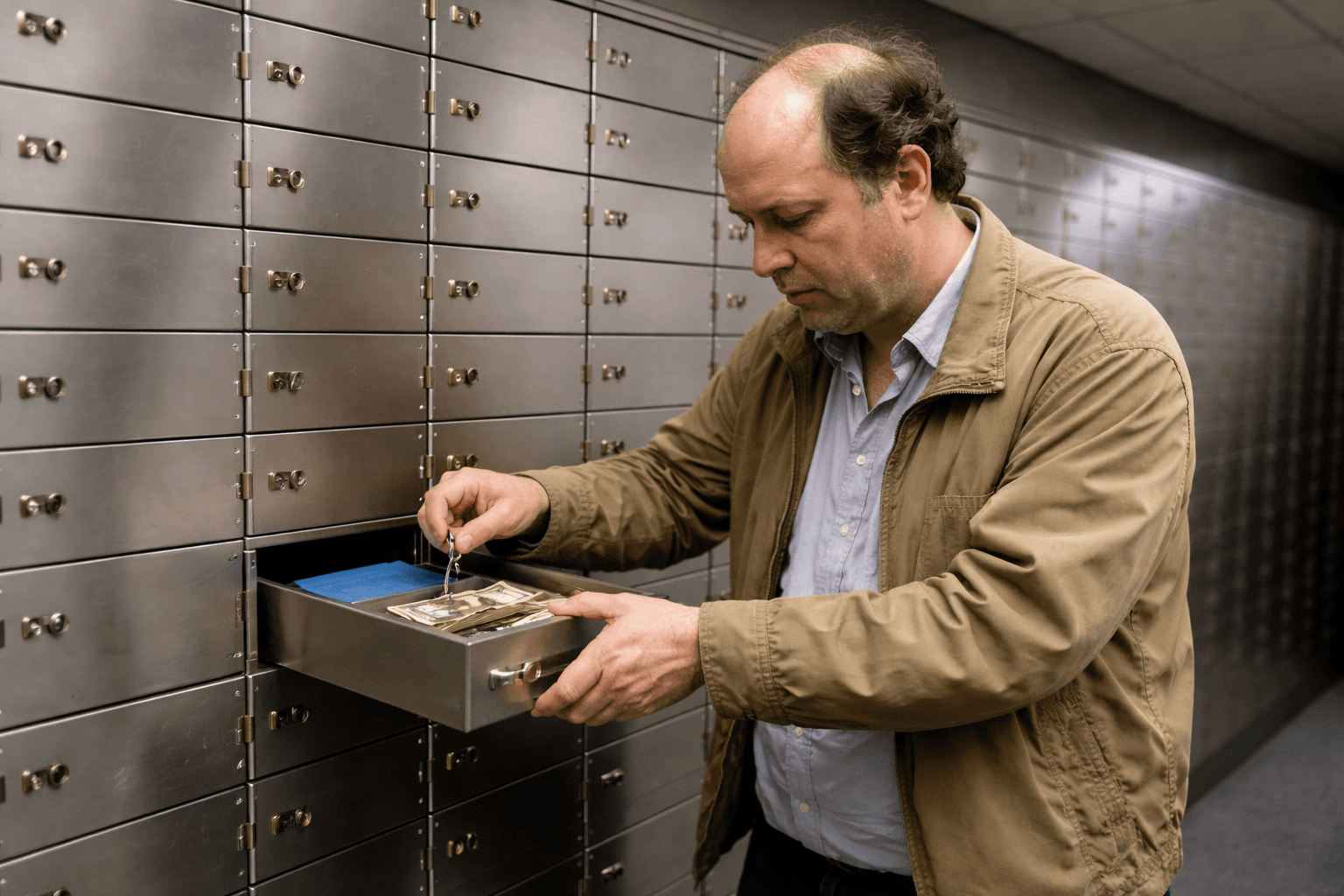

Digital Safe Deposit Boxes for Families: What Banks Never Designed For

|

Trustworthy

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

Key Takeaways

Traditional safe deposit boxes were designed for individual use, not shared family responsibilities.

Families often need access to important documents at unpredictable moments, quickly and from different locations.

Physical safe deposit boxes limit access and are difficult to share when roles overlap or change.

Digital safe deposit boxes support controlled sharing, remote access, and family-level organization.

For modern households, managing access matters as much as protecting documents.

Traditional safe deposit boxes were created for a different kind of household: one where a single person managed important documents, access was infrequently needed, and emergencies were handled in person at a bank branch.

That’s not how most families operate today.

Modern families share responsibilities, manage information across multiple life stages, and need access to documents at unpredictable moments.

This article looks at why traditional safe deposit boxes fall short for families — and how digital safe deposit boxes have evolved to meet needs that banks never planned for.

How Families Actually Use Important Documents

Q: How do families typically interact with critical documents?

A: Families don’t use important documents in isolation or on a fixed schedule. They need them in real, often time-sensitive situations.

Common examples include:

A parent needing a child’s medical or school forms.

A spouse accessing insurance or financial information.

An adult child helping manage paperwork for aging parents.

Families traveling or relocating and needing IDs or records quickly.

A family sharing important documents with a professional advisor.

In most cases, the person who needs a document isn’t the same person who originally filed it away.

Q: Why does shared responsibility matter so much?

A: Because family logistics rarely follow clean lines.

One person may handle finances, another medical care, and another scheduling or travel.

If documents are locked behind a single owner, or a single physical location, even well-organized families can struggle when roles overlap or change.

Shared responsibility requires shared visibility, not just shared ownership.

Where Traditional Safe Deposit Boxes Fall Short

Q: Why weren't safe deposit boxes designed for families?

A: Traditional safe deposit boxes were built around individual control.

That model doesn’t account for spouses needing different documents, adult children stepping in temporarily, or caregivers requiring limited access.

Q: What practical problems does this create for families?

A: Several common ones.

Safe deposit boxes:

Can’t be accessed remotely.

Are restricted to banking hours.

Don’t support partial or temporary access.

Are often known only to one person.

If the person who controls the box is unavailable — due to illness, travel, or death — the rest of the family may be left guessing where to find critical information is stored.

How Digital Safe Deposit Boxes Support Family Life

Q: How do digital safe deposit boxes work differently for families?

A: Digital safe deposit boxes are built around access control rather than physical possession.

They allow families to:

Store documents by category or family member.

Grant access to specific people for specific purposes.

Update information as life changes.

Retrieve documents from anywhere.

Instead of a single key, access is based on permissions.

A modern digital safe deposit box gives families a secure way to manage important information together, without relying on a single person or a single location.

Q: Why does controlled sharing matter so much for families?

A: Families rarely need full access to everything.

A spouse may need financial records but not medical notes. An adult child may need insurance details but not account credentials. A caregiver may need instructions but not legal documents.

Digital safe deposit boxes make it possible to share only what’s needed, reducing both risk and confusion.

Family Scenarios Banks Never Planned For

Q: What are real-life emergencies where digital access matters?

A: Many common family scenarios highlight the limits of physical storage:

A parent hospitalized while traveling.

Proof of medical insurance needed on short notice.

An executor trying to locate documents quickly.

A family dealing with a natural disaster or evacuation.

In these moments, access speed matters more than location security.

Boundaries and Best Practices

Q: Do digital safe deposit boxes replace legal or financial planning?

A: No. They don’t replace wills, trusts, or powers of attorney.

What they do is support those plans by ensuring the right documents can be found and shared when the responsible people need them. They reduce friction, not legal requirements.

Q: What’s the best way for families to use a digital safe deposit box?

A: Families get the most value when they:

Decide who needs access to what.

Review documents at least once a year.

Avoid over-sharing.

Communicate where information is stored and who has access to it.

A digital safe deposit box works best as a shared system, not a private stash.

Final Thoughts

Safe deposit boxes were never designed for modern family life. They assume single ownership and stable circumstances, assumptions that don’t hold up for most households today.

Digital safe deposit boxes evolved to fill that gap. By supporting shared responsibility, controlled access, and continuity over time, they address the practical realities families face every day — not just during emergencies.

For families managing information together, that difference isn’t theoretical. It’s essential.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.