How to Stop the Mail of a Deceased Person

October 1, 2025

|

Larry Li

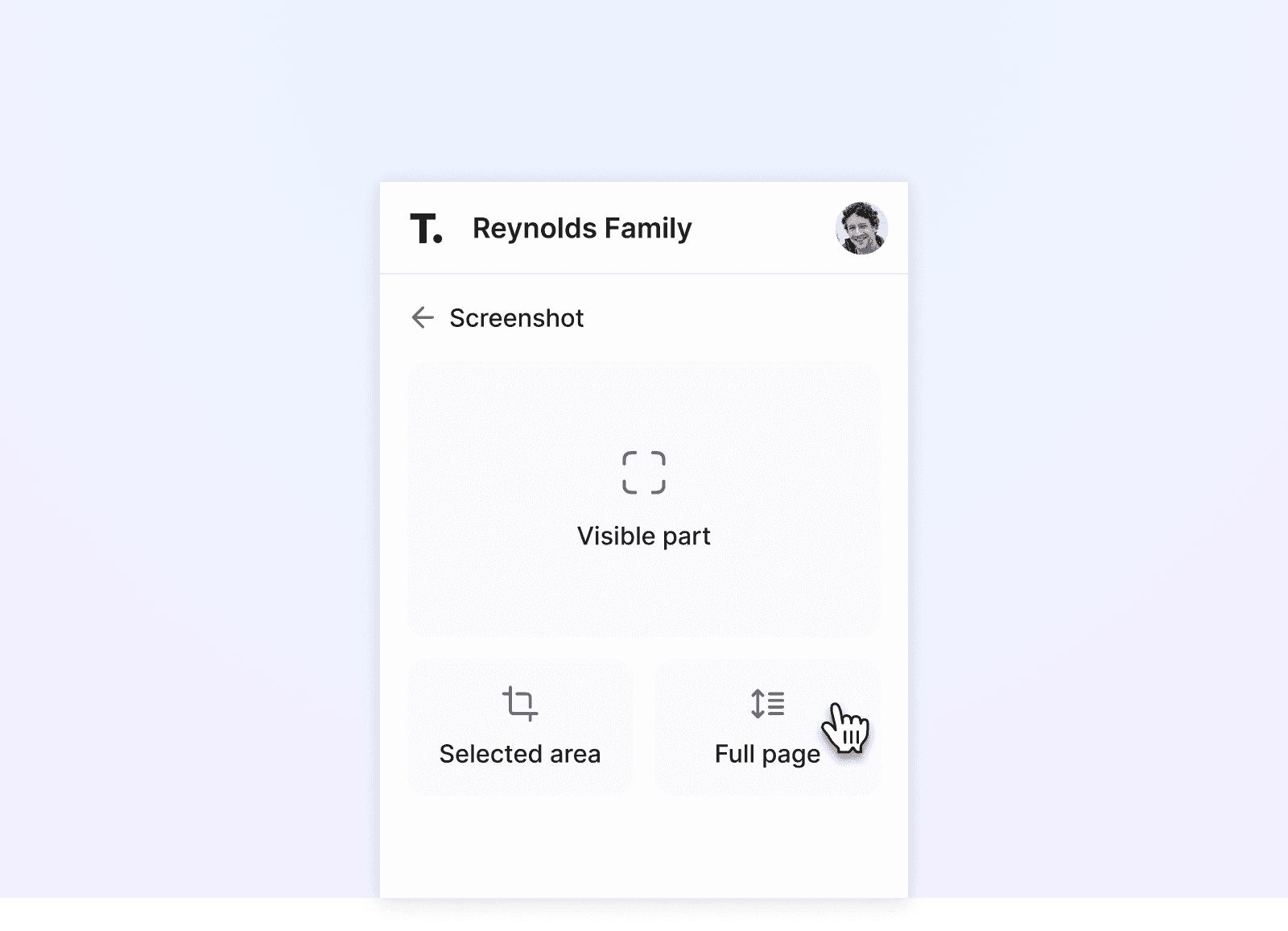

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

There’s nothing more difficult than dealing with the loss of someone you cherish. Whether it’s a spouse, friend, or family member, you need time to grieve and honor the life of your loved one.

But what about the practical tasks that follow — like mail that continues to arrive? In this article, we’ll answer common questions about what happens to a deceased person’s mail, and the steps you can take to stop or redirect it.

What Happens to Mail When Someone Dies

Q: Does mail automatically stop when someone passes away?

A: No. The U.S. Postal Service (USPS) keeps delivering mail to the deceased person’s last address until someone formally notifies the post office.

That means letters, bills, and marketing pieces can continue arriving daily. For grieving family members, this can be a painful reminder of their loss. More importantly, it also creates practical and security risks: Statements could reveal account numbers, subscription renewals could drain funds, and sensitive details could fall into the wrong hands, leaving your loved one's estate vulnerable to fraud.

Although the Social Security Administration notifies certain agencies, such as those responsible for pensions, it doesn’t cover everything. Utilities, credit cards, and private subscriptions must be managed by the estate's executor.

Mail might still have value temporarily — it can help track down accounts and settle final bills. But once the estate is settled, it’s best to stop delivery altogether.

Who Is Responsible for Stopping the Mail

Q: Who has the legal authority to manage or stop a deceased person’s mail?

A: Only the executor of the estate has the legal right to do this.

The executor is appointed by the probate court to settle all affairs, including handling accounts, paying debts, and notifying organizations. The executor is also the only person who can officially request the USPS to halt or forward mail.

If other family members receive mail addressed to the deceased, they should forward it to the executor rather than handling it themselves. That prevents confusion and ensures the estate is managed according to legal requirements.

Executors must also notify the Social Security Administration, credit bureaus, and in some cases banks, to prevent identity theft and protect the estate.

What to Know About Stopping the Deceased's Mail

Q: How should the executor notify the post office, and what challenges should they expect?

A: The executor should provide the local post office with a copy of the probate order once the probate process is complete. This court document proves that the executor has authority to act on behalf of the estate. Along with the order, the executor should include a written request for mail delivery to stop.

The process isn’t uniform: Some post offices allow you to complete an online form, while others require an in-person visit.

Because policies vary, the safest approach is to call ahead and confirm what documentation your branch requires. Executors should also be aware that there are no exceptions by mail type — all mail continues until probate is closed. That’s why timing matters.

Q: What is the DDNC list, and how does it help reduce unwanted mail?

A: The Deceased Do Not Contact (DDNC) list, run by DMA Choice, helps remove a deceased person’s information from many direct marketing databases. Registering reduces phone calls, emails, and marketing mail.

This doesn’t stop everything — some advertisers aren’t members of DMA Choice — but it does significantly cut down on junk mail.

The executor can register online through the DMA Choice website by submitting the deceased’s details. While not legally required, this step saves surviving family members from the emotional sting of junk mail addressed to someone who has passed away and reduces the risk that personal information might be misused by marketers or fraudsters.

Q: When should mail be forwarded instead of stopped, and what proof is required?

A: Sometimes, it’s better to forward mail temporarily rather than stopping it right away. Forwarding allows a surviving spouse or the executor to receive bills, financial notices, or final account statements. This makes it easier to identify and settle outstanding debts before shutting everything down.

To set this up, the executor must complete a forwarding change of address form at the local post office. Proof of authority, usually in the form of a court order naming the executor or estate administrator, is required. Without this proof, the USPS cannot process the request.

Common issues include forgetting to forward mail during the transition period, which can delay bill payments or cause accounts to go delinquent.

Q: What subscriptions need to be canceled, and what happens if they aren’t?

A: Executors must cancel both physical subscriptions (magazines, newsletters, newspapers) and digital services (streaming platforms like Netflix or Spotify, and online news subscriptions).

If these accounts remain active, charges may continue to hit the deceased’s bank account or credit card, draining funds meant for beneficiaries. In some cases, unpaid accounts can be sent to collections, creating unnecessary disputes for the estate.

Digital subscriptions are especially easy to miss, since no physical mail arrives. Executors should carefully review bank and credit card statements for recurring charges to ensure all services are canceled.

Q: How does the return-to-sender process work, and what are its limitations?

A: Executors or family members can write “Deceased, Return to Sender” on any incoming mail and place it back in the mailbox. The postal carrier will collect it and return it to the sender. This is a useful way to notify organizations that haven’t updated their records.

However, it works only for first-class mail, which includes stamped, metered, priority, and special-endorsed letters.

Non-first-class mail — the kind used by most marketers — doesn’t include free return service. In those cases, the executor may need to contact the sender directly to request removal from mailing lists.

Executors should also expect some lag time; even with returns and notifications, it can take weeks before all unwanted mail stops.

Stopping Mail Completely

Q: Is it possible to eliminate all mail after someone dies?

A: Sadly, no. Junk mail in particular is almost impossible to eliminate entirely, since not all senders honor removal requests. But with a combination of notifying the post office, registering on the DDNC list, forwarding mail when necessary, canceling subscriptions, and using return-to-sender, executors can stop the majority of mail.

For stubborn senders, direct contact is the best option. Executors can write to the company, explain that the person has passed away, and request removal. While this takes effort, it’s often the only way to permanently stop certain marketing materials.

Planning With Trustworthy

At Trustworthy, we understand how difficult it is to deal with losing someone you love. We also know that having to handle all aspects of your loved one’s estate in the midst of your grieving and remembrance makes everything more difficult. Trustworthy simplifies this process so you have space to grieve and heal.

Trustworthy is an innovative digital family assistant that's dedicated to storing and securing sensitive information. You can manage estate details and collaborate with estate planning attorneys, executors, and other professionals through Trustworthy.

Trustworthy can also help you manage your own estate. With the Estate Planning tab, you can secure all your estate planning documents like power of attorney and last will and testament in one secured location. This allows you to review and edit your estate documents regularly while keeping your estate attorney and executor updated with the latest changes.

Have more questions about estate planning? Our estate planning guide can help.

Our Trustworthy Certified Experts™ can help you gather the necessary documents to start drafting your estate plan. Get started with Trustworthy.

Related Articles

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.