Key Takeaways

Google Drive encrypts uploaded and stored files, offering general protection from breaches.

However, it isn’t designed specifically for financial or tax document security.

Storing tax documents in Google Drive carries some risk if sharing or permissions aren’t managed properly.

Trustworthy provides stronger protection with family-focused, privacy-first security.

The guide explains encryption, best practices, and how Trustworthy compares with Drive.

Managing all of your paper tax documents is challenging and time-consuming. There’s nothing enjoyable about digging through filing cabinets to find a specific tax document. Because of this, you may be thinking about storing your tax documents on Google Drive.

But is it safe to store tax documents on Google Drive?

Google Drive is generally safe from external threats such as data breaches and cyber-attacks because your files are encrypted when they’re uploaded and stored on Google Drive. However, Google Drive isn’t designed explicitly to store financial documents, and it isn’t the safest digital storage platform.

Trustworthy is a better digital storage solution for your tax documents in comparison to Google Drive. Although Google Drive is convenient and free, there’s a chance your tax documents fall into the wrong hands when they’re stored on Google Drive.

By the end of this guide, you’ll understand the best practices for storing tax documents on Google Drive and why Trustworthy is the best Google Drive alternative.

In today’s crucial tax preparation guide, I’ll cover:

An overview of Google Drive’s security and encryption

5 tips for storing tax documents on Google Drive

Google Drive vs paper storage for tax documents

Google Drive vs internal/external drives for tax documents

Google Drive vs Trustworthy for tax documents

Google Drive Security and Encryption: Overview

With over 4 billion Google users worldwide, data protection and security are the top priorities at Google. A single data breach can lead to catastrophic consequences because of Google’s massive userbase. For this reason, Google offers 256-bit Advanced Encryption Standard technology (aka best of class encryption software) on all of its Drive servers.

Security threats come in many forms, including:

Hackers

Software and hardware bugs

Human error

Unethical employees

When storing tax documents on Google Drive, the primary security characteristic you should consider is file safety during uploads and transfers.

When your files are in transit as you upload them to Google Drive, they are encrypted with the Transport Layer Security (TTL) protocol. Files are most vulnerable as they’re in transit, and the TTL protocol prevents hackers from intercepting the data.

Although it’s not impossible, breaching Google’s security during the transfer process is incredibly difficult.

5 Tips for Storing Tax Documents on Google Drive

The most significant risk to your documents on Google Drive is actually yourself. ‘

Since you may have multiple computers and devices connected to your Google Drive account, it can be challenging to keep track of everything.

Let’s discuss 5 key tips for storing tax documents on Google Drive. These tips ensure the highest level of security for your Google Drive account.

1. Create a Unique and Memorable Google Drive Password

As I mentioned in this guide, your tax documents are safe when you store them in Google Drive. Therefore, the most considerable risk comes from a hacker logging into your actual Google Drive account. Because of this, you should focus on keeping your account safe.

This starts by creating a strong password.

I recommend using a password that includes letters, numbers, and symbols. It should also be at least 12 characters long.

You can create a long password that’s easy to remember by using:

A line from your favorite novel

A lyric from your favorite song

Your favorite movie quote

Make sure to add a few numbers and symbols to your password to make it bulletproof.

2. Enable Two-Factor Authentication to Log In

You should enable two-factor authentication (2FA) on all of your online accounts, including Google Drive. 2FA is a login protocol that requires two pieces of information to access your Google Drive account.

You’ll need to provide your Google password as well as a verification code sent to your phone. Once you enable 2FA, hackers won’t be able to log in to your account even if they know your password.

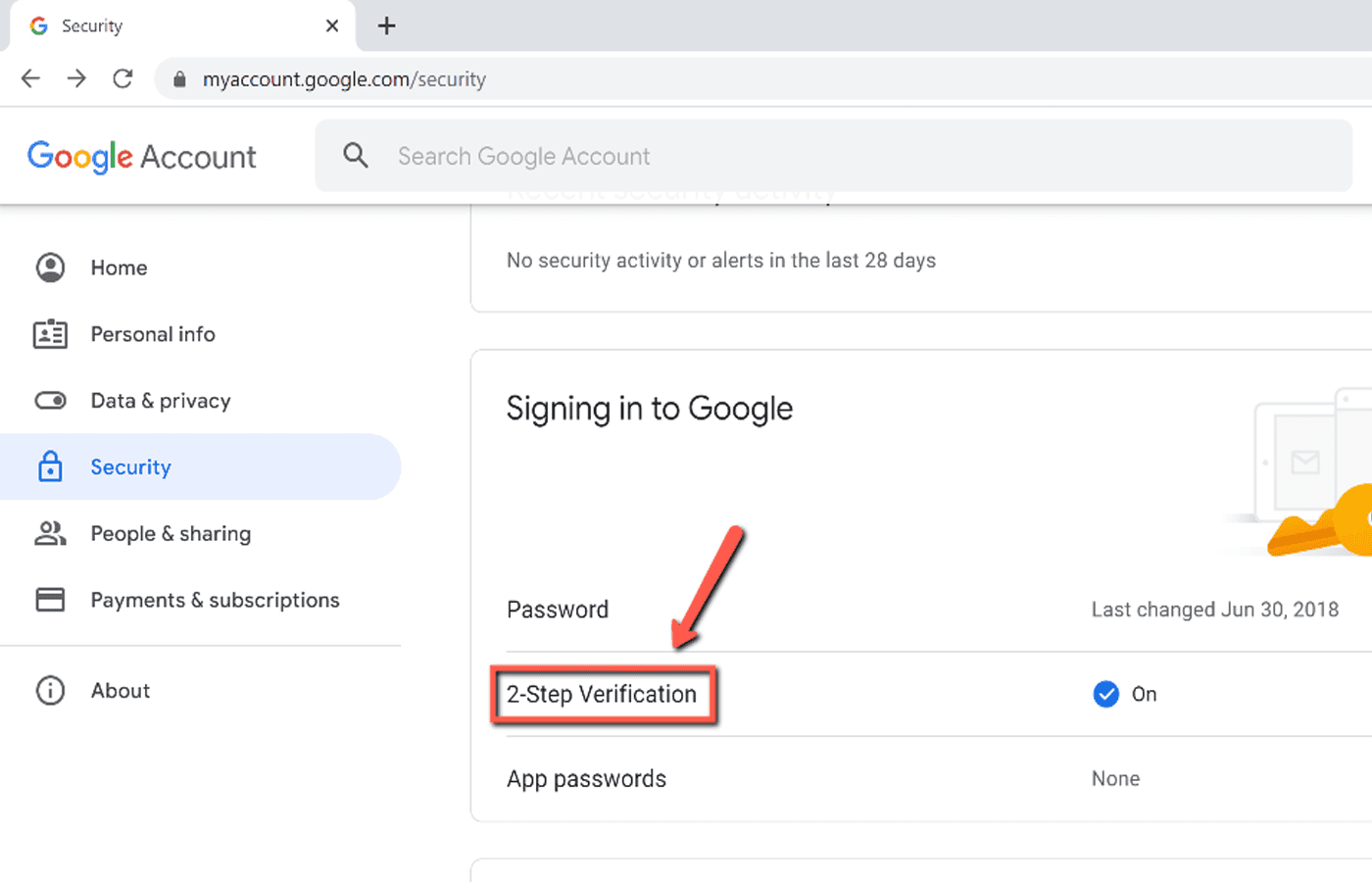

To enable 2FA on your Google Drive account, visit your Google account settings and open the Security section. Then, click on 2-Step Verification. Google will offer a list of verification methods.

Select your preferred method and verify your mobile device to successfully enable Google Drive’s two-factor authentication.

3. Encrypt Your Tax Documents With Passwords

You can add a layer of protection to your tax documents by encrypting them with a password. For example, Microsoft Word and Adobe Acrobat allow you to protect documents with a password. Therefore, I recommend adding a password to your tax documents before uploading them to Google Drive.

Even if a hacker accesses your uploaded tax documents, they won’t be able to open the file without the document’s password.

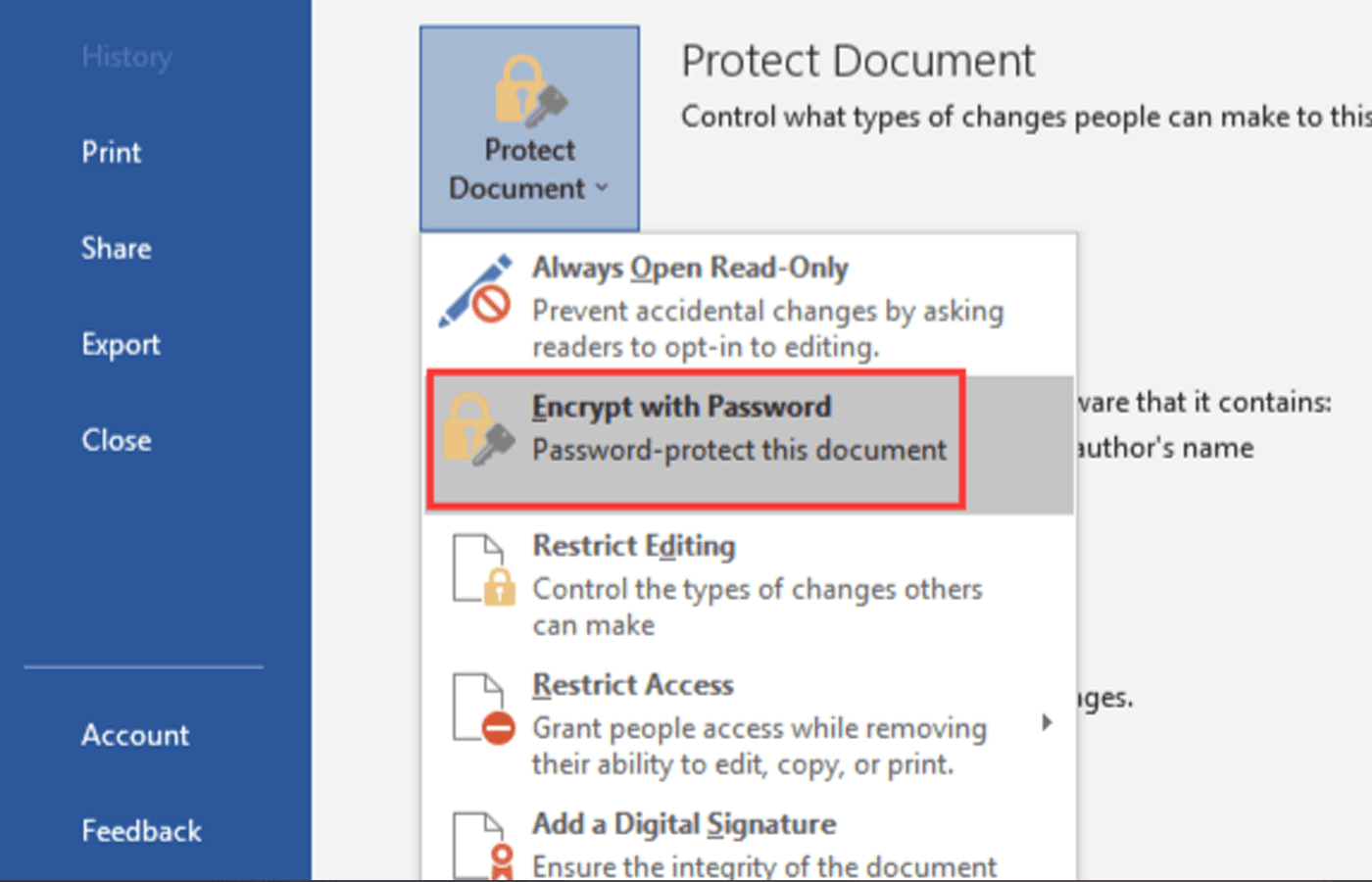

To encrypt a Microsoft Word document, open the document and go to File > Protect Document > Encrypt With Password. Pick a secure password that you’ll never forget. If you forget the document’s password, the file will be lost forever.

To encrypt an Adobe PDF document, open the PDF and go to File > Protect Using Password.

Once your files are encrypted, you can upload them to Google Drive.

4. Audit Your Google Drive Account Logins

Since your Google Drive account is potentially logged into multiple devices, you should audit your account logins.

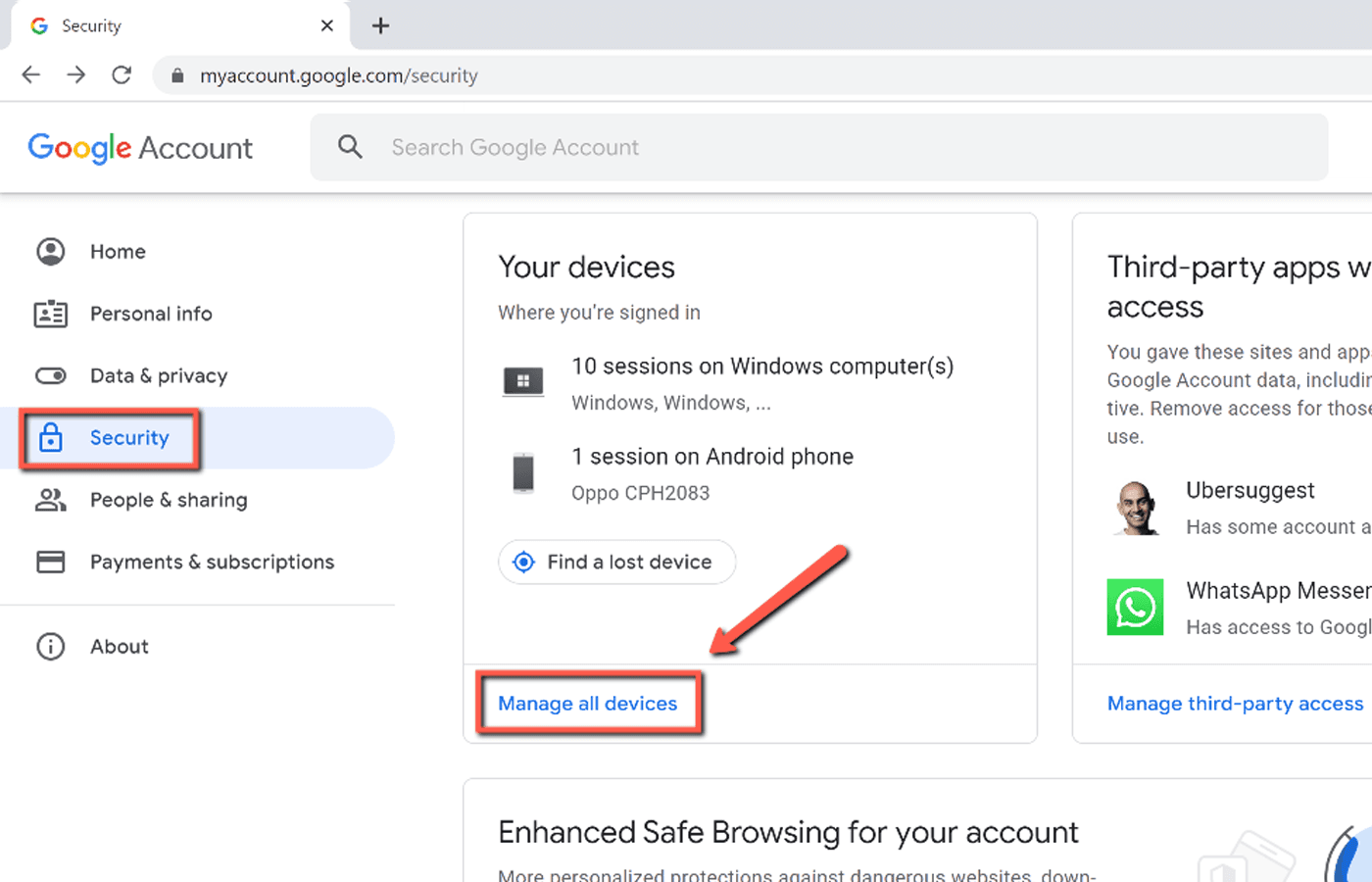

Visit your Google Account and select Security on the left-hand side. Next, scroll down to Your devices and click on it. Here, you can view a list of all the devices that are signed in to your Google account.

If you see a device you don’t recognize, you can click the triple-dotted icon and select Sign out. You should immediately change your Google password after you remove an unrecognizable device.

5. Practice Safe Internet Usage Guidelines

As I previously mentioned, the biggest risk of compromising your Google Drive account is yourself. Google is a prime target for hackers because of all the sensitive information and data Google stores.

For this reason, there are many Google Drive scams, including:

Creating fake Google Drive websites to steal your password

Hiding malware inside Google Drive files

Leaving comments or messages with phishing links

There are dozens of additional methods hackers use to steal information from unsuspecting individuals. This is why it’s essential to practice safe internet usage guidelines.

Here’s a list of tips to follow as you’re browsing the web:

Use a reputable antivirus software

Don’t click on suspicious links

Never download files from sketchy websites

Avoid giving out personal information

Google Drive vs. Paper Method for Tax Documents

Keeping paper tax documents without having electronic backups is inefficient and risky. If your home were to catch on fire or flood, replacing your tax documents could be difficult and time-consuming. Furthermore, digging through your filing cabinet to find a specific document is inconvenient and bothersome.

With the amount of high-quality digital storage tools available, keeping paper tax documents is suboptimal. Instead, you should digitize your documents and store them on a cloud-based platform such as Google Drive or Trustworthy.

This way, you can neatly organize your tax documents and access them from anywhere in the world.

Google Drive vs. Internal/External Drives for Tax Documents

Is it safe to store tax documents on internal or external drives such as computer hard drives, USB flash drives, or SD cards? Although it’s relatively safe, it’s riskier than storing your tax documents on a cloud-based storage platform.

Internal and external drives are vulnerable to corruption, damage, and theft. As a matter of fact, hard drives can fail at any time. Furthermore, what happens if the only copies of your tax documents are stored on a flash drive that was stolen? No matter where your files are stored, it’s risky to keep only one copy.

If you want to store your financial documents on an internal or external drive, you should keep backup files on a secure digital storage platform. This way, you can ensure a permanent backup of your documents if something were to happen to your drive.

Google Drive vs. Trustworthy for Tax Documents

As I outlined in this guide, storing your tax documents in a cloud-based storage platform is essential. However, Google Drive isn’t the best digital storage solution to secure sensitive financial documents. Trustworthy is the better solution because it offers more security, privacy, and file organization.

Trustworthy is a digital storage platform built to store, secure, and manage all of your personal information and documents. While Google Drive is designed to store any type of file, Trustworthy is exclusively used for sensitive information.

Offering best-in-class security and privacy protocols, Trustworthy also specializes in file organization. With Trustworthy’s intuitive dashboard interface, you can easily upload, view, and share your tax documents.

Trustworthy (Try it free) is a comprehensive digital management platform that provides an innovative solution to store all of your classified financial information. In addition to tax documents, you can also use Trustworthy to store sensitive information like social security IDs, insurance documents, and bank account passwords.

Frequently Asked Questions

Below are a few popular questions surrounding is it safe to store tax documents on Google Drive.

What Is the Best Way to Store Old Tax Returns?

The best way to store old tax returns is by digitizing them and uploading them to a secure digital storage platform like Trustworthy. Storing your old tax returns in a cloud-based platform provides easy accessibility and a backup in case you accidentally lose or destroy the paper tax returns.

Can Tax Records Be Stored Electronically?

You can store tax records electronically by scanning your documents and uploading them to a secure digital storage platform. Storing your tax records electronically offers a faster and more convenient way to find them in the future. Furthermore, electronic tax records can’t be lost or stolen if you store them in a reliable digital storage platform.

Is Google Drive Safe From Hackers?

Google Drive is generally secure from hackers because Google encrypts your files when they’re being transferred and stored. Although your files are never 100% safe when they’re stored online, Google Drive provides industry-standard security protocols.

Other Information Management Resources

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.