How to Choose an Estate Planning Attorney

December 5, 2024

|

Joel Lim

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Planning your estate is one of the most important things you can do before you pass away. However, it can be complicated and costly if you aren’t knowledgeable about it. That’s why we suggest hiring a good estate planning attorney to do it for you.

But with so many attorneys to choose from, how do you find the right one? In this guide, we’ll explore what makes a good estate planning attorney, how to find one, and how to prepare a meeting with them.

Key Takeaways

An estate planning attorney will prepare your estate documents, identify beneficiaries, establish a POA, and assist with tax planning.

A good estate planning attorney has expertise in the field, strong attention to detail, and is client-focused.

Before meeting with your attorney, organize all legal documents, talk about your wishes with your family, and prepare your questions.

What Does an Estate Planning Attorney Do?

Before we get into the details of choosing an estate planning attorney, you should understand what they do. This will ultimately help your decision-making in the future.

Prepare Estate Documents

The gathering and preparation of many documents makes estate planning an overwhelming task without the help of an estate planning attorney.

These include your will, trusts, insurance policies, account details, a list of your physical and digital possessions, power of attorney documents, and debts if you have any. You also need to prepare all your estate tax documents.

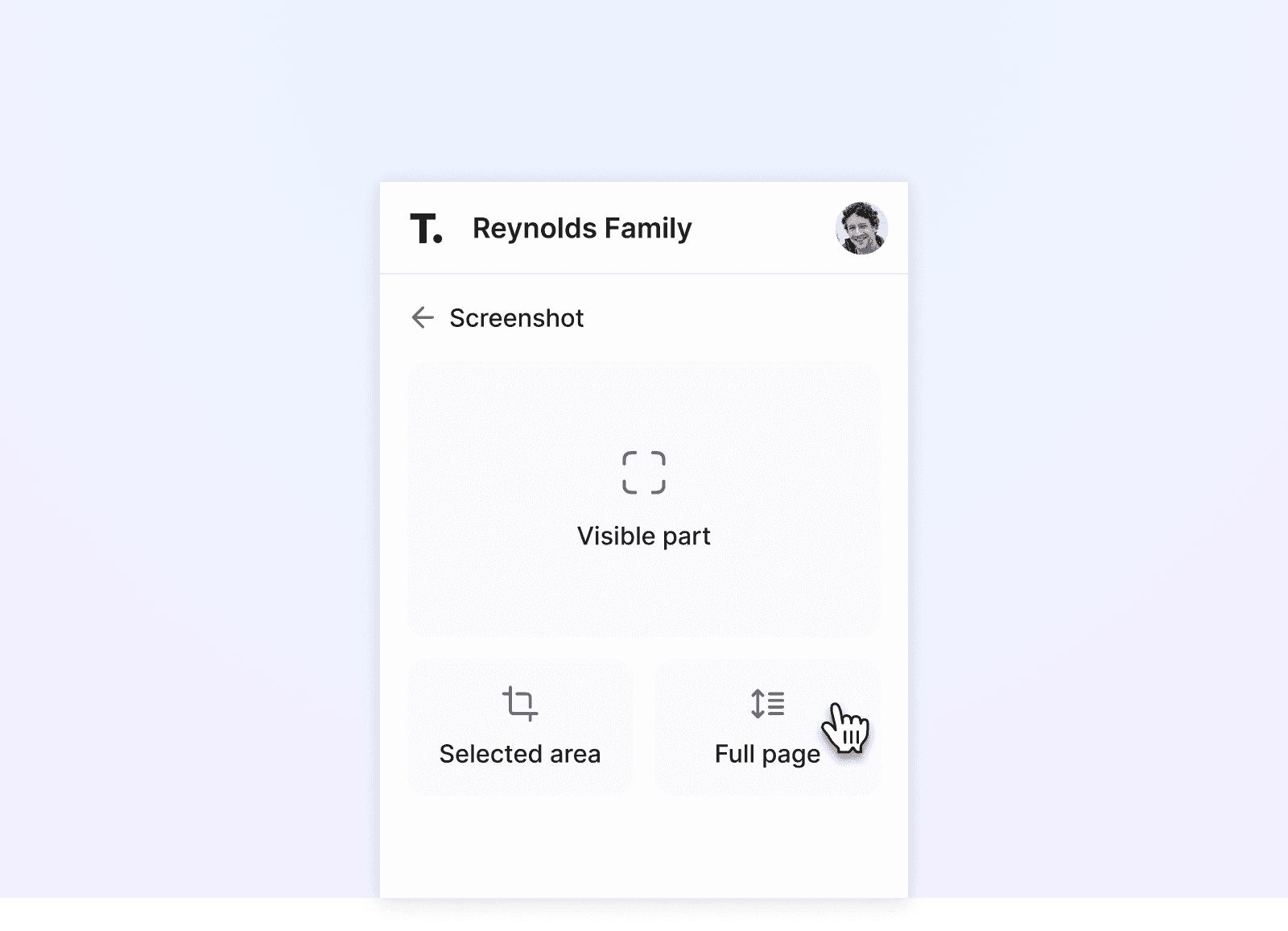

Having an attorney specializing solely in estate planning can be a tremendous help. While working alongside your estate planning attorney, you can also use a family operating system like Trustworthy to keep all your documents safe and organized in a secure location. The collaboration features make it easy for your attorney to access prepared documents.

Identify Beneficiaries

Part of planning your estate is identifying which family members or friends you’ll leave your physical possessions and monetary proceedings to. Your estate planning attorney can help you identify beneficiaries for any retirement accounts or insurance policies. They will prepare the estate plan to ensure the beneficiary receives these assets as you wish.

Establish Power of Attorney

Your estate planning attorney can assist you in setting up your power of attorney. This document will name specific people you want to carry out all your important matters, such as medical or financial decisions. Your attorney will prepare the document for you to sign with this information.

Make Advanced Health Directives

Advanced health directives are documents in which you can list your specific and legal instructions for your medical care preferences. These instructions are carried out when you can no longer make sound decisions.

Make a Suitable Trust for You

Creating a trust is an important plan you need to complete for your loved ones after your passing. The trust is an arrangement where your trustee of choice will hold onto your assets on behalf of your selected beneficiary. Your estate planning attorney will draw up a suitable trust for you and your loved ones.

Tax Planning

Your estate planning attorney can assist with other tax planning. For example, they can help you sort out your estate taxes and ensure it complies with local and federal law.

This will help minimize the chances of issues with the IRS after a passing, which is the last thing you want.

Ensure Minimal or No Probate Process

Nobody likes spending an excessive amount of money on estate assets tax, also known as probate fees. Consulting with an estate planning attorney can minimize the probate process or help your estate avoid this process altogether.

During the estate planning process, stay organized with Trustworthy. Your attorney will thank you for it.

What Makes a Good Estate Planning Attorney?

Now you know why you might need an estate planning attorney, but how do you choose a good attorney? Here are some traits you should look out for.

Expertise in Estate Planning Law

When choosing an attorney, select one with experience in estate planning, not just a general attorney. One way of doing this is to check if they have the relevant qualifications. Most times, the attorney will have this information easily accessible.

Paul Rabelias, an estate planning attorney, recommends to consider this as one of the top selection factors:

“Do they practice at a minimum, if not exclusively, in the estate planning area? In the estate planning area, there are a ton of little nuances and unless the lawyer works in that area on a daily basis, then it’s likely that they may miss something, so you want to work with somebody who practices regularly or preferably exclusively in the area of estate planning.”

This makes time because, if they practice regularly or exclusively in this field, they know the ins and outs of estate planning, what to expect, and how to best guide you through the process.

Attention to Detail

A good estate planning attorney has excellent attention to detail, which is important when preparing and filing important documents with the government. Keep all your important documents stored safely on Trustworthy.

Communication Skills

Choose an attorney with great communication skills. This includes professional written and verbal communication skills. Good communication skills means they should be clear about what they need from you. They should also provide updates as needed. Choosing an attorney with good communication skills helps the entire estate planning process go as smoothly as possible.

Strategic Thinking

Being an estate planning attorney is more than just filling out a bunch of documents. Your attorney should be able to think strategically to create an estate plan that benefits your family in the long run. For example, they can help minimize or do away with probate fees and lower the amount of taxes to pay.

Client-Focused

Another trait to look out for is if your attorney is client-focused. This means they have their client’s interests at the forefront of whatever they’re doing, rather than just seeing their clients as a means to make money off of them.

Do I Need an Estate Planning Attorney?

You may wonder if you need an estate planning attorney. Not everyone needs one, but here are some circumstances where you should consider it:

You have kids: Planning an estate is highly recommended if you have kids to ensure they get your assets. This will mean drawing up a suitable trust.

You’re at risk for incapacity: If you suffer from, have been diagnosed, or are at risk for a chronic/terminal illness, and know that you won’t be able to make sound decisions about your money or health.

Your state has estate taxes: In addition to the federal estate tax, some estates have their own state estate taxes that you need to be aware of.

You’re not confident navigating the legal process alone: Estate planning can be daunting, so having an estate planning attorney at your side can give you peace of mind.

How to Find a Good Estate Planning Attorney

Finding a good estate planning attorney isn’t difficult if you know what to look for and how to do it. To assist you in your search, we compiled some useful tips.

Identify Your Specific Needs

Before you look for a good estate planning attorney, consider your specific needs. Perhaps you are struggling with creating only certain parts of the estate plan, or you’re unsure of the financial planning involved. Once you establish exactly what you need in an attorney, you can begin your search.

We suggest making a list of your needs and storing it on Trustworthy so it does not get lost.

Ask for Referrals

One of the best advertising tools is word of mouth, and asking for referrals often guarantees good results because people will be more than happy to refer attorneys they’ve used themselves. Ask for referrals among friends and family, your workplace, or even online forums like Facebook.

Request Free Consultations

Many estate planning attorneys offer free consultations to help you get to know them before deciding whether to use their services. During a consultation, you can ask them some things to help you decide whether to hire them.

Ask the attorney:

Is estate planning your primary focus?

How long have you been practicing?

What is your estate tax experience?

What will happen during the first meeting with your office?

What is included in your fees?

What is not included in your fees?

What additional costs should I be aware of?

How to Prepare for a Meeting with an Estate Planning Attorney

Once you choose an attorney, it’s important to prepare and organize all the necessary information beforehand so you enter the meeting confidently.

Prepare Legal Documents

Before your meeting, prepare all your legal documents. These include your financial details, accounts, insurance policies, and other important documents, including your medical information, tax information, and a list of all your possessions.

Use Trustworthy to store your legal documents in a secure location and share them with your spouse, other family members, or your attorney.

Talk to Family About Wishes

Talk to your family about your wishes before your meeting. Let them know what you plan to do to keep them informed and hear their thoughts and ideas about what they would like. Discuss who will manage your money, who will make decisions regarding your healthcare, and who will be your executor. This gives your family a chance to prepare for their new roles.

Have Specific Requests & Questions Ready

The last step to preparing for your meeting is to get all your questions and requests ready for your attorney. This is a chance to express your concerns and wishes before progressing further into the planning process. You can talk with your attorney about what to expect during the planning process, how long it will take, and any other things you need to know.

Frequently Asked Questions

What are the important factors to consider in estate planning?

Some important factors of estate planning include your will, estate taxes, your life insurance policies, and choosing your beneficiaries.

How much does an estate planning attorney cost?

The cost of an estate planning attorney will depend on the complexity of the estate and the actual attorney. Generally, estate planning will start from $1,000 for basic plans and around $5000 for complex plans. They generally cost between $350 and $700 per hour.

How much do most lawyers charge for a will?

Again, the costs will vary, but a basic will start from $300 to $1,200.

At what net worth does a trust make sense?

A good rule of thumb is to have a net worth of at least $100,000 to make having a trust make sense.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.