Durable Power of Attorney: What Powers Does It Grant?

April 26, 2024

|

Ty McDuffey

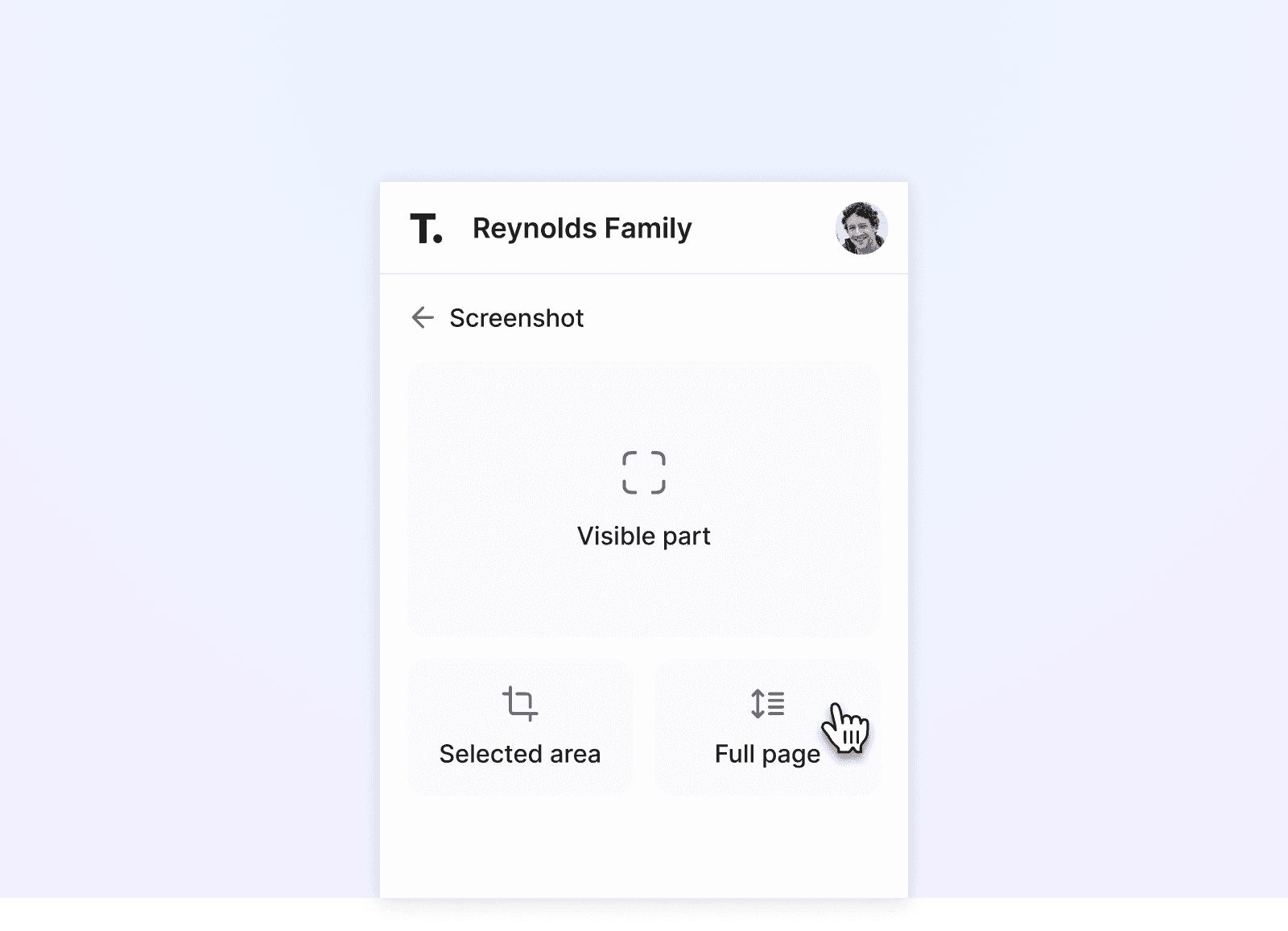

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

A durable power of attorney (DPOA) is an important part of estate planning, as it ensures your financial and legal affairs are managed according to your wishes if you cannot do so yourself.

We’ll explore what a durable power of attorney allows you to do, the types of powers it can grant, and how Trustworthy can help you securely store and manage this important document.

Key Takeaways

A durable power of attorney allows you to designate someone to make financial, legal, and medical decisions on your behalf if you become incapacitated.

The powers granted by a DPOA can be broad or limited, depending on your specific needs and preferences.

Regularly reviewing and updating your DPOA is one way to ensure it reflects your current wishes and circumstances.

What Does a Durable Power of Attorney Let You Do?

The specific powers granted by a DPOA can be tailored to your unique needs and preferences, but some common powers include:

1. Financial Management

One of the primary purposes of a durable power of attorney is to allow your attorney-in-fact to manage your financial affairs if you become incapacitated. This can include powers such as:

Accessing your bank accounts and managing your bills and expenses.

Making investment decisions on your behalf.

Filing your tax returns and managing your tax obligations.

Buying, selling, or refinancing real estate properties.

Managing your insurance policies and making claims as needed.

2. Legal Affairs

A durable power of attorney can also grant your attorney-in-fact the authority to handle your legal affairs. This can include powers such as:

Signing contracts and legal documents on your behalf.

Representing you in legal proceedings.

Hiring and communicating with attorneys and other legal professionals.

Making decisions related to your business or professional interests.

3. Healthcare Decisions

While a separate healthcare power of attorney is often used to designate someone to make medical decisions on your behalf, a durable power of attorney can also include healthcare-related powers. These might include:

Accessing your medical records, communicating with your healthcare providers, and making decisions about your medical care based on your wishes and best interests.

Arranging for your care in a hospital, nursing home, or other facility.

Making decisions about end-of-life care, such as hospice or palliative care.

Personal and Family Matters

In addition to financial, legal, and healthcare powers, a durable power of attorney can grant your attorney-in-fact the authority to handle personal and family matters on your behalf. This might include:

Managing your household and personal property.

Making decisions about your living arrangements, such as moving to a nursing home or assisted living facility.

Communicating with your family members and loved ones about your care and well-being.

Making travel arrangements or managing your transportation needs.

Regularly Reviewing and Updating Your DPOA

Once you've created a durable power of attorney, reviewing and updating it regularly is important to ensure it reflects your current wishes and circumstances. Some events that might prompt a review of your durable power of attorney include:

Changes in your health or cognitive abilities.

Changes in your financial or legal situation.

Changes in your relationship with your chosen attorney-in-fact.

Changes in state laws or regulations governing powers of attorney.

Attorney and writer Jane Haskins explains: “You can revoke a durable POA at any time, as long as you're of sound mind. You should do this in writing. It's also a good idea to notify financial institutions and other businesses that your agent has dealt with. Durable POAs automatically terminate on the death of the person granting the power of attorney.”

By keeping your DPOA up to date, you can ensure someone will manage your affairs according to your current preferences and that your attorney-in-fact will have the authority to act on your behalf.

Related: How to Draft a Power of Attorney

Storing and Your DPOA on Trustworthy

A durable power of attorney is a key component of your estate plan, and it's important to store it securely. You also must ensure your attorney-in-fact and other relevant parties can access it when needed. Trustworthy offers a secure online platform for storing and sharing your DPOA and other essential estate planning documents.

With Trustworthy’s unique features, you can:

Upload and store your DPOA and other important documents in a secure, encrypted digital vault.

Share your DPOA with your attorney-in-fact and other trusted individuals.

Set permissions to control who can access and view your documents.

Receive reminders to review and update your DPOA regularly.

Access your documents from anywhere, at any time, using any device.

By storing your DPOA with Trustworthy, you can have peace of mind knowing that this document is protected and easily accessible when needed.

It's important to note that a durable power of attorney is only valid during your lifetime. If you pass away, your attorney-in-fact's authority ends, and your estate will be managed according to the terms of your will or trust.

Frequently Asked Questions

Whom should I choose as my attorney-in-fact?

When selecting an attorney-in-fact, choose someone who is trustworthy and reliable, and understands your wishes and values. They should be able to make difficult decisions under pressure, have financial and legal acumen, and be willing to take on the responsibilities of the role. Consider their physical and mental capacity to serve in this position.

How is a durable power of attorney different from a general power of attorney?

The main difference between a durable power of attorney and a general power of attorney lies in its validity after the principal becomes incapacitated. A general power of attorney typically ceases to be effective if the principal loses mental capacity. A durable power of attorney is specifically intended to continue its effectiveness even after the principal is no longer mentally competent to handle their affairs.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.