Questions to Ask an Estate Attorney After a Death

January 31, 2023

|

Ty McDuffey

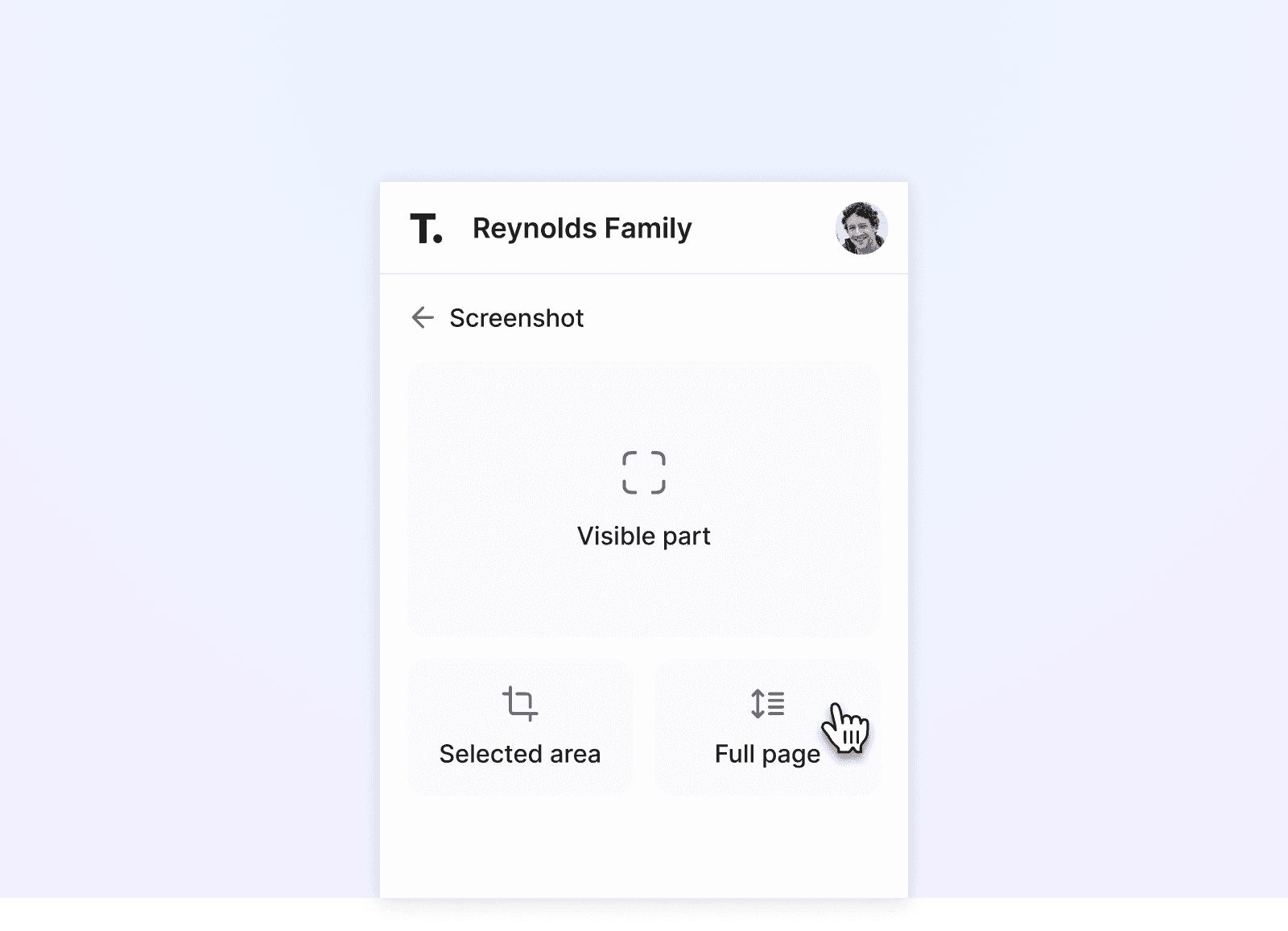

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

It is understandable if you aren't in the correct frame of mind to handle the concerns of the decedent's estate while grieving your loss.

However, to lessen the stress and financial agony associated with this trying time, asking the proper questions to an estate attorney can make all the difference in the world.

Here are some of the top questions you should ask your estate attorney after the death of a loved one:

How do I notify loved ones of the death?

How do I get a death certificate?

Is the previous power of attorney still effective?

How can I determine if there is a will?

Do I need to file for probate?

Asking the right questions to an estate attorney after a death can also reduce the likelihood of conflicts arising within the family over the division or administration of an estate.

For this reason, Trustworthy has compiled this list of important questions to ask an estate attorney following a loved one's passing.

After reading this article, you will know the right questions to ask your attorney after the death of a loved one.

How Do I Notify Loved Ones of the Death?

You shouldn't just assume that everyone will learn of the death when they need to. You can't rely on the obituaries to spread the word because printed newspapers are becoming increasingly scarce, and word-of-mouth may not be as reliable as you expect.

You should also speak with an estate lawyer to learn more about the notification requirements, such as obligatory death announcements in the neighborhood newspapers and elsewhere. This will provide you the warning you need to safeguard your legal rights and stop other people from contesting the estate.

In addition to family members, you should get in touch with creditors and anybody else who regularly sends invoices or withdraws funds from any bank accounts your loved one may have had. This covers utilities, carriers for cell phones, and credit card companies.

Though you should double-check this, many funeral homes will immediately suspend Social Security payments.

Additionally, be careful to cancel any payments that are automatically deducted from the bank account of your loved one. Account cancellation can help avoid expenses from automatically renewing accounts and safeguard against fraud and identity theft. Check recent credit card statements to find websites and services that might have the deceased's credit card information.

Trustworthy’s Family Operating System® secures and organizes your family’s important information. Trustworthy gives you a streamlined platform to access your estate planning documents whenever and wherever you need them.

Try Trustworthy free today.

How Do I Get a Death Certificate?

Making sure you obtain the death certificate is vital.

After the funeral service, the death certificate should be made available, and most funeral homes will assist surviving family members in obtaining the necessary paperwork.

Ask the funeral director for a death certificate as soon as possible if you do not receive one from the funeral home.

A death certificate is necessary for the administration of the estate as well as to claim some benefits. Contact your local Department of Vital Records if you require more copies of the death certificate.

A certified death certificate is required whenever you must produce documentation of the decedent's passing. Some instances include:

Claiming Social Security survivor benefits

Requesting veterans' benefits

Launching a probate court case

Putting property held in joint tenancy in the name of the survivor

Changing an IRA that belonged to a deceased person to become an inherited IRA

Obtaining around a dozen certified copies is generally a good idea.

You will have to make formal written requests to the county or state vital records office if you require further copies in the future.

County offices are oftentimes confusing to navigate. Your lawyer can help you contact the county clerk, county registrar, or health department.

Is the Previous Power of Attorney Still Effective?

You could mistakenly think that a power of attorney for the recently deceased is still in effect. It is crucial to recognize that a power of attorney is no longer effective as a result of the decedent's passing.

You are not authorized to manage the estate after the passing of your loved one under a previous power of attorney.

The person designated as the executor or personal representative is the only one with authority to manage the estate. The court will designate and appoint that person.

How Can I Determine if There Is a Will?

Determining if a legitimate will exists is crucial. Doing so can significantly ease the estate administration process. Although you can start by searching the deceased's belongings and papers for a will, the will is frequently stored elsewhere.

The will might be kept in a safe deposit box; you might check with the bank where the deceased held accounts.

You could also ask the lawyer who handled the deceased's taxes and other legal problems.

If your search for a legitimate will is still fruitless, talk with your estate attorney.

I Know My Loved One Wanted Me to Have These Objects; Can I Take Them?

After a person passes away, an estate must be formally "opened" to discover what assets are included with it. You cannot take objects until the estate is opened.

It could be challenging to get back anything that has been taken if other family members start claiming ownership of items.

My Loved One Died Without a Will. Do I Need to File for Probate?

It's a common misconception among many people that they won't need to start a probate estate, even if their loved one died without a will.

You risk being held accountable for taxes and other claims if you don't start a probate estate.

Even if you don’t believe a probate estate is required, you must go over your choices with a knowledgeable estate lawyer.

How Long Does Probate Take?

The size of your estate will determine this answer. While bigger estates may take a year or longer to probate, smaller estates may take a few months.

How Can I Decrease Probate Costs?

Small estate administration processes that are quicker and simpler than the conventional probate process exist in many states. Although state laws differ, some states set the sum at $100,000.

The executor could benefit from the small estate administration process by keeping the estate's value below this threshold.

What Should I Do About the Insurance?

If your departed loved one had a life insurance policy, your attorney should assist you in filing a claim. The proceeds are sometimes given to the recipients immediately and other times to the estate that has undergone probate.

How Do I Safeguard the Assets that were Left Behind?

Asset preservation is crucial when a loved one passes away, and what you do today could have a major impact afterward.

When a close family member or friend passes away, it can be a perfect opportunity for people or businesses that do not have your best interests, such as dishonest financial advisors or greedy relatives.

Opening the estate as soon as possible is the best strategy to safeguard the assets.

The task of safeguarding the assets and allocating them per the decedent's intentions falls to the executive or personal representative, who the court will appoint.

What Should I Do About Open Bank Accounts?

Before closing an account, some banks may request to see a copy of a death certificate, particularly if it was exclusively in your loved one's name.

Even if there is no cash in an account, keeping it open could result in fines for inactivity.

What Should I Do About Federal and State Taxes?

You should ascertain your deceased loved one's tax status as soon as possible because the IRS has an interest in the estate. When managing an estate, it is easy to forget about taxes, but the IRS will remind you.

You should get in touch with the individual who handled the deceased's returns if you have any questions concerning the tax position. They should know about pending audits, tax debts, or other difficulties and have copies of prior tax returns.

What Should I Do About Debts?

There is a lot of misunderstanding about how debts are handled once someone passes away.

Some people believe that debts just vanish when a debtor passes away, but this isn't always the case. Some debts are discharged upon death, but others remain and become a part of the estate.

The good news is that it's unlikely that the deceased's heirs will be responsible for paying off the debts. Debts do not pass to the loved ones left behind if the estate's assets are greater than its liabilities, including taxes.

Unfortunately, many people don't realize this and end up making payments on obligations for which they are not financially or legally responsible.

How Do You Bill for Your Services?

Some attorneys don't disclose their costs on their websites, so you should get clarification before hiring one. They occasionally charge flat prices or hourly rates.

Find the answers in advance to avoid unforeseen costs and unpleasant shocks after the probate process.

How Trustworthy Can Help?

Trustworthy’s Family Operating System® allows you to keep all of your estate planning documents secure and organized.

You can easily access your estate planning documents using Trustworthy whenever and wherever you need to. You can also invite family members or trusted professionals like lawyers and accountants to update your estate documents.

Families now require a place where everyone can collaborate on important documents. You want everyone to be aware of important family information like investments, insurance, and other estate planning matters.

Ditch your files and folders and try Trustworthy free today.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.