How to Stop Social Security Direct Deposit After a Death

February 1, 2023

|

Larry Li

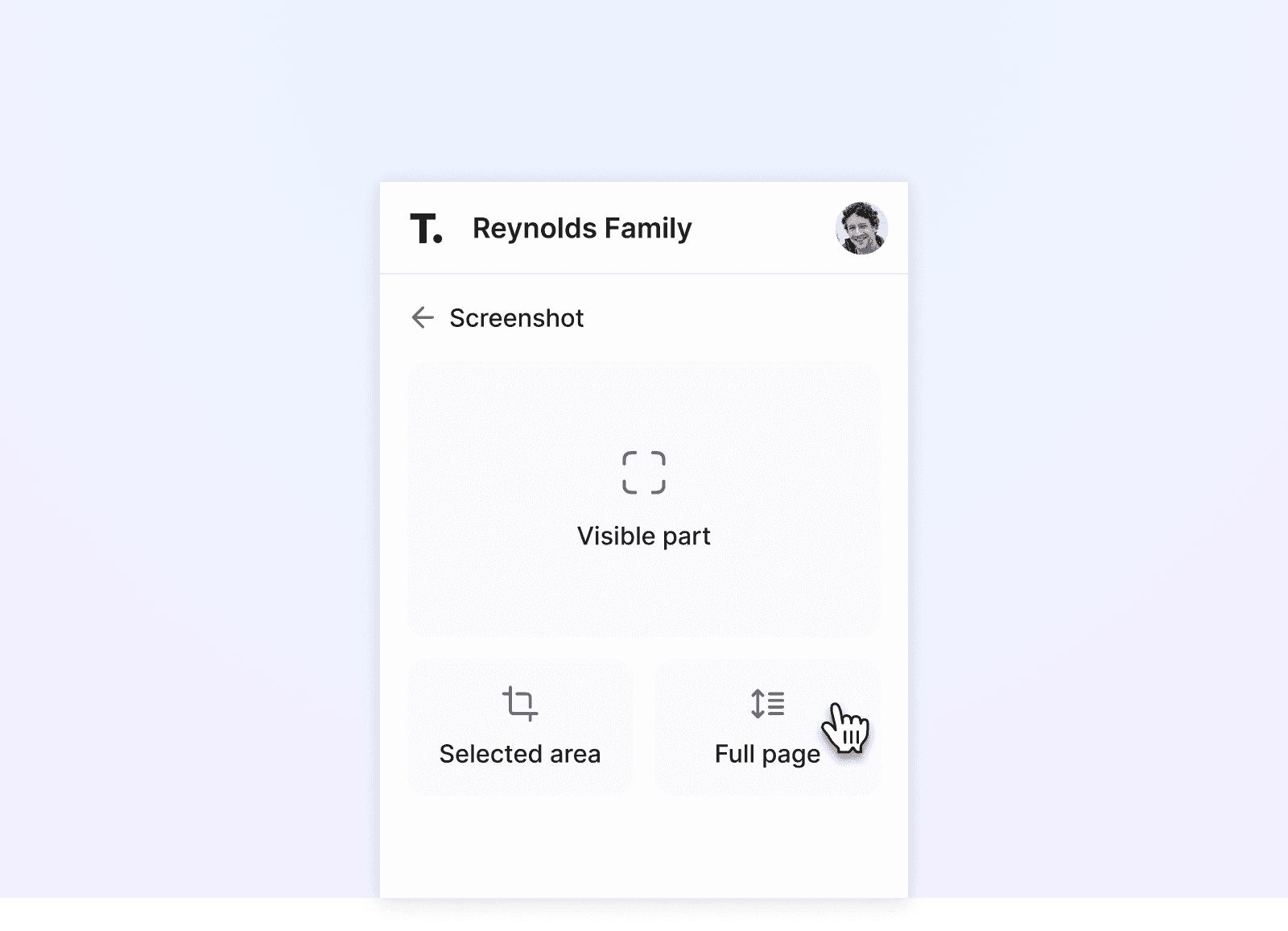

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

One detail of handling a fallen loved one’s affairs that most people aren’t familiar with is how to manage their last Social Security benefits check.

So how do you stop Social Security direct deposit after death?

The next-of-kin, executor, or administrator should notify the Social Security Administration (SSA) about the death by calling the 800 number for the state your loved one resided. The SSA will withdraw the payment electronically if your loved one had the Social Security payment deposited directly into the bank account.

While some people incorrectly assume that the estate is entitled to keep the beneficiary’s Social Security payments, they must usually be returned to the Social Security Administration. However, you may be entitled to survivor benefits depending on your relationship with the deceased.

This comprehensive guide discusses:

If Social Security knows when someone dies.

An explanation of the timing of Social Security payments.

How to notify Social Security of a death.

How to return Social Security payments after a death.

How to apply for Social Security survivor benefits.

Does Social Security Know When Someone Dies?

In the majority of cases, funeral homes report deaths to the Social Security Administration as part of their client services. The SSA provides a form for this purpose.

Furthermore, vital-statistics offices in the United States have integrated Electronic Death Registration, a web-based system that delivers death information to the SSA with greater accuracy and speed.

However, a representative payee, a person appointed by the SSA to handle benefits payments for someone who’s passed away, is also responsible for reporting a beneficiary’s death as part of their duty.

Therefore, it’s in your best interest to notify the SSA about your loved one’s death.

Understand the Timing of Social Security Payments

The SSA makes Social Security payments in the month following the month for which they are due. For instance, if your June benefit is received in July, your July benefit is direct-deposited in August, and so on.

It’s important to understand that the SSA pays benefits for a specific month only if the beneficiary was alive for the entire month.

For example, if your grandfather received a Social Security payment on Oct. 10 but passed away Oct. 25, his estate can keep that check because it’s actually the payment for the month of September.

However, if his next check is directly deposited in November, it must be returned. That is because the check is for October, and the SSA does not pay benefits for the month a beneficiary died.

How to Notify Social Security of a Death

While funeral directors may notify the Social Security Administration about the death of your loved one, you should still notify the SSA yourself. You can notify the SSA by calling 800-772-1213 or visiting your local Social Security office.

Notifying the Social Security Administration about the death will immediately stop Social Security direct deposits after death.

Keep in mind that Social Security beneficiary deaths cannot be reported online. However, it’s important to report the death of a Social Security beneficiary to avoid a few problems. First of all, you must return any payments you continue to receive from the SSA after the beneficiary’s death.

Continuing to collect payments after someone dies is a federal crime punishable by fines or imprisonment. Furthermore, failing to report the death can cause you to miss out on collecting Social Security Survivor Benefits.

Returning Social Security Payments After Death

Prompt notification to the SSA allows the organization to stop paying benefits as soon as possible, reducing the likelihood of confusion over whether a late beneficiary’s last check must be returned or not. If the SSA does make a payment for the month of your loved one’s death, do not spend the money.

Furthermore, if a late beneficiary received their benefits in check form, do not cash any checks for the month of their death or later. Instead, send the check back to the SSA as soon as you can.

If the benefit payments are sent by direct deposit, contact the bank or alternative financial institution as soon as possible and ask them to return the funds received for the month of death or later. Acting with haste will help surviving family members avoid financial confusion during an already challenging time.

Applying for Social Security Survivors Benefits

Social Security survivor benefits are payments sent to eligible survivors of a deceased beneficiary.

Eligible survivors include:

Surviving divorced spouses (under specific circumstances).

Widows and widowers age 60 or older (50 or older if disabled).

Widows and widowers of any age who care for the deceased person’s child who is under age 16 or disabled.

Unmarried children of the deceased who are under 18, or any age if disabled.

Stepchildren, grandchildren, step-grandchildren, and adopted children.

Parents age 62 or older who depended on the deceased for at least half of their support.

If you believe you are eligible to receive Social Security survivor benefits after the death of your loved one, there are a few steps you must take to apply for them.

Step 1: Contact the SSA

First, you must report the death to the Social Security Administration if the funeral home hasn’t completed it already. You can also start the application process at the time you report the death. Simply tell the person on the line or at the office that you want to apply for Social Security survivor benefits.

They will give you instructions based on your relationship with the deceased.

Step 2: Collect Important Documentation

The next step is to collect the required documents. However, the documentation you need depends on whether you apply for benefits as a widow or widower, as the parents of the deceased’s child, or as the deceased person’s parent.

Typically, the list of documents includes:

Proof of the beneficiary’s death (a death certificate).

Your birth certificate.

Proof of citizenship.

Proof of marriage.

Birth certificates for each child for whom you’re claiming benefits.

W-2 forms and tax returns for the deceased beneficiary.

Your divorce decree if you apply as a divorced surviving spouse.

The Social Security Administration may also ask you some questions to help determine your survivor benefits eligibility. These questions cover general items such as your name, address, and date of birth. They may also dive into your earnings and work history, and the deceased’s earnings and work history, military history, and disability status.

Planning With Trustworthy

There’s rarely anything more difficult than dealing with the loss of someone you care about. From grieving and funeral planning to handling the deceased person’s last wishes, there are dozens of tasks to manage.

However, you can better prepare yourself for life’s most fragile moments with Trustworthy.

Trustworthy is a super-secure cloud-based digital storage platform dedicated to keeping your sensitive information safe. Therefore, you can safely upload all of your family’s estate planning documents, such as wills, power of authorities, and living wills.

Then, you can securely share these documents with your loved ones. This way, your family knows how to handle a key aspect of the post-death process.

You can use Trustworthy (Try it free) to plan, organize, and reliably share your estate documents.

Trustworthy also safely stores personal IDs, passwords, financial documents, and much more.

Related Articles

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.