Related Articles

Apr 19, 2024

Removing a Deceased Spouse from a Deed: 5 Necessary Steps

Apr 17, 2024

After Death: Can a Spouse Change the Deceased's Will?

Apr 17, 2024

Divorced Spouse's Rights to Property After Death Explained

Apr 11, 2024

Navigating Dual Benefits: VA Disability and Social Security

Apr 11, 2024

Veteran Benefit Eligibility: Understanding Denials and Exclusions

Apr 4, 2024

Eligibility for Veteran’s Spouse Benefits: What You Need to Know

Apr 3, 2024

VA Disability Payments: Can They Be Discontinued?

Mar 30, 2024

Veteran Death: Essential Actions and Checklist for Next of Kin

Mar 27, 2024

SLATs in Estate Planning: An Innovative Strategy Explained

Mar 27, 2024

Maximize Your Estate Planning with Survivorship Life Insurance

Mar 23, 2024

VA Benefits Timeline: When They Stop After Death

Mar 20, 2024

Is Estate Planning a Legitimate Business Expense: Unveiling The Truth

Mar 15, 2024

Does Right of Survivorship Trump a Will: Legal Insights

Mar 13, 2024

Palliative Care at Home: Understanding Insurance Coverage

Mar 13, 2024

Navigating Insurance Coverage for Hospice Care A Complete Guide

Mar 9, 2024

Choosing an Estate Planning Attorney: Traits of Excellence

Mar 7, 2024

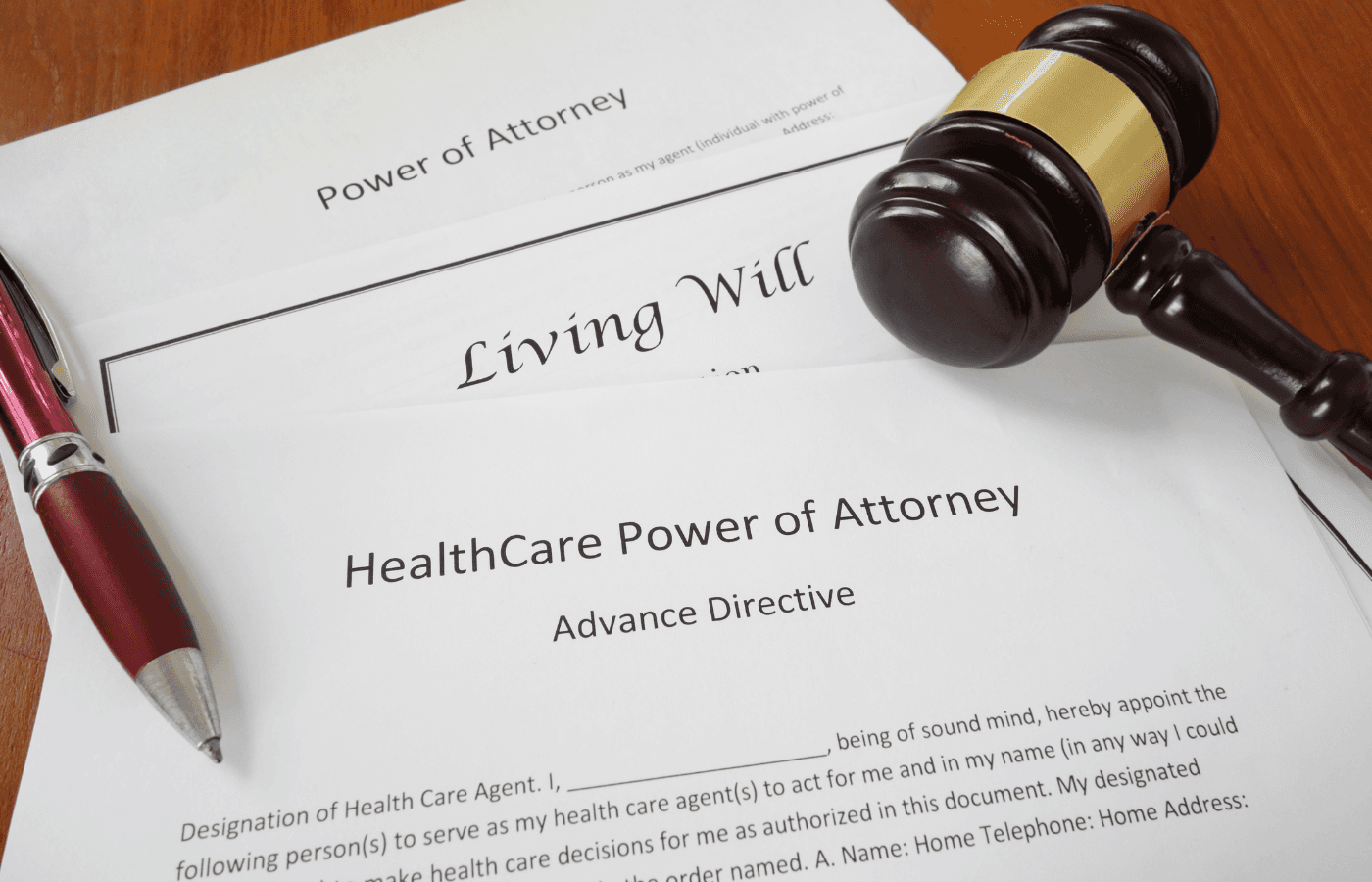

Can Family Overrule an Advance Directive? What You Need to Know

Mar 7, 2024

Funding Hospice Care in Nursing Homes: Who Bears the Cost?

Mar 5, 2024

Who Can Legally Witness an Advance Directive? Know Your Rights

Mar 5, 2024

Exploring Hospice Care: What’s Not Included?

Mar 5, 2024

Respite Care in Hospice: Providing Relief for Caregivers

Mar 5, 2024

Exploring the Spectrum: Different Types of Advance Directives

Feb 28, 2024

Deciding on Hospice Care: Knowing When It's Time

Feb 27, 2024

Hospice Care Duration: How Long Can It Last?

Feb 27, 2024

Hospice Care Timeline: Estimating How Long to Live

Feb 22, 2024

Doctor-Ordered Hospice Care: When and Why It Happens

Feb 20, 2024

Funeral Planning Timeline: How Long Does it Really Take?

Feb 15, 2024

Writing a Heartfelt Obituary for Your Husband: Inspiring Examples

Feb 14, 2024

Planning Your Funeral: The Best Age To Start

Feb 14, 2024

Crafting a Loving Obituary For Your Son: Meaningful Examples

Jan 18, 2024

Improving Communication Between Caregivers and Doctors

Nov 29, 2023

Can Anyone Get a Copy of a Death Certificate? Who Is Authorized?

Nov 25, 2023

Original Death Certificate vs. Certified Copy: Key Differences And Why They Matter

Nov 25, 2023

How Do You Handle Negative Aspects of the Deceased's Life in a Eulogy?

Nov 25, 2023

Can There Be More Then One Eulogy at a Funeral? Etiquette Explained

Nov 24, 2023

My Dad Died, Can I Get His Retirement Pension?

Nov 24, 2023

How Many Copies of a Death Certificate Should You Get?

Nov 24, 2023

Can a Eulogy Be Funny? Yes, Here Are 10 Respectful but Funny Examples

Nov 24, 2023

How Do You Receive Inheritance Money WITHOUT any issues?

Nov 17, 2023

Who Gets The Tax Refund of A Deceased Person? An Accountant Answers

Nov 17, 2023

How To Start a Eulogy: 15 Heartfelt Examples

Nov 14, 2023

How To Discuss End-of-Life Care With Parents (Simple Guide)

Nov 14, 2023

How To Cancel a Deceased Person's Subscriptions the EASY Way

Nov 8, 2023

What Should You Not Put in a Eulogy (9 Things To Avoid)

Nov 7, 2023

How Are Estates Distributed If There's No Will? A Lawyer Explains Intestate

Nov 6, 2023

Does Microsoft Word Have an Obituary Template?

Nov 6, 2023

How To Post an Obituary on Facebook: A Step-by-Step Guide

Nov 6, 2023

Why Do You Need A Death Certificate For Estate & Probate Process?

Nov 2, 2023

How Do I Correct Errors on a Death Certificate? And, How Long Does It Take?

Nov 2, 2023

12 Steps For Writing a Eulogy For Mom

Nov 2, 2023

12 Steps for Writing a Eulogy for Dad

Nov 1, 2023

Who Does The Obituary When Someone Dies?

Nov 1, 2023

How Late Is Too Late For An Obituary? 6 Steps To Take Today

Nov 1, 2023

How Much Does It Cost To Publish An Obituary? Breaking It Down

Nov 1, 2023

6 Reasons You Need an Obituary (Plus 6 Reasons You Don't)

Oct 30, 2023

Where Do You Post an Obituary: A Step-By-Step Guide

Oct 30, 2023

Obituary vs Death Note: What Are the Key Differences?

Oct 5, 2023

Buying A House With Elderly Parent: 10 Things To Know

Sep 14, 2023

I'm Trapped Caring for Elderly Parents

Oct 5, 2023

401(k) and Minors: Can a Minor be a Beneficiary?

Sep 12, 2023

How to Self-Direct Your 401(k): Take Control of Your Retirement

Aug 3, 2023

The Ultimate Guide to Decluttering and Simplifying Your Home as You Age

Aug 3, 2023

The Essential Guide to Preparing for Retirement

Aug 3, 2023

Estate Planning For Blended Families (Complete Guide)

Aug 3, 2023

Estate Planning For Physicians (Complete Guide)

Jul 14, 2023

Are You Legally Responsible For Your Elderly Parents?

Jun 7, 2023

How To Travel With Elderly Parent: Here's How to Prepare

Jun 6, 2023

Checklist For Moving A Parent To Assisted Living

Jun 6, 2023

How to Set Up A Trust For An Elderly Parent: 6 Easy Steps

Jun 6, 2023

How To Stop Elderly Parents From Giving Money Away (9 Tips)

Jun 6, 2023

Should Elderly Parents Sign Over Their House? Pros & Cons

May 17, 2023

Estate Planning: A Comprehensive Guide

May 2, 2023

Helping Elderly Parents: The Complete Guide

May 1, 2023

Trustworthy guide: How to organize your digital information

Apr 15, 2023

Can My Husband Make a Will Without My Knowledge?

Apr 15, 2023

What is a Last Will and Testament (also known as a Will)?

Apr 15, 2023

Can A Wife Sell Deceased Husband's Property (6 Rules)

Apr 15, 2023

Should I Shred Documents Of A Deceased Person? (5 Tips)

Apr 15, 2023

Can I Change My Power of Attorney Without A Lawyer?

Apr 15, 2023

Can You Have Two Power of Attorneys? (A Lawyer Answers)

Apr 15, 2023

Do Attorneys Keep Copies Of a Will? (4 Things To Know)

Apr 15, 2023

Estate Planning for a Special Needs Child (Complete Guide)

Apr 15, 2023

Estate Planning For Childless Couples (Complete Guide)

Apr 15, 2023

Estate Planning For Elderly Parents (Complete Guide)

Apr 15, 2023

Estate Planning For High Net Worth & Large Estates

Apr 15, 2023

Estate Planning For Irresponsible Children (Complete Guide)

Apr 15, 2023

How To Get Power of Attorney For Parent With Dementia?

Apr 15, 2023

I Lost My Power of Attorney Papers, Now What?

Apr 15, 2023

Is It Better To Sell or Rent An Inherited House? (Pros & Cons)

Apr 15, 2023

Is It Wrong To Move Away From Elderly Parents? My Advice

Apr 15, 2023

Moving An Elderly Parent Into Your Home: What To Know

Apr 15, 2023

Moving An Elderly Parent to Another State: What To Know

Apr 15, 2023

What If Witnesses To A Will Cannot Be Found? A Lawyer Answers

Apr 15, 2023

What To Bring To Estate Planning Meeting (Checklist)

Apr 15, 2023

When Should You Get An Estate Plan? (According To A Lawyer)

Apr 15, 2023

Which Sibling Should Take Care of Elderly Parents?

Apr 15, 2023

Who Can Override A Power of Attorney? (A Lawyer Answers)

Apr 15, 2023

Can Power of Attorney Sell Property Before Death?

Apr 15, 2023

Can The Executor Of A Will Access Bank Accounts? (Yes, Here's How)

Apr 15, 2023

Complete List of Things To Do For Elderly Parents (Checklist)

Apr 15, 2023

How To Get Power of Attorney For A Deceased Person?

Apr 15, 2023

How To Help Elderly Parents From A Distance? 7 Tips

Apr 15, 2023

Legal Documents For Elderly Parents: Checklist

Apr 15, 2023

Selling Elderly Parents Home: How To Do It + Mistakes To Avoid

Apr 15, 2023

What To Do When A Sibling Is Manipulating Elderly Parents

Apr 6, 2023

Can An Out of State Attorney Write My Will? (A Lawyer Answers)

Mar 15, 2023

Settling an Estate: A Step-by-Step Guide

Feb 10, 2023

My Deceased Husband Received A Check In The Mail (4 Steps To Take)

Feb 7, 2023

The Benefits of Working With an Experienced Estate Planning Attorney

Feb 6, 2023

How To Track Elderly Parents' Phone (2 Options)

Feb 1, 2023

Can You Collect Your Parents' Social Security When They Die?

Feb 1, 2023

How Do I Stop VA Benefits When Someone Dies (Simple Guide)

Feb 1, 2023

Can You Pay Money Into A Deceased Person's Bank Account?

Feb 1, 2023

Deleting A Facebook Account When Someone Dies (Step by Step)

Feb 1, 2023

Does The DMV Know When Someone Dies?

Feb 1, 2023

How To Find A Deceased Person's Lawyer (5 Ways)

Feb 1, 2023

How To Plan A Celebration Of Life (10 Steps With Examples)

Feb 1, 2023

How To Stop Mail Of A Deceased Person? A Simple Guide

Feb 1, 2023

How to Stop Social Security Direct Deposit After Death

Feb 1, 2023

How To Transfer Firearms From A Deceased Person (3 Steps)

Feb 1, 2023

How To Write An Obituary (5 Steps With Examples)

Feb 1, 2023

Unlock iPhone When Someone Dies (5 Things To Try)

Feb 1, 2023

What Happens To A Leased Vehicle When Someone Dies?

Jan 31, 2023

Do Wills Expire? 6 Things To Know

Jan 31, 2023

How To Get Into a Deceased Person's Computer (Microsoft & Apple)

Jan 31, 2023

Why Do Funeral Homes Take Fingerprints of the Deceased?

Jan 31, 2023

What To Do If Your Deceased Parents' Home Is In Foreclosure

Jan 31, 2023

Questions To Ask An Estate Attorney After Death (Checklist)

Jan 31, 2023

What Happens If a Deceased Individual Owes Taxes?

Jan 31, 2023

Components of Estate Planning: 6 Things To Consider

Jan 22, 2023

What To Do If Insurance Check Is Made Out To A Deceased Person

Jan 8, 2023

What Does a Typical Estate Plan Include?

Apr 15, 2022

Can I Do A Video Will? (Is It Legitimate & What To Consider)

Apr 15, 2022

Estate Planning For Green Card Holders (Complete Guide)

Mar 2, 2022

What Does Your “Property” Mean?

Mar 2, 2022

What is the Uniform Trust Code? What is the Uniform Probate Code?

Mar 2, 2022

Do You Need to Avoid Probate?

Mar 2, 2022

How is a Trust Created?

Mar 2, 2022

What Are Advance Directives?

Mar 2, 2022

What does a Trustee Do?

Mar 2, 2022

What is an Estate Plan? (And why you need one)

Mar 2, 2022

What is Probate?

Mar 2, 2022

What Is Your Domicile & Why It Matters

Mar 2, 2022

What Is a Power of Attorney for Finances?

Mar 1, 2022

Should your family consider an umbrella insurance policy?

Mar 1, 2022

Do I need a digital power of attorney?

Apr 6, 2020

What Exactly is a Trust?