts have a few benefits in addition to your will: they can specify how and when your assets pass to your beneficiaries.

Estate Planning

Estate Planning: A Comprehensive Guide

Kris Kopac

May 17, 2023

Do you have an estate plan?

Estate planning, or end-of-life planning, is one of the most important things you can do for yourself and your family.

Your estate plan is a roadmap for who will take care of your children and/or pets and who will inherit the assets you worked so hard to accumulate when you pass on. Estate plans can also dictate who will make decisions about your medical care if you are unable to make decisions for yourself. Without an estate plan, the laws and courts in your state will make some of those decisions for you, and they may not know your wishes.

End-of-life planning is essential for everyone. However, estate planning is also one of the easiest things to put off, because no one likes thinking about what will happen after they die. In fact, a study by AARP found that nearly 60% of American adults don’t have a will or living trust.

We know that it can be tough to get started on end-of-life planning. That’s why we put together this simple guide for you. We will walk you through the basics of estate planning step-by-step.

What is an estate plan?

Simply put, an estate plan is a guide for your loved ones, trusted professionals, and the courts to make sure that your wishes are fulfilled when you pass away or are incapacitated.Your “estate” is all of your property and assets, including your home, personal property, financial assets, family heirlooms, valuables, and even digital currency.An estate plan consists of multiple different documents that cover how to distribute those assets, who will care for your dependents, and how to manage your healthcare emergencies.The specific documents and pieces of your estate plan will vary according to your family, situation, priorities, finances, and the state you live in.

Do I need an estate plan?

Yes! Every adult should have an estate plan, even if you have no children or assets.

If you die without a will (dying intestate), the state will step in to decide what happens to your assets and who your heirs are. Your assets could be tied up in probate court. This process adds time, stress, and additional costs for your loved ones, and could leave a very different legacy than the one you would choose.

It is particularly important to have an estate plan if you have:

A spouse: In many cases, your spouse will inherit your possessions if you die without a plan, but that is not always guaranteed. Your estate plan makes sure that your spouse receives the support they need.

Kids, pets, or other dependents: you need an estate plan to specify who will be your dependents’ guardian if something happens to you. Your estate plan can also designate funds for their care.

Why do I need an estate plan?

Among many other benefits, your estate plan can:

Allow you to choose who inherits specific assets, possessions, and other valuables.

Reduce the time and cost it takes for the courts to settle your estate.

Name guardian(s) for your dependents.

Reduce family conflicts over your estate.

Help you reduce taxes on your estate for your heirs.

Outline a plan for your funeral to reduce stress on your loved ones while they are grieving.

Designate someone you trust to make medical decisions for you if you cannot make them for yourself.

Assign a loved one or trusted advisor to manage your finances if you cannot manage them independently.

Organize your estate documents in Trustworthy.

How to make an estate plan

Step 1: Decide whether to bring in an expert.

The first step in creating an estate plan is deciding whether to bring in professionals like an estate planning attorney or a financial advisor to help. These experts can help you manage more complex estates and ensure that everything in your plan is airtight.

While everyone would benefit from working with estate planning experts, you would particularly need professional support if you:

Own a vacation home or other property in a different state.

Have a partner with whom you aren’t legally married.

Have a divorce or custody agreement in place.

Remarried or have a blended family — especially if you have children.

Prefer that someone does (or doesn’t) get access to you at the hospital.

Are concerned about state or federal estate and gift taxes.

If you use Trustworthy, you can add your attorney and financial advisor to your Trustworthy account to collaborate on your estate plan. Our expert team can also help you gather paperwork or documents to share with your estate planning attorney.

Add a new collaborator in Trustworthy

Step 2: Make a list of your physical possessions

Before you can decide what will happen to your possessions, you need to make sure that you are accounting for all of them.

You should list everything of value, including your home (if you own it), vehicles, jewelry, art, antiques, family heirlooms, computers, tvs, power tools, and other electronics.

Property category in Trustworthy

Are you overwhelmed by the idea of trying to find all your property and assets? Trustworthy is here to help. Instead of starting with a blank page, our AI creates a customized template for you to inventory your possessions.

Organize property details

Even better, you can add important information that your loved ones will need to know about the property, from account numbers to family stories. Simply sign into Trustworthy, go to the Property tab, and start filling in your template.

Step 3: List your digital possessions

Our lives are increasingly lived in the digital as well as the physical world. As such, estate planning has to take your digital assets and life into account.

Put together a list of all your email and social media accounts, cryptocurrency, money transfer apps (like PayPal and Venmo), and important passwords.

Most of your digital estate plan should be kept out of your will. Your will becomes public after you die, and it would not be good for your important passwords and accounts to end up in the hands of nefarious strangers. The digital world also changes faster than the physical world, and you don’t want to have to update your will every time you change a password or create a new account.

You can list your important digital accounts and passwords in the Passwords section of Trustworthy, or find a secure location where your family members can access the information.

Step 4: List your debts

Next, it is time to inventory all of your debts, from credit cards to mortgages, personal loans, auto loans, and private student loans.

In your list, you should add account numbers, contact information for the companies, and where to find any related documents or agreements.

Connect financial accounts with Plaid

Trustworthy makes this process easy. In the Money tab, you can enter credit cards and loans. With your permission, Trustworthy can automatically pull in your account information with Plaid and add the company’s contact information.

Once you are finished with your list of debts, make copies of your lists of assets and debts for your estate planning experts, your executor, and your partner. You can also invite them as collaborators to your Trustworthy account.

Step 5: Check and update the beneficiaries on your retirement accounts and insurance policies.

An essential part of estate planning is checking and updating the beneficiaries on your financial accounts and insurance policies. If you have designated a beneficiary, the account will pass on to them no matter what your will says about how your assets will be divided.

Many accounts will allow you to update your beneficiaries online. However, if your 401k account or life insurance is provided through work, you may have to contact your company’s plan administrator to check and update your beneficiaries.

Step 6: Choose an executor and guardians (if you have children)

The next step is to choose your executor. An executor is a person who is selected to manage the execution of your last will and testament and make sure that your wishes are carried out.

Executing a will can take dozens of hours of phone calls, paperwork, and diligence and years of work. For that reason, it is important to choose an executor who has the administrative and organizational chops to get things done.

Some people choose not to name a close family member as the executor of their will because they understand the emotional pain this task may cause. Whatever you decide, you should inform your chosen executor of your decision and ask them if they’re able to take on the role, as it is a big commitment on their end.

You can name more than one executor. However, it is important to note that your executors would have to make all decisions unanimously, which might be difficult in such a challenging time. If you name more than one executor, every executor must co-sign paperwork.

It’s also a good idea to name someone as a backup, in case your first choice isn’t able to perform the duties.

Step 7: Create a will.

Once you have your lists of assets and debts and your executor in place, it is time to start creating the documents in your estate plan. We recommend that you start with your will, the centerpiece of your estate plan.

Many lawyers will help you create a will for less than $1,000.

You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Your will should include:

Assets and property - the property and assets you are passing on to your loved ones, from your 401(k) and your house deed to grandpa’s favorite watch.

Beneficiaries - the people who will inherit your property and assets.

Custodian/Trustee - an adult custodian who is named to manage money in a trust account on behalf of a beneficiary who is a minor.

Executor - Someone to manage your will and close your estate. An executor is also called an administrator or personal representative

Guardian - the person/people selected to take care of your kid(s) and pet(s).

Instructions on finances, distribution of money, and paying debts.

Additional funeral or burial instructions.

Gifts to individuals or charities.

Once you have drafted your will with your lawyer or an online service, it is time to sign and notarize it. Although a probate judge may adhere to the instructions of an unsigned will if there is reason to believe it represents your true intentions, an unsigned will is not sufficient proof of your intentions. There is no guarantee that your wishes will be carried out if your will is unsigned.

It is standard procedure to sign your will in the presence of two witnesses. They will also sign your will to validate it.

Signing your will with your two witnesses and a notary present is an additional safeguard to ensure your will is legally binding, although it isn’t required in most states. You can usually find a free notary service at your bank or credit union, and some UPS stores offer notary services for a nominal fee. You could work with a mobile notary who will travel to your office or home for an additional fee.

An increasing number of states have legalized online notary services, but you should check your state’s laws before getting your will notarized online.

Step 8: Complete your estate plan.

With your will completed, it’s time to finish the other documents in your estate plan.

We will cover how to create two of the most common documents: a power of attorney and a living will (advance healthcare directive). As with your last will and testament, your estate planning attorney can also help you create these documents, or you can work with an online service.

Create a power of attorney (POA)

The power of attorney (POA) document names specific people who will take care of important matters - such as financial and medical decisions - on your behalf while you are alive. After you have passed away, the POA is revoked and your will becomes effective.

In your power of attorney, you do not have to choose only one person to take care of your affairs while you are unable to make decisions for yourself. In fact, you should name a backup person for each role in case your first choice isn’t able to carry out their responsibilities.

The different powers of attorney include:

Executive power of attorney

An executive POA takes the lead in managing big decisions on your behalf. If you have named several different POAs, this person will do their best to ensure your wishes are being carried out by the team you chose. If you don’t name POAs for different roles, the executive POA will cover all these roles. Once you die, the executor of your will takes over managing your wishes.

Medical power of attorney

A medical POA advocates for you when you are unable to communicate your medical preferences or provide consent for procedures. For example, if you are in the hospital with a severe injury that has caused you to lose consciousness, a medical POA will step in to advocate for you. The medical POA does not apply to end-of-life decisions. Designating a medical POA is not the same as completing a living will, which we will discuss in the next section.

Financial power of attorney

A financial POA manages your personal accounts. An accountant can provide an annual review to manage your bank accounts, or your executive POA can hire a professional to manage your bookkeeping, file taxes, and review statements.

Digital power of attorney

For many, our administrative lives now center around digital accounts. A digital POA is granted access to your online and digital accounts to help needed transactions run smoothly.

In order to make your digital POA’s tasks more easy and accessible, consider granting them access to a password manager so they are able to log into the necessary accounts. For example, if your executive POA has access to your Trustworthy account, they can share your password information with your digital POA.

Create a living will (advanced care directive)

A living will (also known as an advance directive, healthcare directive, declaration, or directive to physicians) records your wishes around end-of-life care if you are unable to speak for yourself. It is state-specific and legally binding.

As with your last will and testament, it is important to make a living will in advance. Once you actually need a living will, it is too late to create one.

What to include in your living will

A living will should be as specific as possible because very few medical decisions are cut-and-dried. Clearer guideposts about the types of medical care you do and do not want to receive will help remove some of the uncertainty in end-of-life decisions for your loved ones.

What does your quality of life mean to you? Answering that question in your living will helps your medical POA speak for you. The more specific your answer, the better.

A living will may answer questions around whether you do/do not want to receive:

Antibiotics

Cardiac resuscitation

Invasive diagnostic tests or procedures

Mechanical respiration

Kidney dialysis

Tube feeding

Experimental medical procedures

A living will requires witness signatures and sometimes notarization, depending on the state in which you live. Some states also do not allow the following people to act as your witness:

Someone who may inherit part of your estate

Someone named in your last will and testament

A relative by blood or marriage

You can find a notary at your bank, credit union, library, county clerk’s office, or local UPS store. An increasing number of states will also let you use online notary services, but you should check the law in your home state before working with an online notary.

Step 9: Give your executor a copy of your estate documents

Your estate plan documents are finished; great work! You have made it to the last step. Now, it is time to make sure that the people you have chosen to manage your affairs have the information they need to do so.

Make copies of your estate plan documents and give them to your executor and POAs. You should also tell them and the other people named in your will where your original will is stored.

The location that you choose for your original estate documents should be secure. Keep your original estate documents with your attorney, or in a safe spot with other important information.

Connect financial accounts with Plaid

If you use Trustworthy, you can complete this step with a few clicks of a button. Simply upload your plan into the Estate Documents section of Trustworthy, and invite your executor and POAs as collaborators in your account.

How often to update an estate plan

Now that your estate plan is completed, all the work is done, right?

Not quite. You have finished the most time consuming and difficult part of estate planning, but you still need to make sure that your plan changes as life does. You should review your estate plan at least once every four years to make sure it reflects your current wishes and assets.

You should also update your plan after life-changing events, like getting married or divorced or having a child.

Finally, you should keep an eye on financial legislation and changes to tax laws that could affect your estate and change your plan accordingly. If you have worked with a financial advisor or estate planning attorney, they can help you figure out when these changes might require you to update your estate.

Trustworthy reminders save members time and money.

No need to set a calendar reminder. If you add your estate plan to Trustworthy, we will add an automated reminder for you to review and update your estate plan regularly. We remember so you don’t have to.

What documents are part of an estate plan?

There are three main documents that frequently included in estate planning: a last will and testament, a power of attorney, and a living will (or “advance care directive”).

Depending on your circumstances, you may want or need to make additional documents part of your estate plan. We have included the most common ones.

Adding a will to Trustworthy.

Last will and testament

Who gets which family heirlooms? How will your financial assets be divided? Who will take care of your children or pets? These are all crucial answers that a will provides for those you leave behind.

Your last will and testament, or will, is the centerpiece of your estate plan. Wills are state-specific, legally binding documents that state your wishes and instructions on subjects like who will inherit your possessions and how to care for your dependents.

Many lawyers will help you create a will for less than $1,000. You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Power of attorney (POA)

A power of attorney is a legally binding document that allows you to name people to make key decisions for you if you are incapacitated. You can name several people in your POA document to handle specific situations, such as college funds or childcare.

Living will (advanced care directive)

A living will records your end-of-life wishes about what types of medical care you do (or do not) want if you are unable to speak for yourself.

Healthcare proxy

A document that names someone to make medical decisions for you if you are incapacitated.

Letter of instruction

A document that covers informal estate information that isn’t addressed in your will. The letter could include a last message for your loved ones, details on where to find the possessions in the will, or funeral plans.

Beneficiary designation

Forms that allow you to transfer assets like financial accounts, retirement accounts, or life insurance policies directly to the recipient, regardless of the terms in your will.

Trust

A legal arrangement where a third party (trustee) holds assets on behalf of your beneficiaries. Trusts have a few benefits in addition to your will: they can specify how and when your assets pass to your beneficiaries.

Estate Planning

Estate Planning: A Comprehensive Guide

Kris Kopac

May 17, 2023

Do you have an estate plan?

Estate planning, or end-of-life planning, is one of the most important things you can do for yourself and your family.

Your estate plan is a roadmap for who will take care of your children and/or pets and who will inherit the assets you worked so hard to accumulate when you pass on. Estate plans can also dictate who will make decisions about your medical care if you are unable to make decisions for yourself. Without an estate plan, the laws and courts in your state will make some of those decisions for you, and they may not know your wishes.

End-of-life planning is essential for everyone. However, estate planning is also one of the easiest things to put off, because no one likes thinking about what will happen after they die. In fact, a study by AARP found that nearly 60% of American adults don’t have a will or living trust.

We know that it can be tough to get started on end-of-life planning. That’s why we put together this simple guide for you. We will walk you through the basics of estate planning step-by-step.

What is an estate plan?

Simply put, an estate plan is a guide for your loved ones, trusted professionals, and the courts to make sure that your wishes are fulfilled when you pass away or are incapacitated.Your “estate” is all of your property and assets, including your home, personal property, financial assets, family heirlooms, valuables, and even digital currency.An estate plan consists of multiple different documents that cover how to distribute those assets, who will care for your dependents, and how to manage your healthcare emergencies.The specific documents and pieces of your estate plan will vary according to your family, situation, priorities, finances, and the state you live in.

Do I need an estate plan?

Yes! Every adult should have an estate plan, even if you have no children or assets.

If you die without a will (dying intestate), the state will step in to decide what happens to your assets and who your heirs are. Your assets could be tied up in probate court. This process adds time, stress, and additional costs for your loved ones, and could leave a very different legacy than the one you would choose.

It is particularly important to have an estate plan if you have:

A spouse: In many cases, your spouse will inherit your possessions if you die without a plan, but that is not always guaranteed. Your estate plan makes sure that your spouse receives the support they need.

Kids, pets, or other dependents: you need an estate plan to specify who will be your dependents’ guardian if something happens to you. Your estate plan can also designate funds for their care.

Why do I need an estate plan?

Among many other benefits, your estate plan can:

Allow you to choose who inherits specific assets, possessions, and other valuables.

Reduce the time and cost it takes for the courts to settle your estate.

Name guardian(s) for your dependents.

Reduce family conflicts over your estate.

Help you reduce taxes on your estate for your heirs.

Outline a plan for your funeral to reduce stress on your loved ones while they are grieving.

Designate someone you trust to make medical decisions for you if you cannot make them for yourself.

Assign a loved one or trusted advisor to manage your finances if you cannot manage them independently.

Organize your estate documents in Trustworthy.

How to make an estate plan

Step 1: Decide whether to bring in an expert.

The first step in creating an estate plan is deciding whether to bring in professionals like an estate planning attorney or a financial advisor to help. These experts can help you manage more complex estates and ensure that everything in your plan is airtight.

While everyone would benefit from working with estate planning experts, you would particularly need professional support if you:

Own a vacation home or other property in a different state.

Have a partner with whom you aren’t legally married.

Have a divorce or custody agreement in place.

Remarried or have a blended family — especially if you have children.

Prefer that someone does (or doesn’t) get access to you at the hospital.

Are concerned about state or federal estate and gift taxes.

If you use Trustworthy, you can add your attorney and financial advisor to your Trustworthy account to collaborate on your estate plan. Our expert team can also help you gather paperwork or documents to share with your estate planning attorney.

Add a new collaborator in Trustworthy

Step 2: Make a list of your physical possessions

Before you can decide what will happen to your possessions, you need to make sure that you are accounting for all of them.

You should list everything of value, including your home (if you own it), vehicles, jewelry, art, antiques, family heirlooms, computers, tvs, power tools, and other electronics.

Property category in Trustworthy

Are you overwhelmed by the idea of trying to find all your property and assets? Trustworthy is here to help. Instead of starting with a blank page, our AI creates a customized template for you to inventory your possessions.

Organize property details

Even better, you can add important information that your loved ones will need to know about the property, from account numbers to family stories. Simply sign into Trustworthy, go to the Property tab, and start filling in your template.

Step 3: List your digital possessions

Our lives are increasingly lived in the digital as well as the physical world. As such, estate planning has to take your digital assets and life into account.

Put together a list of all your email and social media accounts, cryptocurrency, money transfer apps (like PayPal and Venmo), and important passwords.

Most of your digital estate plan should be kept out of your will. Your will becomes public after you die, and it would not be good for your important passwords and accounts to end up in the hands of nefarious strangers. The digital world also changes faster than the physical world, and you don’t want to have to update your will every time you change a password or create a new account.

You can list your important digital accounts and passwords in the Passwords section of Trustworthy, or find a secure location where your family members can access the information.

Step 4: List your debts

Next, it is time to inventory all of your debts, from credit cards to mortgages, personal loans, auto loans, and private student loans.

In your list, you should add account numbers, contact information for the companies, and where to find any related documents or agreements.

Connect financial accounts with Plaid

Trustworthy makes this process easy. In the Money tab, you can enter credit cards and loans. With your permission, Trustworthy can automatically pull in your account information with Plaid and add the company’s contact information.

Once you are finished with your list of debts, make copies of your lists of assets and debts for your estate planning experts, your executor, and your partner. You can also invite them as collaborators to your Trustworthy account.

Step 5: Check and update the beneficiaries on your retirement accounts and insurance policies.

An essential part of estate planning is checking and updating the beneficiaries on your financial accounts and insurance policies. If you have designated a beneficiary, the account will pass on to them no matter what your will says about how your assets will be divided.

Many accounts will allow you to update your beneficiaries online. However, if your 401k account or life insurance is provided through work, you may have to contact your company’s plan administrator to check and update your beneficiaries.

Step 6: Choose an executor and guardians (if you have children)

The next step is to choose your executor. An executor is a person who is selected to manage the execution of your last will and testament and make sure that your wishes are carried out.

Executing a will can take dozens of hours of phone calls, paperwork, and diligence and years of work. For that reason, it is important to choose an executor who has the administrative and organizational chops to get things done.

Some people choose not to name a close family member as the executor of their will because they understand the emotional pain this task may cause. Whatever you decide, you should inform your chosen executor of your decision and ask them if they’re able to take on the role, as it is a big commitment on their end.

You can name more than one executor. However, it is important to note that your executors would have to make all decisions unanimously, which might be difficult in such a challenging time. If you name more than one executor, every executor must co-sign paperwork.

It’s also a good idea to name someone as a backup, in case your first choice isn’t able to perform the duties.

Step 7: Create a will.

Once you have your lists of assets and debts and your executor in place, it is time to start creating the documents in your estate plan. We recommend that you start with your will, the centerpiece of your estate plan.

Many lawyers will help you create a will for less than $1,000.

You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Your will should include:

Assets and property - the property and assets you are passing on to your loved ones, from your 401(k) and your house deed to grandpa’s favorite watch.

Beneficiaries - the people who will inherit your property and assets.

Custodian/Trustee - an adult custodian who is named to manage money in a trust account on behalf of a beneficiary who is a minor.

Executor - Someone to manage your will and close your estate. An executor is also called an administrator or personal representative

Guardian - the person/people selected to take care of your kid(s) and pet(s).

Instructions on finances, distribution of money, and paying debts.

Additional funeral or burial instructions.

Gifts to individuals or charities.

Once you have drafted your will with your lawyer or an online service, it is time to sign and notarize it. Although a probate judge may adhere to the instructions of an unsigned will if there is reason to believe it represents your true intentions, an unsigned will is not sufficient proof of your intentions. There is no guarantee that your wishes will be carried out if your will is unsigned.

It is standard procedure to sign your will in the presence of two witnesses. They will also sign your will to validate it.

Signing your will with your two witnesses and a notary present is an additional safeguard to ensure your will is legally binding, although it isn’t required in most states. You can usually find a free notary service at your bank or credit union, and some UPS stores offer notary services for a nominal fee. You could work with a mobile notary who will travel to your office or home for an additional fee.

An increasing number of states have legalized online notary services, but you should check your state’s laws before getting your will notarized online.

Step 8: Complete your estate plan.

With your will completed, it’s time to finish the other documents in your estate plan.

We will cover how to create two of the most common documents: a power of attorney and a living will (advance healthcare directive). As with your last will and testament, your estate planning attorney can also help you create these documents, or you can work with an online service.

Create a power of attorney (POA)

The power of attorney (POA) document names specific people who will take care of important matters - such as financial and medical decisions - on your behalf while you are alive. After you have passed away, the POA is revoked and your will becomes effective.

In your power of attorney, you do not have to choose only one person to take care of your affairs while you are unable to make decisions for yourself. In fact, you should name a backup person for each role in case your first choice isn’t able to carry out their responsibilities.

The different powers of attorney include:

Executive power of attorney

An executive POA takes the lead in managing big decisions on your behalf. If you have named several different POAs, this person will do their best to ensure your wishes are being carried out by the team you chose. If you don’t name POAs for different roles, the executive POA will cover all these roles. Once you die, the executor of your will takes over managing your wishes.

Medical power of attorney

A medical POA advocates for you when you are unable to communicate your medical preferences or provide consent for procedures. For example, if you are in the hospital with a severe injury that has caused you to lose consciousness, a medical POA will step in to advocate for you. The medical POA does not apply to end-of-life decisions. Designating a medical POA is not the same as completing a living will, which we will discuss in the next section.

Financial power of attorney

A financial POA manages your personal accounts. An accountant can provide an annual review to manage your bank accounts, or your executive POA can hire a professional to manage your bookkeeping, file taxes, and review statements.

Digital power of attorney

For many, our administrative lives now center around digital accounts. A digital POA is granted access to your online and digital accounts to help needed transactions run smoothly.

In order to make your digital POA’s tasks more easy and accessible, consider granting them access to a password manager so they are able to log into the necessary accounts. For example, if your executive POA has access to your Trustworthy account, they can share your password information with your digital POA.

Create a living will (advanced care directive)

A living will (also known as an advance directive, healthcare directive, declaration, or directive to physicians) records your wishes around end-of-life care if you are unable to speak for yourself. It is state-specific and legally binding.

As with your last will and testament, it is important to make a living will in advance. Once you actually need a living will, it is too late to create one.

What to include in your living will

A living will should be as specific as possible because very few medical decisions are cut-and-dried. Clearer guideposts about the types of medical care you do and do not want to receive will help remove some of the uncertainty in end-of-life decisions for your loved ones.

What does your quality of life mean to you? Answering that question in your living will helps your medical POA speak for you. The more specific your answer, the better.

A living will may answer questions around whether you do/do not want to receive:

Antibiotics

Cardiac resuscitation

Invasive diagnostic tests or procedures

Mechanical respiration

Kidney dialysis

Tube feeding

Experimental medical procedures

A living will requires witness signatures and sometimes notarization, depending on the state in which you live. Some states also do not allow the following people to act as your witness:

Someone who may inherit part of your estate

Someone named in your last will and testament

A relative by blood or marriage

You can find a notary at your bank, credit union, library, county clerk’s office, or local UPS store. An increasing number of states will also let you use online notary services, but you should check the law in your home state before working with an online notary.

Step 9: Give your executor a copy of your estate documents

Your estate plan documents are finished; great work! You have made it to the last step. Now, it is time to make sure that the people you have chosen to manage your affairs have the information they need to do so.

Make copies of your estate plan documents and give them to your executor and POAs. You should also tell them and the other people named in your will where your original will is stored.

The location that you choose for your original estate documents should be secure. Keep your original estate documents with your attorney, or in a safe spot with other important information.

Connect financial accounts with Plaid

If you use Trustworthy, you can complete this step with a few clicks of a button. Simply upload your plan into the Estate Documents section of Trustworthy, and invite your executor and POAs as collaborators in your account.

How often to update an estate plan

Now that your estate plan is completed, all the work is done, right?

Not quite. You have finished the most time consuming and difficult part of estate planning, but you still need to make sure that your plan changes as life does. You should review your estate plan at least once every four years to make sure it reflects your current wishes and assets.

You should also update your plan after life-changing events, like getting married or divorced or having a child.

Finally, you should keep an eye on financial legislation and changes to tax laws that could affect your estate and change your plan accordingly. If you have worked with a financial advisor or estate planning attorney, they can help you figure out when these changes might require you to update your estate.

Trustworthy reminders save members time and money.

No need to set a calendar reminder. If you add your estate plan to Trustworthy, we will add an automated reminder for you to review and update your estate plan regularly. We remember so you don’t have to.

What documents are part of an estate plan?

There are three main documents that frequently included in estate planning: a last will and testament, a power of attorney, and a living will (or “advance care directive”).

Depending on your circumstances, you may want or need to make additional documents part of your estate plan. We have included the most common ones.

Adding a will to Trustworthy.

Last will and testament

Who gets which family heirlooms? How will your financial assets be divided? Who will take care of your children or pets? These are all crucial answers that a will provides for those you leave behind.

Your last will and testament, or will, is the centerpiece of your estate plan. Wills are state-specific, legally binding documents that state your wishes and instructions on subjects like who will inherit your possessions and how to care for your dependents.

Many lawyers will help you create a will for less than $1,000. You can also work with online companies like FreeWill and Trust&Will to create your own. (Pro tip: you can access exclusive discounts on these and other services through the Trustworthy marketplace and earn credit toward your Trustworthy membership!)

Power of attorney (POA)

A power of attorney is a legally binding document that allows you to name people to make key decisions for you if you are incapacitated. You can name several people in your POA document to handle specific situations, such as college funds or childcare.

Living will (advanced care directive)

A living will records your end-of-life wishes about what types of medical care you do (or do not) want if you are unable to speak for yourself.

Healthcare proxy

A document that names someone to make medical decisions for you if you are incapacitated.

Letter of instruction

A document that covers informal estate information that isn’t addressed in your will. The letter could include a last message for your loved ones, details on where to find the possessions in the will, or funeral plans.

Beneficiary designation

Forms that allow you to transfer assets like financial accounts, retirement accounts, or life insurance policies directly to the recipient, regardless of the terms in your will.

Trust

A legal arrangement where a third party (trustee) holds assets on behalf of your beneficiaries. Trusts have a few benefits in addition to your will: they can specify how and when your assets pass to your beneficiaries.

Try Trustworthy today.

Try the Family Operating System® for yourself. You (and your family) will love it.

No credit card required.

Try Trustworthy today.

Try the Family Operating System® for yourself. You (and your family) will love it.

No credit card required.

Try Trustworthy today.

Try the Family Operating System® for yourself. You (and your family) will love it.

No credit card required.

Related Articles

Apr 19, 2024

Removing a Deceased Spouse from a Deed: 5 Necessary Steps

Apr 17, 2024

After Death: Can a Spouse Change the Deceased's Will?

Apr 17, 2024

Divorced Spouse's Rights to Property After Death Explained

Apr 11, 2024

Navigating Dual Benefits: VA Disability and Social Security

Apr 11, 2024

Veteran Benefit Eligibility: Understanding Denials and Exclusions

Apr 4, 2024

Eligibility for Veteran’s Spouse Benefits: What You Need to Know

Apr 3, 2024

VA Disability Payments: Can They Be Discontinued?

Mar 30, 2024

Veteran Death: Essential Actions and Checklist for Next of Kin

Mar 27, 2024

SLATs in Estate Planning: An Innovative Strategy Explained

Mar 27, 2024

Maximize Your Estate Planning with Survivorship Life Insurance

Mar 23, 2024

VA Benefits Timeline: When They Stop After Death

Mar 20, 2024

Is Estate Planning a Legitimate Business Expense: Unveiling The Truth

Mar 15, 2024

Does Right of Survivorship Trump a Will: Legal Insights

Mar 13, 2024

Palliative Care at Home: Understanding Insurance Coverage

Mar 13, 2024

Navigating Insurance Coverage for Hospice Care A Complete Guide

Mar 9, 2024

Choosing an Estate Planning Attorney: Traits of Excellence

Mar 7, 2024

Can Family Overrule an Advance Directive? What You Need to Know

Mar 7, 2024

Funding Hospice Care in Nursing Homes: Who Bears the Cost?

Mar 5, 2024

Who Can Legally Witness an Advance Directive? Know Your Rights

Mar 5, 2024

Exploring Hospice Care: What’s Not Included?

Mar 5, 2024

Respite Care in Hospice: Providing Relief for Caregivers

Mar 5, 2024

Exploring the Spectrum: Different Types of Advance Directives

Feb 28, 2024

Deciding on Hospice Care: Knowing When It's Time

Feb 27, 2024

Hospice Care Duration: How Long Can It Last?

Feb 27, 2024

Hospice Care Timeline: Estimating How Long to Live

Feb 22, 2024

Doctor-Ordered Hospice Care: When and Why It Happens

Feb 20, 2024

Funeral Planning Timeline: How Long Does it Really Take?

Feb 15, 2024

Writing a Heartfelt Obituary for Your Husband: Inspiring Examples

Feb 14, 2024

Planning Your Funeral: The Best Age To Start

Feb 14, 2024

Crafting a Loving Obituary For Your Son: Meaningful Examples

Jan 18, 2024

Improving Communication Between Caregivers and Doctors

Nov 29, 2023

Can Anyone Get a Copy of a Death Certificate? Who Is Authorized?

Nov 25, 2023

Original Death Certificate vs. Certified Copy: Key Differences And Why They Matter

Nov 25, 2023

How Do You Handle Negative Aspects of the Deceased's Life in a Eulogy?

Nov 25, 2023

Can There Be More Then One Eulogy at a Funeral? Etiquette Explained

Nov 24, 2023

My Dad Died, Can I Get His Retirement Pension?

Nov 24, 2023

How Many Copies of a Death Certificate Should You Get?

Nov 24, 2023

Can a Eulogy Be Funny? Yes, Here Are 10 Respectful but Funny Examples

Nov 24, 2023

How Do You Receive Inheritance Money WITHOUT any issues?

Nov 17, 2023

Who Gets The Tax Refund of A Deceased Person? An Accountant Answers

Nov 17, 2023

How To Start a Eulogy: 15 Heartfelt Examples

Nov 14, 2023

How To Discuss End-of-Life Care With Parents (Simple Guide)

Nov 14, 2023

How To Cancel a Deceased Person's Subscriptions the EASY Way

Nov 8, 2023

What Should You Not Put in a Eulogy (9 Things To Avoid)

Nov 7, 2023

How Are Estates Distributed If There's No Will? A Lawyer Explains Intestate

Nov 6, 2023

Does Microsoft Word Have an Obituary Template?

Nov 6, 2023

How To Post an Obituary on Facebook: A Step-by-Step Guide

Nov 6, 2023

Why Do You Need A Death Certificate For Estate & Probate Process?

Nov 2, 2023

How Do I Correct Errors on a Death Certificate? And, How Long Does It Take?

Nov 2, 2023

12 Steps For Writing a Eulogy For Mom

Nov 2, 2023

12 Steps for Writing a Eulogy for Dad

Nov 1, 2023

Who Does The Obituary When Someone Dies?

Nov 1, 2023

How Late Is Too Late For An Obituary? 6 Steps To Take Today

Nov 1, 2023

How Much Does It Cost To Publish An Obituary? Breaking It Down

Nov 1, 2023

6 Reasons You Need an Obituary (Plus 6 Reasons You Don't)

Oct 30, 2023

Where Do You Post an Obituary: A Step-By-Step Guide

Oct 30, 2023

Obituary vs Death Note: What Are the Key Differences?

Oct 5, 2023

Buying A House With Elderly Parent: 10 Things To Know

Sep 14, 2023

I'm Trapped Caring for Elderly Parents

Oct 5, 2023

401(k) and Minors: Can a Minor be a Beneficiary?

Sep 12, 2023

How to Self-Direct Your 401(k): Take Control of Your Retirement

Aug 3, 2023

The Ultimate Guide to Decluttering and Simplifying Your Home as You Age

Aug 3, 2023

The Essential Guide to Preparing for Retirement

Aug 3, 2023

Estate Planning For Blended Families (Complete Guide)

Aug 3, 2023

Estate Planning For Physicians (Complete Guide)

Jul 14, 2023

Are You Legally Responsible For Your Elderly Parents?

Jun 7, 2023

How To Travel With Elderly Parent: Here's How to Prepare

Jun 6, 2023

Checklist For Moving A Parent To Assisted Living

Jun 6, 2023

How to Set Up A Trust For An Elderly Parent: 6 Easy Steps

Jun 6, 2023

How To Stop Elderly Parents From Giving Money Away (9 Tips)

Jun 6, 2023

Should Elderly Parents Sign Over Their House? Pros & Cons

May 17, 2023

Estate Planning: A Comprehensive Guide

May 2, 2023

Helping Elderly Parents: The Complete Guide

May 1, 2023

Trustworthy guide: How to organize your digital information

Apr 15, 2023

Can My Husband Make a Will Without My Knowledge?

Apr 15, 2023

What is a Last Will and Testament (also known as a Will)?

Apr 15, 2023

Can A Wife Sell Deceased Husband's Property (6 Rules)

Apr 15, 2023

Should I Shred Documents Of A Deceased Person? (5 Tips)

Apr 15, 2023

Can I Change My Power of Attorney Without A Lawyer?

Apr 15, 2023

Can You Have Two Power of Attorneys? (A Lawyer Answers)

Apr 15, 2023

Do Attorneys Keep Copies Of a Will? (4 Things To Know)

Apr 15, 2023

Estate Planning for a Special Needs Child (Complete Guide)

Apr 15, 2023

Estate Planning For Childless Couples (Complete Guide)

Apr 15, 2023

Estate Planning For Elderly Parents (Complete Guide)

Apr 15, 2023

Estate Planning For High Net Worth & Large Estates

Apr 15, 2023

Estate Planning For Irresponsible Children (Complete Guide)

Apr 15, 2023

How To Get Power of Attorney For Parent With Dementia?

Apr 15, 2023

I Lost My Power of Attorney Papers, Now What?

Apr 15, 2023

Is It Better To Sell or Rent An Inherited House? (Pros & Cons)

Apr 15, 2023

Is It Wrong To Move Away From Elderly Parents? My Advice

Apr 15, 2023

Moving An Elderly Parent Into Your Home: What To Know

Apr 15, 2023

Moving An Elderly Parent to Another State: What To Know

Apr 15, 2023

What If Witnesses To A Will Cannot Be Found? A Lawyer Answers

Apr 15, 2023

What To Bring To Estate Planning Meeting (Checklist)

Apr 15, 2023

When Should You Get An Estate Plan? (According To A Lawyer)

Apr 15, 2023

Which Sibling Should Take Care of Elderly Parents?

Apr 15, 2023

Who Can Override A Power of Attorney? (A Lawyer Answers)

Apr 15, 2023

Can Power of Attorney Sell Property Before Death?

Apr 15, 2023

Can The Executor Of A Will Access Bank Accounts? (Yes, Here's How)

Apr 15, 2023

Complete List of Things To Do For Elderly Parents (Checklist)

Apr 15, 2023

How To Get Power of Attorney For A Deceased Person?

Apr 15, 2023

How To Help Elderly Parents From A Distance? 7 Tips

Apr 15, 2023

Legal Documents For Elderly Parents: Checklist

Apr 15, 2023

Selling Elderly Parents Home: How To Do It + Mistakes To Avoid

Apr 15, 2023

What To Do When A Sibling Is Manipulating Elderly Parents

Apr 6, 2023

Can An Out of State Attorney Write My Will? (A Lawyer Answers)

Mar 15, 2023

Settling an Estate: A Step-by-Step Guide

Feb 10, 2023

My Deceased Husband Received A Check In The Mail (4 Steps To Take)

Feb 7, 2023

The Benefits of Working With an Experienced Estate Planning Attorney

Feb 6, 2023

How To Track Elderly Parents' Phone (2 Options)

Feb 1, 2023

Can You Collect Your Parents' Social Security When They Die?

Feb 1, 2023

How Do I Stop VA Benefits When Someone Dies (Simple Guide)

Feb 1, 2023

Can You Pay Money Into A Deceased Person's Bank Account?

Feb 1, 2023

Deleting A Facebook Account When Someone Dies (Step by Step)

Feb 1, 2023

Does The DMV Know When Someone Dies?

Feb 1, 2023

How To Find A Deceased Person's Lawyer (5 Ways)

Feb 1, 2023

How To Plan A Celebration Of Life (10 Steps With Examples)

Feb 1, 2023

How To Stop Mail Of A Deceased Person? A Simple Guide

Feb 1, 2023

How to Stop Social Security Direct Deposit After Death

Feb 1, 2023

How To Transfer Firearms From A Deceased Person (3 Steps)

Feb 1, 2023

How To Write An Obituary (5 Steps With Examples)

Feb 1, 2023

Unlock iPhone When Someone Dies (5 Things To Try)

Feb 1, 2023

What Happens To A Leased Vehicle When Someone Dies?

Jan 31, 2023

Do Wills Expire? 6 Things To Know

Jan 31, 2023

How To Get Into a Deceased Person's Computer (Microsoft & Apple)

Jan 31, 2023

Why Do Funeral Homes Take Fingerprints of the Deceased?

Jan 31, 2023

What To Do If Your Deceased Parents' Home Is In Foreclosure

Jan 31, 2023

Questions To Ask An Estate Attorney After Death (Checklist)

Jan 31, 2023

What Happens If a Deceased Individual Owes Taxes?

Jan 31, 2023

Components of Estate Planning: 6 Things To Consider

Jan 22, 2023

What To Do If Insurance Check Is Made Out To A Deceased Person

Jan 8, 2023

What Does a Typical Estate Plan Include?

Apr 15, 2022

Can I Do A Video Will? (Is It Legitimate & What To Consider)

Apr 15, 2022

Estate Planning For Green Card Holders (Complete Guide)

Mar 2, 2022

What Does Your “Property” Mean?

Mar 2, 2022

What is the Uniform Trust Code? What is the Uniform Probate Code?

Mar 2, 2022

Do You Need to Avoid Probate?

Mar 2, 2022

How is a Trust Created?

Mar 2, 2022

What Are Advance Directives?

Mar 2, 2022

What does a Trustee Do?

Mar 2, 2022

What is an Estate Plan? (And why you need one)

Mar 2, 2022

What is Probate?

Mar 2, 2022

What Is Your Domicile & Why It Matters

Mar 2, 2022

What Is a Power of Attorney for Finances?

Mar 1, 2022

Should your family consider an umbrella insurance policy?

Mar 1, 2022

Do I need a digital power of attorney?

Apr 6, 2020

What Exactly is a Trust?