Verifying Your SSN: How and Why It Matters

|

Joel Lim

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Your Social Security number, or SSN, is one of the most important identifiers you’ll ever receive. It opens the door to government benefits, Social Security payments during retirement, and access to critical financial systems.

Because of its importance, your SSN is also a target for thieves who commit fraud and other crimes. One of the most effective ways to protect it — and your identity — is by verifying it.

Understanding Social Security Number Verification

Q: What is Social Security Number verification?

A: Social Security number verification confirms that an SSN belongs to the correct person. Golnoush Goharzad, an attorney and founder of Goharzad Law in Irvine, California, explains:

“SSN verification is the process by which third parties, often employers, banks, or the IRS, can verify the authenticity of a Social Security number.”

Verification helps prevent fraud, ensure accuracy in government records, and maintain compliance with identification requirements.

Q: Who uses SSN verification and why?

A: Many organizations rely on SSN verification for different reasons:

Employment: Employers confirm new hires’ identities and eligibility to work in the U.S. as part of the Form I-9 process.

Tax purposes: The IRS verifies SSNs to ensure income and financial data are correctly assigned to the right taxpayer.

Banking and credit: Financial institutions use SSN verification to prevent identity theft and fraud and to comply with federal regulations.

Synthetic identities — combinations of fake and real information — often slip through systems that skip verification, leading to fraud, money laundering, and other crimes.

Q: What happens if you don't verify your SSN?

A: Without verification, you’re more vulnerable to identity theft and fraud. Criminals could use your SSN to open credit cards or take out loans in your name, damaging your finances and credit history.

SSNs were never designed to serve as universal identification numbers, so verification adds an essential layer of protection.

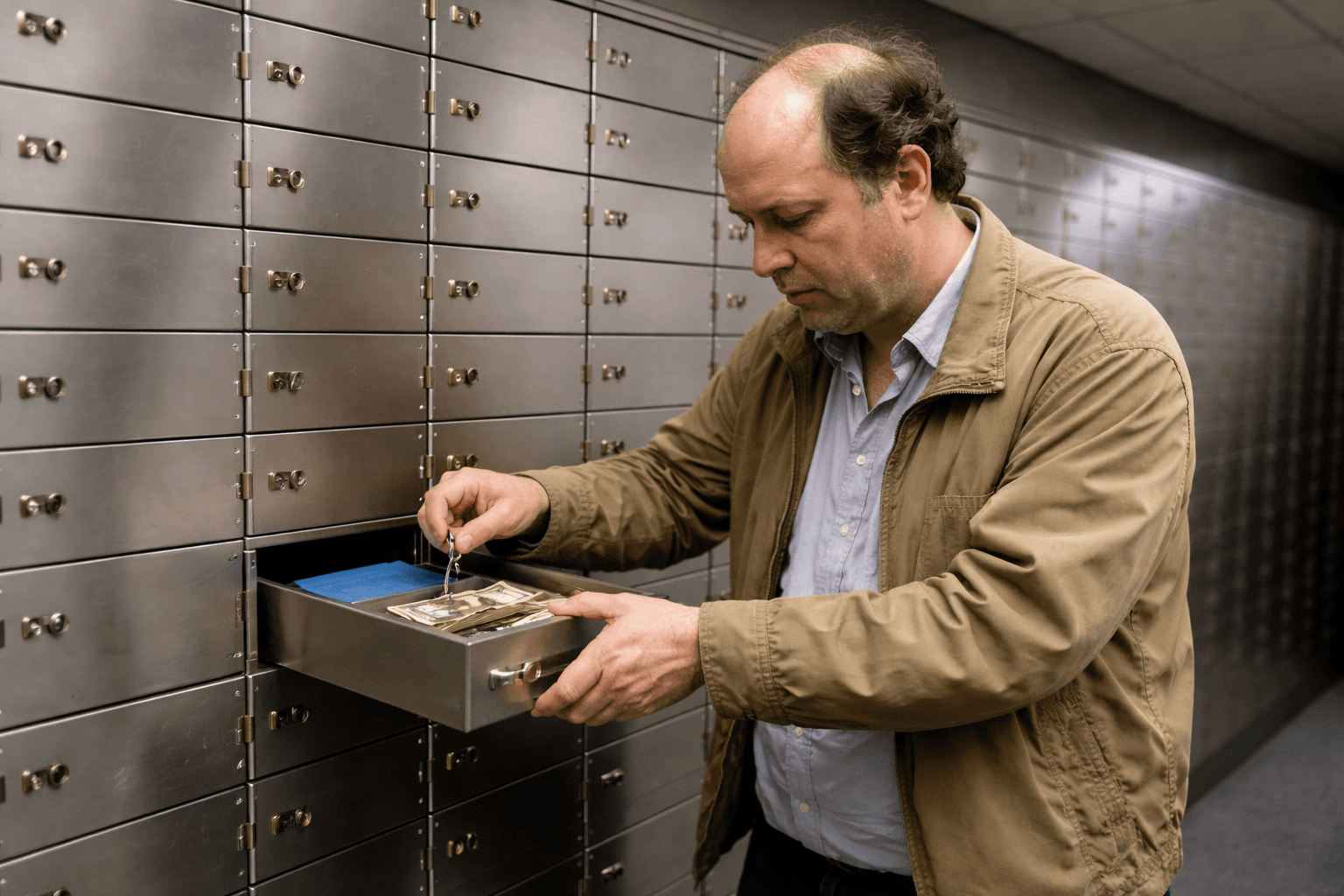

Q: How can you keep your SSN secure?

A: Store your SSN and other sensitive documents in a secure, encrypted digital vault. A Family Operating System like Trustworthy®'s keeps your information private, organized, and accessible only to those you trust.

Trustworthy is SOC 2 Type II and SOC 3 certified, meeting the American Institute of Certified Public Accountants standards for data protection.

Verifying Your SSN

Q: How does the verification process work?

A: The Social Security Administration, or SSA, offers an online tool called the Social Security Number Verification Service.

To use the verification service:

Register for access with the SSA.

Request an activation code.

Log in and verify up to 10 names instantly.

Larger batches typically take one business day. You can also use authorized third-party services that handle verification on your behalf.

Q: Can you verify your SSN without your card?

A: Yes. If you know your SSN but don’t have the physical card, you can use other legal documents that list your SSN — such as bank loan papers, pay stubs, or tax forms.

Q: Can you check your SSN status online?

A: If you recently applied for an SSN card or benefits, you can track your application status online through the Social Security Administration's website.

Types of Verification Methods

Q: What methods are used to verify SSNs?

A: There are three main types of verification, each suited to different needs and risk levels.

eCBSV (Electronic Consent Based SSN Verification): Offered by the SSA, eCBSV detects synthetic identities that can bypass traditional database checks. It’s used by employers, lenders, and institutions handling high-risk transactions.

eCBSV provides instant, highly accurate validation, making it one of the most secure — though costlier — options.

Authoritative Database Verification: This method compares SSNs against U.S.-based authoritative databases, such as credit bureaus or financial data aggregators. It’s widely used but not as accurate as eCBSV.

Document verification: This simpler method cross-references information on a trusted document (like a tax return, pay stub, or loan document) with your SSN, name, and address. It’s best for low-risk scenarios where database checks aren’t required.

Why Verification Matters

Q: Why is SSN verification important?

A: It protects your identity, ensures you receive government benefits, and helps organizations comply with legal and financial regulations.

Identity verification: SSN verification builds trust and reduces cybercrime risks by confirming identities accurately.

Fraud prevention: Verifying SSNs prevents identity theft and financial loss by confirming that a person’s identity matches their records before transactions or loans are approved.

Employment verification: Employers must verify each employee’s SSN and legal work status under federal law — a key safeguard against unauthorized employment and fraud.

Government benefits: Your SSN connects you to Social Security and other federal programs. Verification ensures benefits are distributed properly. You can estimate your future benefits on the SSA website — and store that information securely in Trustworthy, sharing access only with trusted family members or advisors.

Regulatory compliance: Banks and other institutions must verify SSNs to comply with anti-money-laundering laws. Failure to do so can lead to costly fines and legal penalties.

The Bottom Line

Verifying your Social Security number helps protect against fraud, ensures accurate records, and keeps financial systems secure.

To keep your SSN and supporting documents protected, store them in Trustworthy, the Family Operating System®. With end-to-end encryption, tokenization, multi-factor authentication, biometric login support, YubiKey hardware security key support, and customizable sharing controls, Trustworthy keeps your most sensitive data private — and always within your control.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Explore More Articles

Lost documents and forgotten passwords? Not on our watch. We'll help you keep your digital life in order.