Check for Deceased Husband Came in the Mail. Now What?

February 10, 2023

|

Larry Li

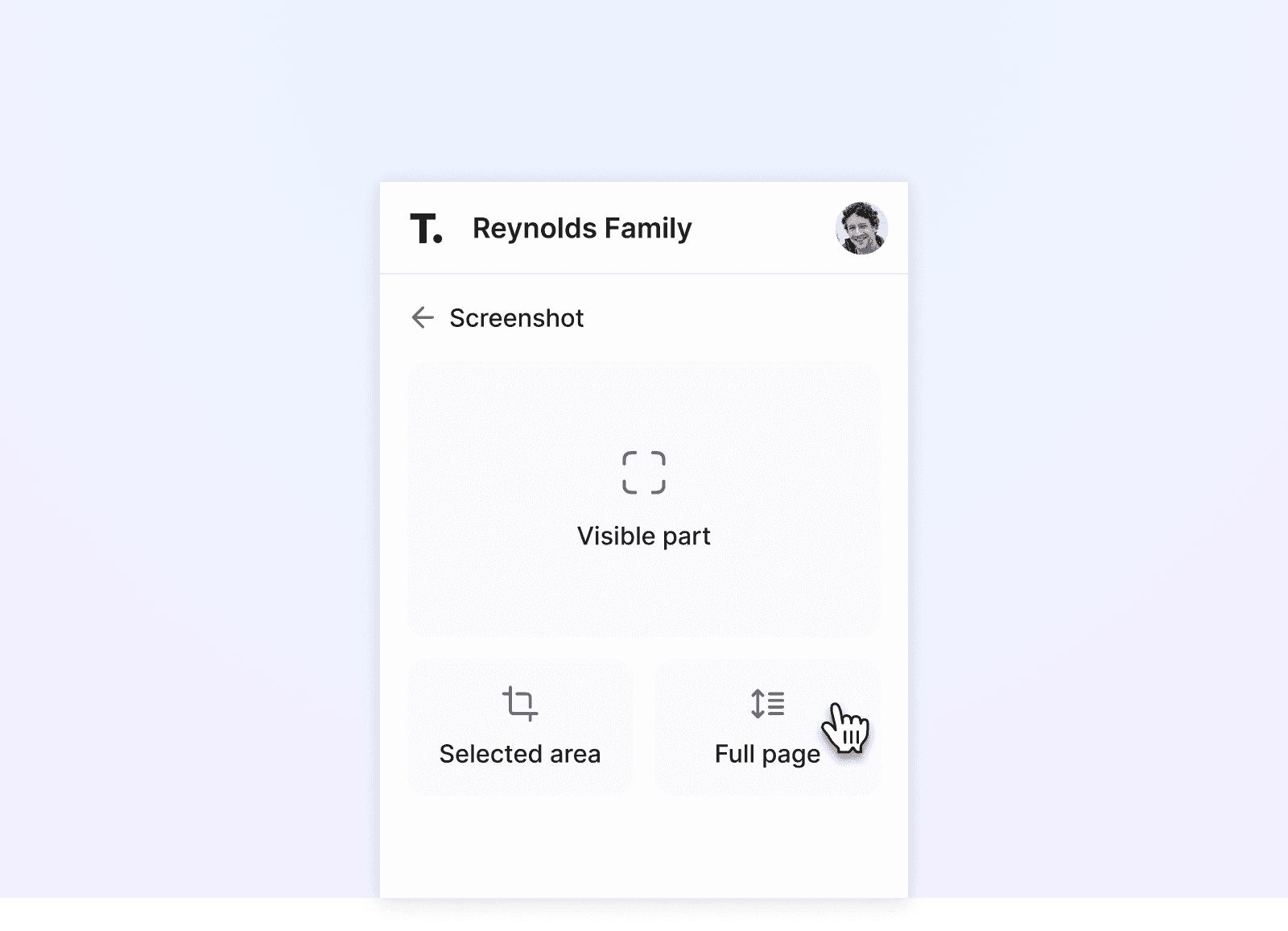

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Coping with the loss of a loved one is already difficult, and it can become even more challenging if you receive a check in their name.

So, what should you do if your deceased husband receives a check in the mail?

Often, you cannot personally deposit a check written to your dead husband. This is because the check for your deceased husband belongs to his estate, even if you are his spouse.

Instead, the check must be given to the executor of his estate. The executor can deposit it into the estate account to use for bills when settling your husband's estate.

If any money is left at the end of the expense settlements, the executor can distribute it as they see fit. Even if you have a joint bank account, you won’t be able to deposit a check payable to your dead husband into your account. This is because his name was removed when he passed away.

If the check sent to your deceased husband was for Social Security benefits, the estate executor can determine whether to deposit the check with the estate or to return it to the Social Security Administration.

First Steps to Take

1. Check for a POD Account

If you receive a check in your late husband's name, first determine whether he had a payable-on-death account. This is an account that names a beneficiary to receive any money left in the account upon the account holder's. The money will automatically pass to the beneficiary.

If you're the beneficiary, you may need to provide your husband's ID, death certificate, and other information that verifies your relationship with the deceased.

2. Contact the Executor

If a payable-on-death account doesn't exist, the next step is to contact the executor or administrator of your late husband’s estate, if that's not you.

By law, the executor of a deceased individual’s estate can endorse checks, including checks on interest or principal, tax refunds, or payments for services and goods. Therefore, it makes sense to contact the executor and ask that the payment is honored.

3. Act as Executor

If you are the executor of your deceased husband’s estate, you have the power to cash the check into an estate account. However, if you are not the estate’s executor, you cannot endorse or deposit the check.

As the executor, your primary task is to open an estate account.

4. Open an Estate Account

The correct way of depositing checks of a deceased person is through an estate account by the executor. This is because the executor is the legal representative of your deceased husband’s estate, so they have the authority to perform duties that may impact the estate. As such, depositing a check for cash value is undoubtedly an activity that affects the estate.

Bring your ID and court documents designating you as the executor of the estate to the bank. You may need to bring the official documents with the raised seal since the bank may not accept copies. This is because the bank uses these documents to officially identify you the executor of the estate account.

Once you open the estate account, you can deposit the check into the deceased’s estate. Since the probate process requires all of the deceased person’s assets to be accounted for, deposing a check into an account not owned by your husband is illegal.

In any case, the best plan of action is to contact the sender who issued the check. This way, you can know with certainty what is allowed or disallowed based on what the check was issued for. So if you received a Social Security check for your late husband, you should contact the Social Security Administration or visit a local office to explain the situation.

Plan With Trustworthy

In essence, only the estate executor can handle checks for your late husband. That check typically moves into the estate’s checking account, which is used to take care of pending expenses or distributed to beneficiaries, such as yourself.

However, you can avoid most of the post-death financial headaches by preparing yourself with Trustworthy. Trustworthy is an innovative digital storage platform dedicated to storing and organizing all of life’s essential documents and files.

With Trustworthy, you can safely upload and share your family's estate plans. This includes wills, advance directives, and financial information. This way, your family is prepared if someone you love passes away.

Trustworthy helps to plan, organize, and securely share estate planning documents, making it the most convenient way of handling the aftermath of a death in the family. Try Trustworthy free for yourself.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.