Divorced at Midyear? Here's How to Handle Your Taxes

December 30, 2025

|

Nash Riggins

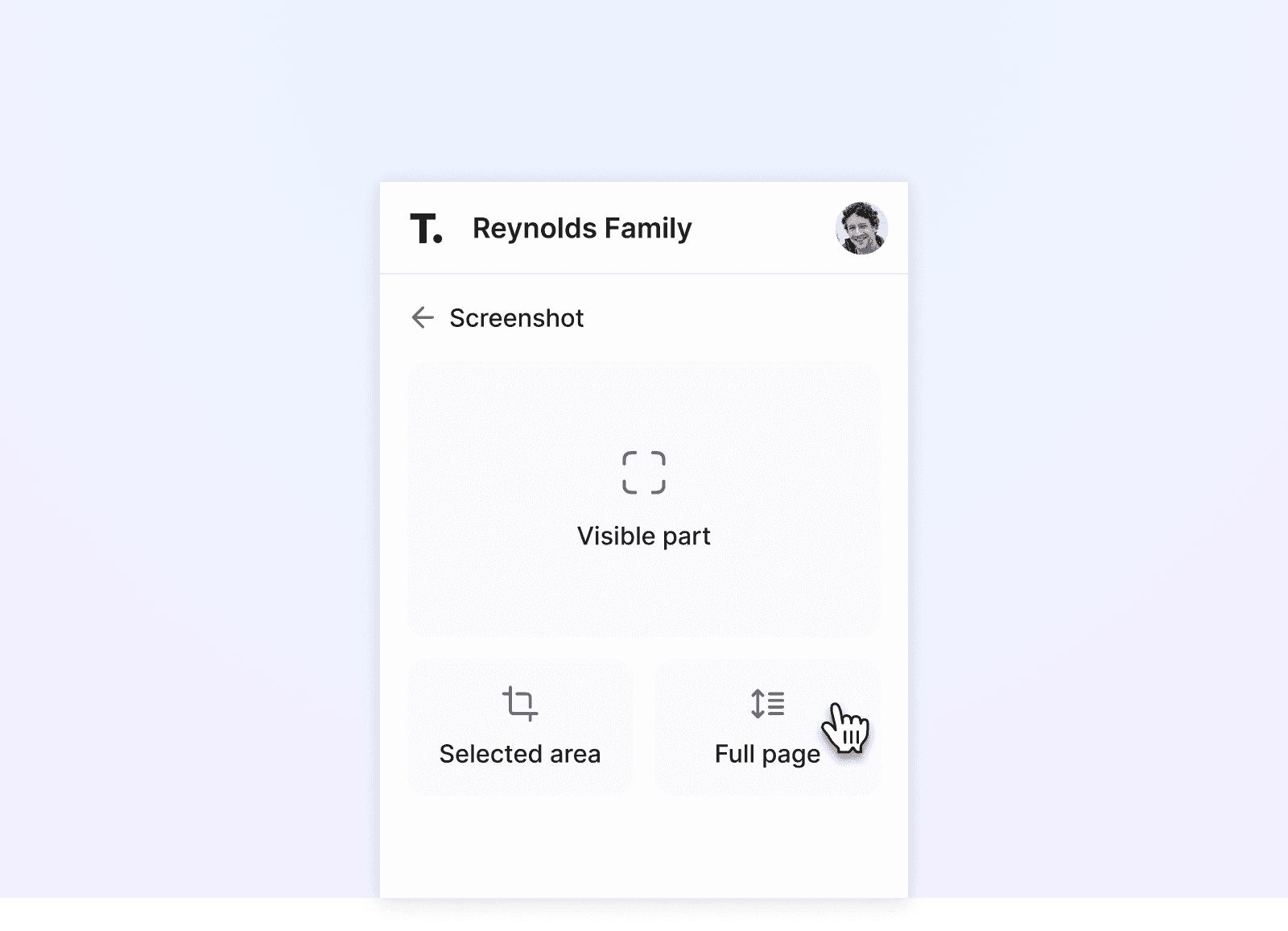

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Divorces can get incredibly complicated, particularly when tax season rolls around.

When you and your spouse split up, you’re faced with a number of important decisions related to filing status, dependents, withholding, and deductions. Some of those decisions may affect which credits you qualify for and how much tax you ultimately owe.

The answers below explain how federal tax rules apply after a divorce for tax year 2025, including how filing status is determined, how children and alimony are treated, and what administrative updates you may need to make.

Filing Status After Divorce

Q: How does divorcing during the year affect my tax return?

A: For federal tax purposes, your filing status for the entire tax year is determined by your marital status at the end of the year:

If your divorce or legal separation is final by Dec. 31, the IRS considers you unmarried for the entire year.

If you are still legally married on Dec. 31 — even if you separated earlier in the year — you are considered married for the entire year.

You cannot divide a single tax year into multiple filing statuses. There is always one filing status per tax year.

Under IRS rules, you and your spouse are considered married until a court issues a final divorce decree or a decree of legal separation.

Q: What filing statuses are available if my divorce is final by Dec. 31?

A: If you are divorced or legally separated by the end of the year, you are considered unmarried and may be eligible to file as:

Single. For tax year 2025, the standard deduction for single filers is $15,750. This option is straightforward and applies to many people after divorce.

Head of household. You may qualify for head of household if:

You paid more than half the cost of keeping up your home.

A qualifying dependent lived with you for more than half the year.

For tax year 2025, the head of household standard deduction is $23,625, and tax brackets are generally more favorable than for single filers.

Q: What if my spouse died instead of divorcing?

A: If your spouse died during the year, different rules apply.

In the year of death, you may still file married filing jointly if you otherwise qualify. In subsequent years, you may be eligible to file as a Qualifying Surviving Spouse With Dependent Child if all IRS requirements are met.

To qualify:

Your spouse must have died.

You must not have remarried.

You must have qualified to file jointly in the year of death.

You must claim a qualifying dependent who lived with you.

You must have paid more than half the cost of keeping up your home.

This status allows you to use the same standard deduction as married filing jointly, which for tax year 2025 is $31,500, even though you are filing alone.

Q: What filing statuses are available if I am still married on Dec. 31?

A: If you are legally married at the end of the year, you generally have two filing options:

Married filing jointly. This status typically provides access to the broadest range of tax credits, including the Earned Income Tax Credit and the Child and Dependent Care Tax Credit.

Married Filing Separately. This option may be appropriate in limited circumstances but often restricts access to credits and deductions.

As Ben Michael, an attorney at Michael & Associates in Texas, explains:

“Different circumstances and jurisdictions can change this, but for the most part, your income taxes, mortgage interest deduction, dependent children, and other key factors will function in this way.”

Q: Is it usually cheaper to file jointly if we’re still married?

A: In many cases, yes, but not always.

“If the divorcing couple can cooperate, it's usually financially advantageous to file as a married couple,” attorney Michael says.

Filing jointly can reduce the overall tax bill due to higher deductions and wider credit eligibility. However, it also creates joint liability for the return, which may be a concern during divorce proceedings.

Withholding and Administrative Updates

Q: Does my tax withholding usually change after separation or divorce?

A: Often, yes.

Tax withholding is the amount your employer sends to the IRS from each paycheck on your behalf. Changes in filing status or dependents can significantly affect how much tax you owe.

“Withholding should typically be changed as soon as you are aware in a year that your filing status will be changing,” says Diana A. Crawford, CPA at Crawford, Merritt and Co. in Georgia.

“If couples jointly operate businesses or have disproportionate incomes, they may be required to make estimated tax payments while they are married. Great care and caution should be made to report the estimated tax payments to the proper spouse in a year where you may not end up filing jointly.”

Most people should file a new Form W-4 to reflect these changes.

Alimony, Child Support, and Legal Fees

Q: Are alimony or separate maintenance payments tax-deductible?

A: For divorce or separation agreements executed after Dec. 31, 2018, alimony and separate maintenance payments are not deductible by the payer and not taxable income to the recipient.

Child support payments are also non-deductible and non-taxable.

Q: Can I deduct legal fees related to my divorce?

A: Generally, no.

Legal fees related to divorce are considered personal expenses and are not tax-deductible. In limited cases, fees directly related to tax advice may be deductible, but this is uncommon.

“As soon as a divorce is contemplated or imminent, each spouse should plan towards filing a return solely based on their income and deductions,” CPA Crawford says.

Claiming Children and Tax Credits

Q: Who can claim children as dependents after a divorce?

A: In most cases, the custodial parent — the parent with whom the child lived for more than half the year — may claim the child as a dependent.

If parents share custody equally and cannot agree, IRS tie-breaker rules apply. Typically, the parent with the higher adjusted gross income (AGI) may claim the child.

Q: Which tax benefits usually go to the custodial parent?

A: In most cases, the custodial parent is eligible for:

Head of household filing status.

Child Tax Credit (up to $2,000 per qualifying child for 2025, with up to $1,700 refundable).

Child and Dependent Care Tax Credit (up to $3,000 in expenses for one qualifying person or $6,000 for two or more).

Education credits may be transferred to the noncustodial parent using Form 8332, if both parents agree.

Retirement Accounts and Property Taxes

Q: How does divorce affect retirement plans and beneficiaries?

A: Divorce is an important time to review beneficiaries and ownership of retirement plans, life insurance policies, and annuities.

"Often, divorce settlements will have spouses transferring portions of their accounts to their spouse's pre-tax account in property settlement," CPA Crawford says.

Q: Who is responsible for back taxes or property taxes after divorce?

A: If a joint return was filed, both spouses are generally responsible for any taxes owed for that year, even after divorce. Divorce agreements may allocate responsibility, but the IRS can pursue either spouse.

Property tax responsibility depends on ownership and the terms of the divorce decree. If both spouses own the property when taxes are assessed, both may be liable.

The Bottom Line

Divorce often requires sharing and updating a large volume of financial, legal, and personal documents, sometimes over an extended period of time. Having a secure, organized way to store tax records, divorce agreements, retirement statements, and prior-year returns — such as through Trustworthy — can help reduce confusion and ensure that everyone involved is working from the same, up-to-date information.

Whether you’re coordinating with a former spouse, a tax professional, or an attorney, clear documentation can make an already complex process easier to manage.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.