Filing Taxes as a Married Couple: A Step-by-Step Guide

September 12, 2023

|

Joel Lim

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

How you file your taxes can save you thousands. As newlyweds or married couples looking to get the least tax liability possible this year, you want to know you are getting the most from your tax return.

This step-by-step guide to filing taxes as a married couple will cover everything you need to know for tax season. We’ll discuss how to file your taxes, what to consider before you file, and tips to help you save as much as possible.

Key Takeaways

Filing jointly with your spouse typically allows you to receive a smaller tax liability. However, there are some situations where filing separately may be better.

There are several things to consider before filing your taxes as newlyweds. This includes name and address changes, withholdings, and you and your spouse’s filing status.

By preparing two tax returns, one jointly and one separately, you can see which option will grant you the most savings.

How Should You File Taxes as a Married Couple?

As a married couple, you can file your taxes jointly or separately. The taxes you pay and the deductions you may receive are different depending on how you file.

Benefits of Filing Jointly

For most couples, filing jointly will be the best option. Filing jointly allows you to qualify for more tax credits and deduct a significant amount from your taxable income.

The tax credits you can qualify for when filing jointly include:

Child and Dependent care tax credit

American Opportunity and Lifetime Learning education tax credits

Earned Income tax credit

These credits allow you to reduce the taxes you owe. It is worth investigating whether you and your spouse qualify for these credits, so you can ensure you receive the largest return possible.

The other benefit to filing jointly is that you and your spouse are granted a higher threshold to be still eligible to receive deductions.

For example, the threshold as a single filer could be only up to $50,000 a year, but when filing jointly, it would be increased to $60,000 per person. This means you can earn more money and still qualify for the same deductions.

Consequences of Filing Separately

When you file separately from your spouse, you are automatically ineligible to receive the deductions mentioned earlier and additional breaks.

If you file separately, you are automatically ineligible to receive the following:

Earned Income Credit

Education Credits

Student Loan Interest Deduction

Maximum IRA Contribution Deduction

The money you may receive or save from these deductions can add up to more than a thousand dollars.

Another consequence of filing separately is that you will return to the standard threshold to qualify for deductions and breaks.

This means that if you earn more, you will not receive fewer deductions and will likely have to pay more tax.

When Does It Make Sense To File Separately?

Despite the benefits for those who file jointly, there are still instances where it may be better to file separately. The situations where it makes sense to file separately include:

You and your spouse have a similar income: When you file jointly, your combined income might place you in a higher tax bracket. This means you may pay more taxes than you would if you file separately.

You or your spouse has a large amount of out-of-pocket medical expenses: To claim a deduction for medical expenses on your tax return, the total amount you spent on medical expenses must exceed 7.5% of your adjusted gross income.

If you file jointly, you can only receive the medical deduction if the expenses exceed 7.5% of your and your spouse’s combined adjusted gross income.

For example, if you spent $10,000 on medical expenses throughout the year and your AGI is $40,000. You qualify for the deduction.

However, if your spouse’s adjusted gross income is $100,000, your combined adjusted gross income is $140,000. You would not qualify for the medical deduction because $10,000 is not more than 7.5% of your AGI.

You or your spouse has tax debt: If you file separately, the IRS will not hold you responsible for any tax debt your spouse may have, and vice versa. You will still receive your full refund without liability for your spouse’s balance.

Things to Consider Before Filing Taxes

Due to the complex tax laws surrounding the liability of married couples, it can be challenging to know how to file your taxes correctly while ensuring you receive the most savings, so here are several things to consider before filing your taxes.

It’s important to keep track of where all your money went and how much you received throughout the year. Here are some good questions to ask before filing:

Did we contribute to political campaigns?

Did we have any capital gains or losses?

Did we have any gambling losses?

How much did we pay for medical expenses?

Has the interest on one of our student loan(s) increased?

Questions like these can help you better understand what taxes you are obligated to pay and any deductions you are eligible for.

Checklist for Married Couples

If you’re a newlywed, going through and editing your tax information before the next tax season is essential. Here is a helpful checklist of items to review and edit if necessary.

Name: If you or your spouse changed your name due to your marriage, it is crucial to report the change to the Social Security Administration. If the name on file does not match the name you use on your tax return, it may delay receiving your return.

Address: If you changed your address after getting married, you must report the change to the IRS and the U.S. Postal Service.

Withholding (W-4): You and your spouse can use tools like the IRS’ tax withholding estimator to determine the new withholding you need to set. Newlyweds must submit a new W-4 to their employer within ten days of getting married.

Beware of scams: When changing this information and dealing with sensitive matters, it is crucial to be cautious of scams. The IRS only ever contacts through the mail, so any other form of communication is mostly likely a scam.

What Qualifies as Being a Married Couple?

To be qualified as a married couple, in the eyes of the IRS, you must be married by Dec. 31 of the tax year and your marriage must be legally recognized.

For example, if you get married on December 31, 2022, the IRS will consider you married for all of 2022 for tax purposes. However, if you get married on January 1st, 2023, even though taxes aren’t due until April, the IRS will not consider you married for the 2022 tax year.

Tax Tip: Prepare Two Tax Returns

A great way to ensure you get the largest return when you file your taxes as a married couple is to file two separate returns; one should be filed jointly and the other separately.

I recommend this for newlyweds or those needing to learn which way of filing has a better outcome.

There are great softwares available, like TurboTax, that can automatically determine which return will save you more. It may take extra time to input all the information, but knowing you are choosing the option that will save you more money will be worth it.

Another alternative is to ask an accountant to help you determine which filing status is more beneficial for you. To do this, you and your spouse must have all the required tax documents prepared to calculate eligibility for deductions accurately.

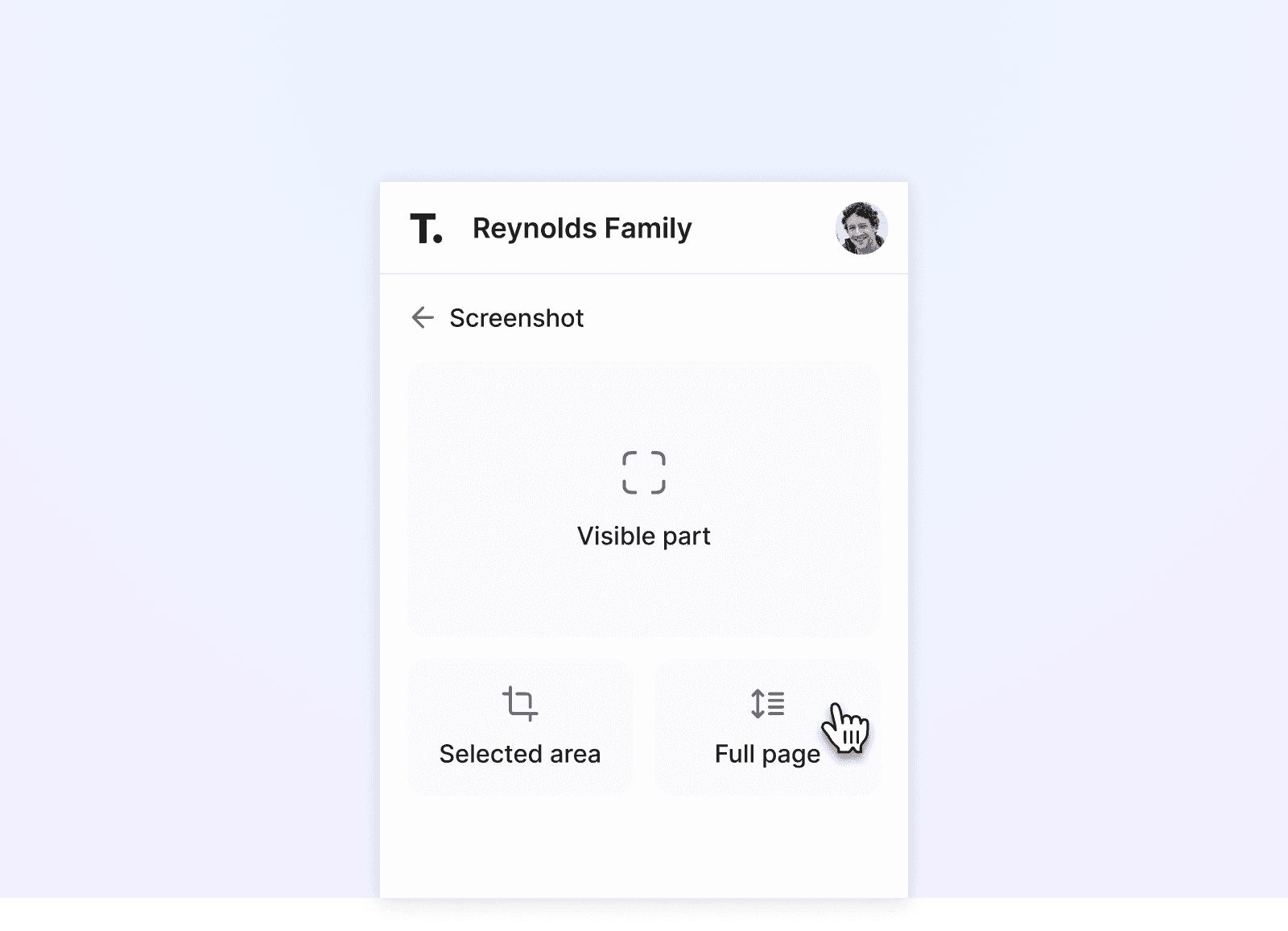

This is where Trustworthy comes in. Trustworthy can store all your sensitive tax and family information securely in one place so you can get all the information you need quickly and without hassle.

Frequently Asked Questions

What happens if my wife and I file taxes separately this year?

If you and your spouse file taxes separately, you are automatically ineligible to receive many of the tax deductions you could receive by filing jointly, including deductions for education and earned income credits. Despite this, filing separately could produce better outcomes, so it’s worth comparing both methods.

Can a married couple file separately one year and jointly the next?

Yes, you and your spouse can change your filing status without penalty. You can change your filing status even if you have filed the same way for years. In some cases, it may even be beneficial to change your filing status from year to year based on changes in income, medical expenses, and debt.

Does it matter when you get married in the year for taxes?

Yes, it does matter when you and your spouse get married in the year. The IRS will only officially recognize your marriage for tax purposes if you were legally married by December 31st of the tax year. If you are married at any time before then, the IRS will consider you married for the whole year.

Can you get in trouble for filing separately when married?

There is no penalty for filing separately from your spouse, even if you are married. Therefore, if filing separately produces a better outcome than filing jointly, you can do so without worry.

Do you get a bigger refund filing married?

Typically, if you file jointly with your spouse, you are more likely to receive a bigger tax return and less tax liability. However, this is not true for everyone, and you should examine your situation closely to decide which way of filing will benefit you most.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.