Tips for a Smooth Home-Buying Process

April 3, 2025

|

Stephanie Booth

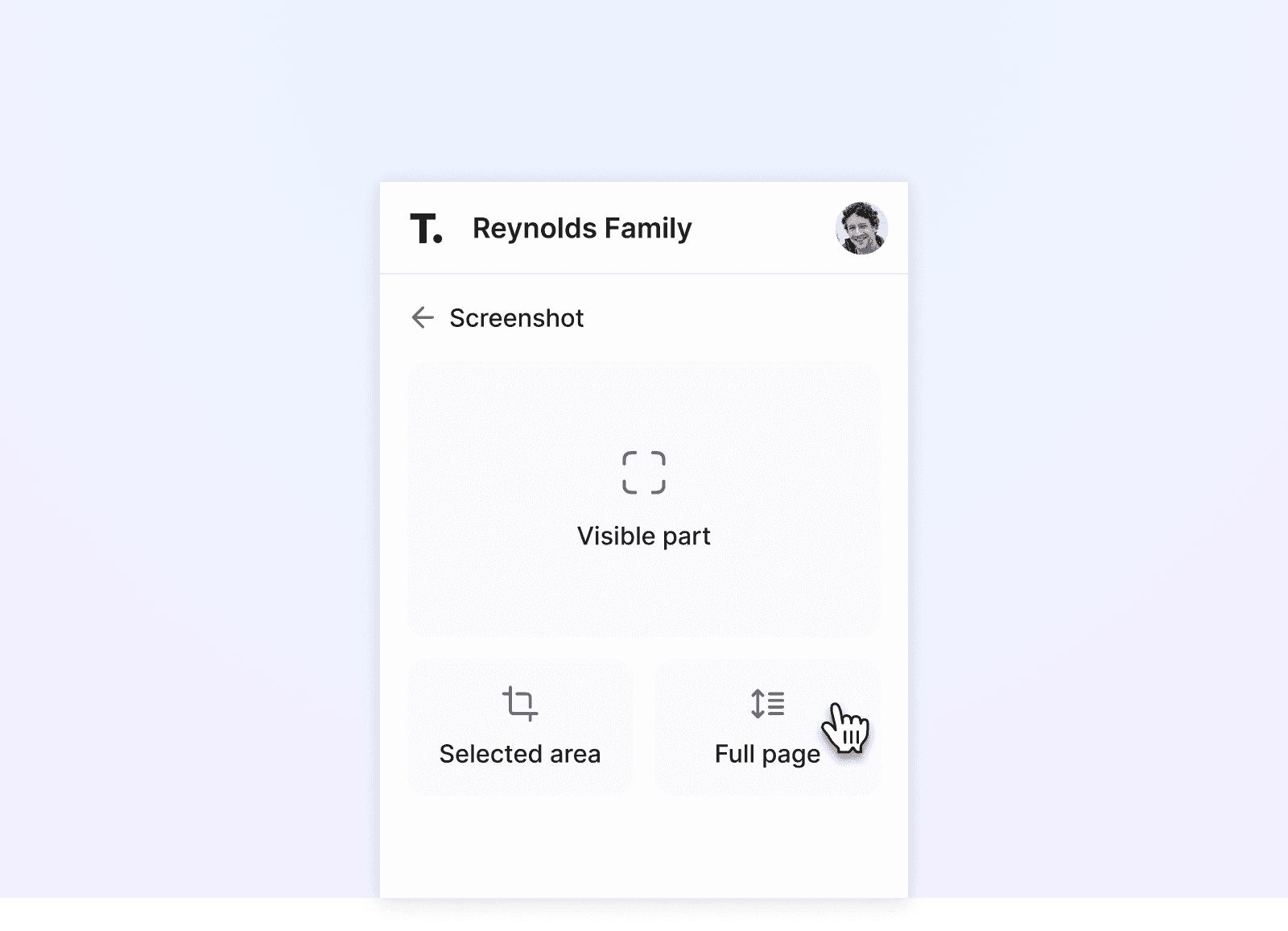

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

What is one of the biggest investments — and, let’s be honest, daunting decisions — you can make? Buying a house.

The best way to view the process? As a marathon, not a sprint. Or as a journey. Either way, try to stay calm.

Below is an overview of the process, from finding the right house, to understanding financing and closing costs, to closing on your big purchase. With the right preparation, knowledge, and first-time home buyer tips, you'll be ready to buy your dream home and make a great investment.

Key Takeaways

Understand when you’re ready to buy your dream home — and how much home you can afford.

Get a big-picture view of the home-buying process.

Learn about all the costs involved, from agent fees to closing costs.

Deciding Whether to Buy a House

Buying a house would be simpler if all you had to consider was whether you really liked a property. But because a home isn’t just a personal decision, but a financial investment and added responsibility, there’s a lot more you’ll have to consider.

Two-thirds of U.S. adults own a home, but that doesn’t mean that it’s right for you, right now. Here are some questions to ask yourself:

Do you prioritize stability — that is, living somewhere for at least five years — or flexibility (being able to move on short notice)?

In your desired neighborhoods, which are more within your budget — the homes for sale or for rent?

Do you want to be able to independently renovate and make repairs to your home?

Are you financially ready to manage the costs of not just buying a house, but also maintaining it?

Let’s dig into that last question — which is arguably the most important one — a bit more.

Can You Afford to Buy a Home?

Generally speaking, here are the factors you’ll need to consider:

Your Income

There’s no shortage of debt-to-income estimates and home affordability calculators online, but here’s a shortcut. Experts often suggest that you choose a house that’s no more than three to five times your annual income.

Your Credit Score

This snapshot of your credit behavior determines not only whether you qualify for a loan, but a lender’s interest rates and terms.

A credit score of at least 620 is the requirement for many mortgage companies, but there are plenty of exceptions. If you fill out an application for a jumbo loan — $726,200 or more — be prepared to show a credit score of at least 700.

Why do you want a high credit score? The higher your credit score, the more favorable lending rates you’ll get. For example, having a high credit score could put you in line for lower interest rates.

A Down Payment

How much cash do you have to put toward a home? In the fourth quarter of 2024, the median U.S. home price was $419,200, with some lenders asking for 20 percent of the purchase price as a down payment. While others may be satisfied with as little as 3 percent, you may need to come up with $80,000 or more upfront.

While convenient, a small down payment comes with a price. You’ll need to purchase private mortgage insurance (PMI), which will drive up your monthly mortgage payments.

Your Debts

Carrying debt like a car loan, student loan, or credit card balance is a part of life, but the amount you have can affect how much money you have each month to make mortgage payments.

One rule of thumb: Ideally, your monthly debts should be no more than 36% of your pretax income.

Buying a House, Step by Step

Scrolling through homes on Zillow or touring them in person is the best part of buying a home. But there are a lot of steps to take before you get to that point (spoiler alert: there are also several important steps that come after).

To get started on your journey toward homeownership, here is our home-buying process guide:

1. Check Your Credit Score

One of the first steps to buying a house is knowing your credit scores, which can help you know the types of mortgages you’ll be able to get. You can find your number:

On your credit card statement. Many companies share a credit score on a monthly basis.

Through credit reporting agencies. For instance, at myFICO, you can request your FICO for free or with a paid credit monitoring service.

Not sure why you have the credit scores you do? Through AnnualCreditReport.com, you’re entitled to a free credit report once a year from the three major credit reporting agencies — Equifax, Experian, and TransUnion.

2. Save for a Down Payment

How much you’ll need to save varies widely by location. In 2024, the medium down payment for a home ranged from $3,857 in Arkansas to $100,000 in California.

Once you have a number in mind, these strategies can help you reach your goal:

Make an investment. Shop around to find the best rates on high-yield savings accounts, CDs, and money market funds.

Talk to family members. Is a relative able and willing to contribute money toward you buying a house?

Get support. Many local and state programs offer assistance with down payments. That might include a grant (one-time lump sum), a low-interest or deferred-payment loan, or a matched savings account, in which the money you put in to save for a home is matched by public or private funds.

3. Create a Housing Budget

Homeownership comes with some surprising costs. To make sure you are well-prepared:

Know How Much House You Can Afford

Mortgage lenders have two specific ways of assessing your finances:

Housing expense ratio: Ideally, less than 28% of your monthly gross income will go toward your monthly mortgage payment (including taxes and insurance).

Debt-to-income ratio: Less than 45% of your monthly gross income should go toward all your combined debt (including car payments, student loans, credit cards, etc.).

Running these numbers now could play an important role in your decision-making process later on.

Prepare for the Extra Costs of Purchasing a Home

Be prepared for closing costs of purchasing your dream home because these can add up to 5 percent of your loan principal. Some common closing costs for a home purchase price of $500,000 will look like:

Application and credit fees ($200).

Home inspection fee ($500).

Appraisal fee ($500).

Title fees ($3,000+).

Transfer tax ($4,000).

Prepare for the Extra Costs of Homeownership

A monthly mortgage payment is a given when you buy a home, but don’t forget about costs like:

Monthly utilities.

Property taxes.

Homeowners association dues.

Homeowners insurance.

Remodeling projects.

Home maintenance, such as lawn care and regular checks of your heating and cooling systems.

Home repairs, which could range from a small plumbing problem to a leaky roof that needs to be replaced.

As a ballpark estimate, plan on spending 1-2% of your mortgage balance for home maintenance and repairs each year. That percentage will likely be higher if your home is old, has a lot of square footage, or just needs some extra TLC.

Property taxes vary widely, but the average rate nationwide is 1.1% of a home’s assessed value.

4. Get Pre-Approved for a Mortgage

A mortgage pre-qualification letter lets a seller know that you’re serious about buying a house. It’s basically the lender’s estimate of how much you can afford to spend.

Even better? A pre-approval letter. This means that your lender has taken extra steps to verify your employment, credit scores, tax returns, and other important financial documents.

To get a pre-approval, you’ll need to fill out an application with the lender of your choice. Be prepared to share:

Personal documentation, such as your Social Security number, driver's license, or passport.

Proof of income, including tax returns from the past two years and W-2 forms.

Proof of assets, like your banking and investment statements.

Verification of employment, such as paystubs.

Before you choose your lender, it is crucial to compare them against others to ensure you’re getting the value for money that suits your financial needs. You should also have a clear understanding of the different types of mortgages and which one is best for you.

For example, fixed-rate mortgages are the most common long-term loans, whereas adjustable-rate mortgages may have lower introductory rates but change over time.

Trustworthy can help with this step. The Family Operating System® provides immediate access to documents like these, so you don’t need to spend hours rummaging through old-school filing cabinets or asking your partner where they are.

Trustworthy also allows you to share these documents securely and control who can access them and for how long. To put your mind at ease, the Trustworthy Family Operating System® includes bank-level security with AES 256-bit encryption, tokenization, multi-factor authentication, biometric authentication, physical security keys, and continuous threat detection.

5. Decide Whether to Hire a Buyer's Agent

Do you have to hire a real estate agent? The short answer is no. But buying a home can be intimidating, and hiring a licensed professional to help you navigate the process could be worth it. As an added bonus, you likely won’t pay for it — a real estate agent’s commission is typically paid by the seller.

While you can certainly search for homes by yourself, a real estate agent has the experience and expertise to help you:

Recognize a home’s red flags or future repairs.

Research schools, crime rates, and comparable home prices in neighborhoods.

Support you through the decision-making process.

Negotiate an offer.

Understand the purchase agreement.

Look for a real estate professional who has a great track record and credentials. If you feel confident about taking on their responsibilities yourself, you may want to at least consider working with a real estate attorney who can review the paperwork and offer any legal advice.

6. See Multiple Homes

You’ve done a lot of number-crunching up to this point, so now it’s time to enjoy yourself and tour properties that may be a good fit.

Let your real estate agent (if you’re using one) know what’s on your wishlist. They can find potential homes for you to tour through the Multiple Listing Service (MLS), a comprehensive database of homes for sale.

The average homebuyer tours 10 houses over 10 weeks before they find “the one.” That may seem like a long time, but try not to rush into a purchase that you might regret later.

7. Make an Offer

Ready to put in a formal, written offer? Here’s what that legally binding document will need to include:

The price you’re willing to pay.

The projected closing date (i.e., when you’d like the sale to be complete).

The amount of your earnest money (the deposit, which will be put toward the home price).

Contingencies (reasons you can legally back out of the deal without losing your deposit).

Clear title stipulation (proof that the owner has a legal right to sell their home).

Closing cost details (including how property taxes may be prorated once you take possession).

Any other state-required disclosures or provisions.

The date your offer expires.

After the home seller reviews the offer, they can accept it, make a counteroffer, or reject it.

Here’s where working with a real estate agent can really come in handy. They can likely offer tips ahead of time to help you craft an offer that will get the seller to say yes. Hint: A super-fast closing date or too many contingencies can often be deal-breakers.

8. Get a Home Inspection

You just found the home of your dreams — so of course, the next step is to make sure that it’s not going to fall apart.

Home inspections aren’t pass/fail tests. They’re a walk-through by a professional that assesses the condition of the property, including the home’s foundation, roof, framing, heating and cooling system, plumbing, and electrical work.

According to the American Society of Home Inspectors, a home inspector can’t tell you whether you should buy a house or whether you should ask for repairs.

Also, contrary to popular belief, a home seller has no legal obligation to fix or pay for an issue that shows up on an inspection report. If you’d like them to, it will be up to you (and your real estate agent) to negotiate.

9. Negotiate Repairs and Credits

The expectation is that you’re buying a house that’s reasonably safe and healthy.

If a home inspector finds issues that weren’t apparent or disclosed to you when you made the offer, it may be reasonable to ask the seller to repair them before closing or reduce the price of the house.

Some repairs that are reasonable to ask for include:

High levels of radon.

An outdated or unsafe electrical panel.

Loose or missing deck railings.

Appliances that don’t work properly.

Termites.

Leaking roof.

Mold.

That said, in a competitive market that favors sellers, you may want to consider which issues are deal-breakers for you and which you’re willing to pay to have fixed yourself.

10. Compare Mortgage Options

Remember that pre-approval letter you got a while ago? Well, it’s not the same thing as applying for a mortgage. And you don’t even have to use the lender who pre-approved you!

Once you’re ready to secure financing, you’ll want to get loan estimates from several lenders so you can shop around for the best deal. A loan officer at a mortgage company can help with this step, but it’s wise to compare:

The loan amount.

The interest rate (and if it could rise).

The monthly payment.

The monthly mortgage insurance cost.

Your upfront loan costs.

Lender credits (which lower your closing costs in exchange for a higher interest rate).

The amount you’ll need to bring to closing.

Looking back on your budget can help you with this decision-making process. If you’re not enthusiastic about any offer, try negotiating with a lender. Sometimes, especially if you have offers from other lenders, they may be willing to change their initial terms.

11. Apply for a mortgage

It's time (again) to pull together lots of documentation. Once you notify a lender that you’ll accept their terms, you’ll need to officially apply for a mortgage. Here’s what you’ll need to do that:

Most recent pay stubs.

W-2 forms from the last two years.

Year-to-date profit and loss statement, if you’re self-employed.

Documents to show unpaid accounts receivable, if you’re self-employed.

1099 forms from the past two years.

Checking and savings account statements.

Investment account statements, including 401(k)s and IRAs.

Any down payment gift letters.

Documentation of any rental income.

Alimony and child support documents.

Life insurance policy, if it has cash value.

Credit card statements.

Loan statements, such as student loans, car loans, or personal loans.

Medical bills.

Proof of monthly job-related expenses.

Driver's license.

Social Security card.

Immigration documents.

Rental history.

Documents for any other properties you own.

This is a lot to ask for, but here’s the good news: Mortgage applications can often be filled out in 45 minutes or less if you have all the necessary documents ready ahead of time.

One way to do that? You guessed it: Sign up with Trustworthy. It’s the only platform that gives you a centralized view of all your family’s most important information. A Trustworthy Certified Expert™ can even coach you through the process of gathering your documents and help you find or replace lost documents.

12. Do a Final Walk-Through

Right before your closing — ideally hours before, not days or weeks — visit the house and make sure it looks just as amazing as when you fell in love with it.

You (and your real estate agent, if you used one) will have time to do this final inspection to ensure all the terms of your contract, including any contingencies, have been met.

Excluding any "as-is" conditions that you'd already accepted, check that:

The seller has completely moved out.

The home is clean.

Walls and doorways show no signs of damage.

The door and window locks are functional.

The heating/cooling systems work.

There are no plumbing issues.

All appliances are in working order.

All repairs have been made.

The yard is free of debris.

If you do notice an issue during your walk-through, alert your seller’s agent. The seller can make an immediate repair or put money in escrow so you can fix the problem after closing. If they choose not to do anything, you’ll have to decide whether to back out of the deal or make the repairs yourself.

13. Close on Your House

Before your homeownership becomes official — and you pop open the champagne — you’ve got to show up at closing and make everything legit.

Make sure to bring with you:

Your photo ID.

Marriage certificate (if you and your partners have different last names).

Proof of your home insurance.

A cashier’s check or certified check for the closing costs.

All other home-related paperwork (like closing documents).

Have a pen ready, because you’ll be signing a lot of papers, such as:

Your loan documents.

A closing disclosure.

An initial escrow statement.

A purchase agreement.

And once you’re (finally!) done, it’s time to pull all these new and very important homeownership documents somewhere safe. Upload them to Trustworthy and give yourself some peace of mind.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.