The Comprehensive Guide to Power of Attorney Responsibilities

May 7, 2024

|

Ty McDuffey

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

When you’re appointed as someone's power of attorney (POA), you take on a significant role with many duties and responsibilities. Understanding the scope of your authority and the tasks you may need to undertake is essential for fulfilling your obligations effectively and ethically.

We’ll explain the duties and responsibilities of a power of attorney and provide tips for successfully managing the role.

Key Takeaways

The power of attorney's responsibilities include managing finances, making healthcare decisions, and handling legal matters.

Regularly reviewing and updating the POA document can help ensure that it continues to reflect the principal's wishes and circumstances.

Trustworthy can provide a secure platform for storing, sharing, and managing POA documents and related information.

Types of Power of Attorney and Their Responsibilities

The specific duties and responsibilities of a power of attorney vary depending on the type of POA and the authority granted by the principal (the person giving the POA). The two main types of POA are financial and medical.

Financial Power of Attorney

A financial power of attorney grants the agent authority to manage the principal's financial affairs. This can include a wide range of responsibilities, such as accessing and monitoring the principal's bank accounts and investments, making deposits and withdrawals, investing funds, and managing portfolios.

Ultimately, their goal is to ensure the principal's financial needs are met and their assets are protected, even if they cannot manage their own affairs.

As explained by New York attorney William H. Cooper:

“The primary duty of an agent under a POA is to act in the utmost good faith, always with loyalty and always in the best interest of the principal, avoiding any personal gain from the position.

This includes maintaining truly meticulous records of all transactions and decisions made while acting under the POA, ensuring the principal’s assets are used solely for their benefit and according to their wishes.”

Medical Power of Attorney

A medical power of attorney, also known as a healthcare proxy, grants the authority to make healthcare decisions on behalf of the principal if they become incapacitated. They’re responsible for making treatment decisions, such as consenting to or refusing medical treatments, deciding on surgery or medication, and choosing healthcare providers.

They must communicate with healthcare professionals by discussing treatment options and prognosis with doctors. They also need to access the principal's medical records and advocate for their healthcare needs and preferences.

Another important aspect of the agent's role is enforcing advance directives. This involves ensuring the principal's living will or other advance directives are followed and making end-of-life decisions in accordance with their wishes.

They may also be responsible for arranging long-term care, such as deciding on home healthcare, assisted living, or nursing home care.

General Duties and Responsibilities

Regardless of the type of POA, all agents must adhere to certain general duties and responsibilities.

Acting in the Principal's Best Interests

They must prioritize the principal's needs and wishes, even if they conflict with their own interests or desires. They must avoid any situations that could create a conflict of interest and must never use their authority for personal gain. Every decision should be guided by the question, "What would the principal want in this situation?"

Keeping Accurate Records

They must keep accurate and detailed records of all transactions and decisions made on behalf of the principal. This includes maintaining a clear paper trail of financial transactions, such as bank statements, invoices, and receipts, and documenting any healthcare decisions or legal actions taken. They should provide regular updates and reports to the principal (if they can still understand) and family members or professionals involved in the principal's care.

They must prepare to account for all actions taken under the POA in case they have to justify their decisions or provide evidence of their proper execution of duties.

Communicating Openly and Honestly

Open and honest communication is key to building trust and ensuring the principal's wishes are carried out. The agent should inform the principal about important matters related to their finances, healthcare, or legal affairs and consult with them whenever possible before making significant decisions. If the principal cannot communicate or understand, they should still strive to make decisions that align with their previously expressed wishes and values.

The agent should also be transparent with family members and other interested parties. They must provide them with relevant information and address any concerns while still respecting the principal's privacy and confidentiality.

Understanding the Limitations of Authority

The agent must understand and respect the limitations of their authority under the POA document. They should carefully review it to grasp the scope of their powers and should never overstep the legal and ethical boundaries.

If there is ever any uncertainty about the extent of their authority, the agent should seek professional advice from an attorney or other relevant expert. Acting beyond the scope of authority can have serious legal and financial consequences for both the agent and the principal.

Maintaining Confidentiality

Finally, this person must protect the principal's privacy and confidentiality. This means protecting sensitive personal and financial information and not sharing it with unauthorized parties. They must keep all records and communications related to their role as POA secure and confidential and should only disclose information on a need-to-know basis. Maintaining confidentiality is a legal and ethical obligation and a matter of trust and respect for the principal.

It's important to note that a power of attorney is only valid during the principal's lifetime. Once the principal passes away, the POA is no longer in effect, and the agent's authority ends. At that point, the executor named in the principal's will takes over the management of the estate.

Effectively Managing POA Responsibilities

As an agent under a power of attorney, you take on a significant responsibility to manage the principal's affairs with integrity and care. While this role can be rewarding, it can also be challenging, particularly if you are new to the position or are managing complex financial, legal, or healthcare matters.

Here are some tips for effectively managing your power of attorney responsibilities to help you succeed in this important role.

Read and Understand the POA Document Thoroughly

One of the first and most important steps in managing your power of attorney responsibilities is thoroughly reading and understanding the POA document.

Take the time to carefully review the specific powers and limitations outlined in the document. Pay close attention to any restrictions or special instructions provided by the principal. If anything is unclear, don't hesitate to ask questions and seek clarification from the principal, an attorney, or other trusted advisors.

Keep the Principal's Documents and Information Organized

You’ll need to manage a variety of important documents and sensitive information related to the principal's finances, healthcare, and legal affairs. It's crucial to maintain a secure and organized system for storing these documents to stay organized and ensure you can access what you need.

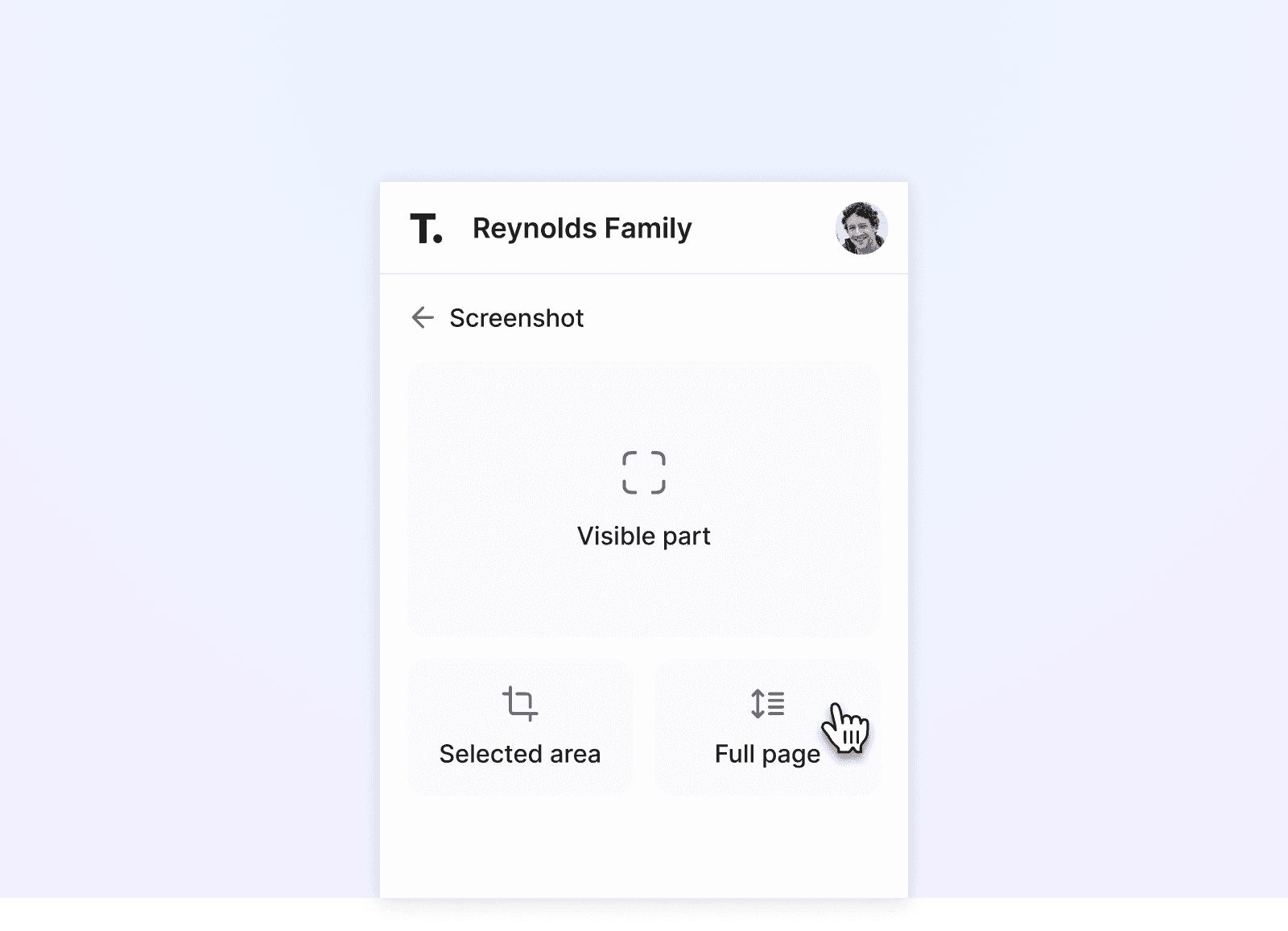

Consider using a tool like Trustworthy, which provides a centralized, secure location for storing and sharing important documents, making them easily accessible to you and other authorized parties.

With Trustworthy, you can:

Securely store and organize POA documents and related information

Share access with the principal, family members, and trusted professionals

Set reminders for important tasks and deadlines

Communicate and collaborate with others involved in the principal's care

Access resources and guidance on best practices for managing your role

By using Trustworthy, you can streamline your duties as a power of attorney, reduce stress and uncertainty, and ensure the principal's wishes are carried out faithfully.

Communicate Regularly With the Principal and Relevant Parties

Regular, open communication is key to successfully managing your power of attorney responsibilities. Make it a priority to schedule regular check-ins with the principal to discuss their needs, preferences, and any concerns they may have. This will help ensure you always act in accordance with their wishes and are aware of any changes in their situation.

Additionally, keep family members and other interested parties informed about significant decisions or changes related to their care or affairs. This transparency can help prevent misunderstandings and conflicts down the road.

Seek Professional Advice When Needed

You may encounter complex or sensitive issues requiring specialized knowledge or expertise as an agent under a power of attorney. Don't hesitate to seek professional advice from attorneys, financial advisors, healthcare professionals, or other experts as needed. These professionals can provide valuable guidance and support to help you make informed decisions and fulfill your responsibilities effectively.

Additionally, make an effort to stay informed about any changes in laws or regulations that may affect your role, such as updates to tax laws or healthcare policies.

Frequently Asked Questions

What happens to a power of attorney after the principal dies?

A power of attorney is only valid during the principal's lifetime. Once the principal passes away, the POA is no longer in effect, and the executor named in the principal's will takes over the management of the estate.

What should a power of attorney do if they no longer want to serve in that role?

First, they should notify the principal, any co-agents, and potentially the court, depending on local laws. They should also formally document their resignation in writing.

Does a power of attorney have the right to gift themselves or others the principal’s money or property?

No, they do not have this right unless it’s specifically granted in the POA document. If authorized by the POA document, they may be allowed to gift to others as part of estate planning or tax reduction strategies. However, all actions must be in the best interest of the principal.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.