Filing Taxes as a Married Couple Living Separately: What You Need to Know

December 30, 2025

|

Nash Riggins

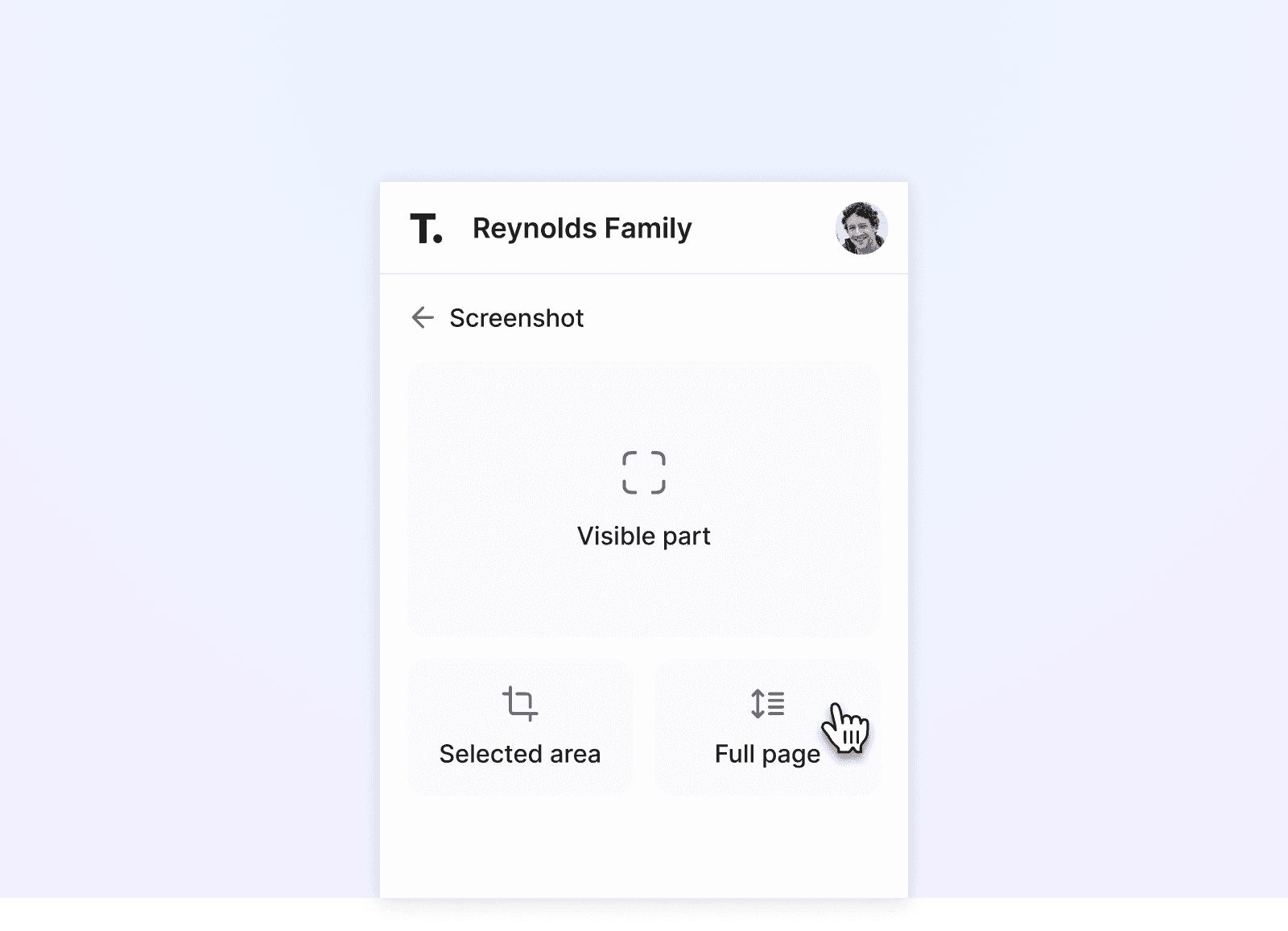

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Tax season can be complicated under the best circumstances. When you’re married but living separately — whether because you’re estranged, living in different cities, or maintaining separate households — filing taxes can feel even more confusing.

The IRS does provide several filing options for married couples who live apart, but each comes with different rules, tradeoffs, and eligibility requirements. Below, we answer common questions about filing status, deductions, and credits for tax year 2025.

Understanding Your Filing Status Options

Q: What tax filing options are available to married couples who live separately?

A: If you are legally married at the end of the tax year, the IRS generally allows you to choose from three filing statuses: married filing jointly, married filing separately, or, in certain situations, head of household with a qualifying person.

Even if you are estranged or living in separate homes, you cannot file as single unless you are legally divorced or legally separated under a final decree by Dec. 31 of the tax year.

Q: How do married filing jointly and married filing separately differ?

A: Married filing jointly means you and your spouse file one combined tax return, reporting all income, deductions, and credits together. This filing status often provides access to more tax benefits and lower overall tax liability.

Married filing separately requires each spouse to file their own return and report only their individual income and deductions. While this status limits access to certain credits, it can reduce financial entanglement when spouses prefer to keep tax responsibilities separate.

Married Filing Jointly

Q: What are the benefits of filing married filing jointly?

A: Filing jointly generally provides access to the broadest range of tax credits and deductions available to married couples.

For tax year 2025, the standard deduction for married filing jointly is $31,500. Couples filing jointly may also qualify for credits such as the Earned Income Tax Credit, the Child and Dependent Care Credit, and education credits like the American Opportunity Tax Credit and the Lifetime Learning Credit, subject to income limits and eligibility rules.

In addition, certain deductions — including the student loan interest deduction — are only available or more generous when filing jointly.

Q: How does the Earned Income Tax Credit work for married couples filing jointly?

A: The Earned Income Tax Credit is a refundable credit for low- to moderate-income workers. For tax year 2025, the maximum credit is $8,046 for families with three or more qualifying children, with smaller maximum credits for families with fewer or no qualifying children.

Eligibility depends on earned income, filing status, and the number of qualifying children. The IRS also sets income limits for eligibility, which are adjusted annually and are higher for couples filing jointly than for those filing separately.

Q: What are the downsides of filing married filing jointly?

A: When you file jointly, both spouses are jointly and severally liable for the return. This means each spouse is legally responsible for the full amount of tax owed, including penalties and interest — even if the issue stems from the other spouse’s income or reporting.

If one spouse has unpaid taxes, makes errors, or fails to pay what is owed, the other spouse can still be held responsible. For couples who are not on good terms or who do not fully trust each other’s recordkeeping, this shared liability can create risk.

Married Filing Separately

Q: When does it make sense to file married filing separately?

A: Married filing separately can be a practical option for couples living apart who want to keep their tax obligations independent.

This status is often used when spouses do not want to share liability for taxes owed, penalties, or interest. It can also be helpful when one spouse has outstanding debts — such as back taxes or child support — that could otherwise reduce or eliminate a joint refund.

Q: What tax benefits are limited when filing married filing separately?

A: Filing separately restricts access to several major tax credits. In most cases, married couples filing separately cannot claim the Earned Income Tax Credit, the American Opportunity Tax Credit, or the Adoption Credit.

Income thresholds for other deductions are also much lower. For tax year 2025, the standard deduction for married filing separately is $15,750.

Q: Can filing separately ever lower your tax bill?

A: In certain situations, yes. One common example involves medical expenses. Medical expenses are deductible only to the extent they exceed 7.5% of adjusted gross income, or AGI.

When spouses file separately, each spouse calculates this threshold using their own AGI. If one spouse incurred significant medical expenses and has a lower individual income, filing separately can make it easier to qualify for the deduction.

Head of Household for Married Taxpayers

Q: Can a married person living apart file as head of household?

A: In limited circumstances, yes. The IRS allows some married taxpayers to be treated as "considered unmarried" for tax purposes and file as head of household.

This filing status generally offers more favorable tax rates and a higher standard deduction than married filing separately, but the eligibility rules are strict.

Q: What are the requirements to file as head of household while married?

A: To qualify, all of the following must be true:

You did not live with your spouse during the last six months of the tax year.

You paid more than half the cost of keeping up your home.

Your home was the main residence for more than half the year for a qualifying person.

You meet the IRS rules for claiming that person as a dependent.

A qualifying person is most commonly a child, stepchild, or foster child, though other dependents may qualify in limited cases. Even if the noncustodial parent claims the child under IRS rules for separated parents, the custodial parent may still qualify for head of household.

Q: What is the standard deduction for head of household in 2025?

A: For tax year 2025, the standard deduction for head of household is $23,625. This amount is higher than the deduction for married filing separately and reflects the additional financial responsibility associated with maintaining a household for a qualifying person.

Practical Considerations for Couples Living Separately

Q: What should married couples living separately keep in mind when filing taxes?

A: Choosing the right filing status depends on income, dependents, deductions, and how closely you and your spouse are willing or able to coordinate.

When filing jointly, accurate sharing of income documents and expense records is critical. When filing separately, couples should still coordinate on items like mortgage interest, property taxes, and dependent-related claims to avoid errors or IRS scrutiny.

Any legal agreements or court orders affecting financial responsibilities should also be documented and accessible to the professionals involved in preparing your return.

Q: How can organization help simplify tax filing when spouses live apart?

A: Filing taxes while living separately often means coordinating records across households, advisors, and timelines.

Using a secure digital system to store tax documents, prior returns, income records, and legal agreements can help reduce confusion and prevent last-minute scrambling.

Platforms like Trustworthy allow you to securely store important financial documents and share controlled access with accountants or financial advisors, so everyone works from the same, up-to-date information without overexposing sensitive data.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.