Why the Bank Safe Deposit Box Is Disappearing

|

Trustworthy

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

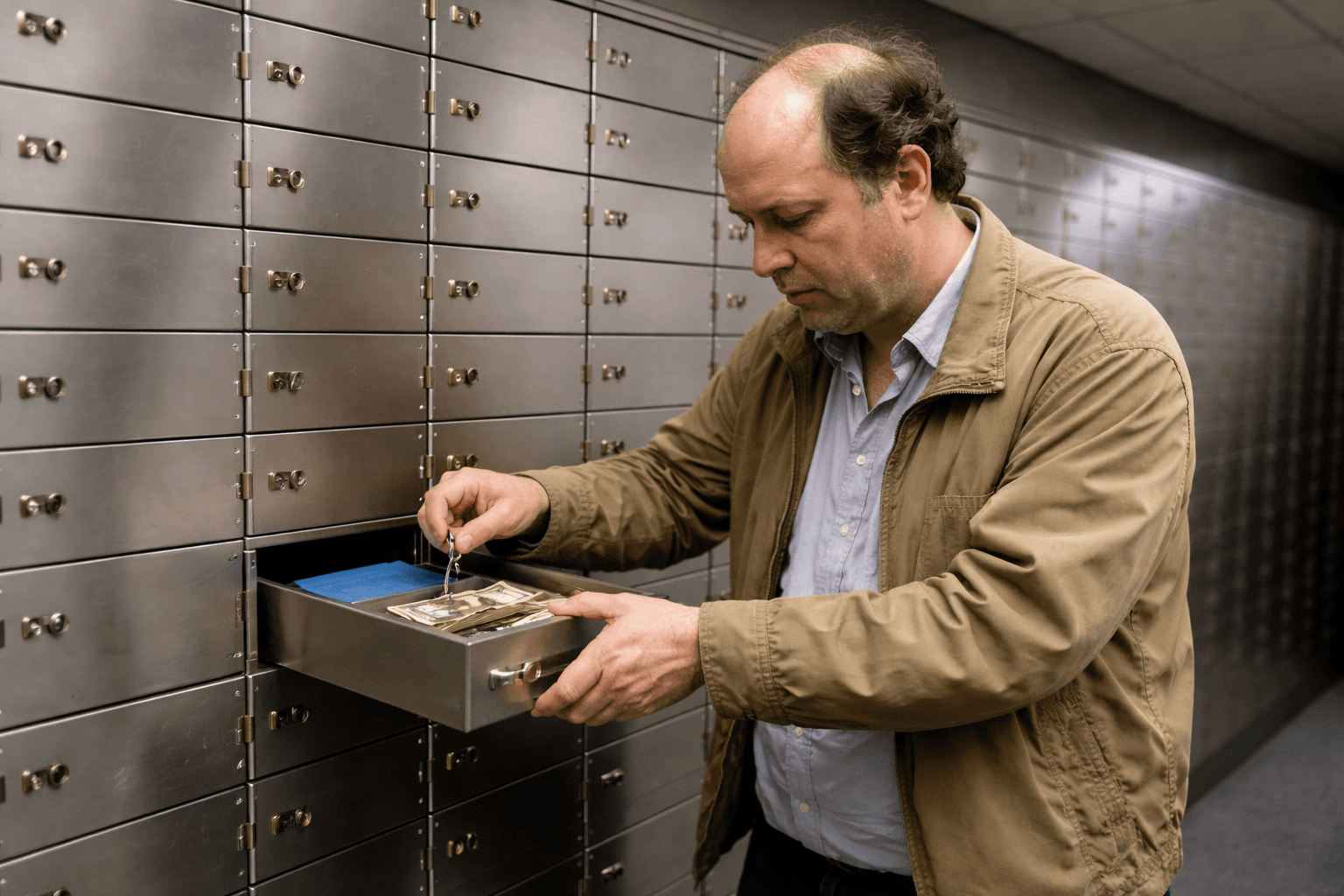

For decades, physical safe deposit boxes were considered a standard way to protect important documents and valuables. But in recent years, many banks have reduced or eliminated their safe deposit box offerings altogether.

That shift has left a lot of people asking why, and what they’re supposed to use instead.

This article explains why banks are moving away from safe deposit boxes, or safety deposit boxes, and what that change means for consumers, and how modern digital alternatives are filling the gap.

The Decline of Physical Safe Deposit Boxes

Q: Are banks really getting rid of safe deposit boxes?

A: Yes. Many banks have reduced the number of locations that offer safe deposit boxes, stopped installing new boxes, or eliminated the service entirely in certain branches.

This isn’t always announced prominently. Instead, customers may discover it when they try to open a box or move to an existing box rental another branch.

The trend reflects broader changes in how people store and manage important information — and how banks evaluate the cost and value of maintaining physical vault space.

Q: Why are fewer people using safe deposit boxes?

A: Demand for physical safe deposit boxes has steadily declined for several reasons.

First, far fewer records are paper-only today. Financial statements, insurance policies, tax documents, and even many legal records are now issued digitally.

Second, people increasingly want remote access. Driving to a bank during limited hours just to retrieve a document no longer fits how most households operate.

Finally, many families realize the benefits of shared access to important information, not single-owner storage — something traditional safe deposit boxes were never designed to support.

Operational Challenges for Banks

Q: What makes safe deposit boxes difficult for banks to maintain?

A: From a bank’s perspective, safe deposit boxes come with several challenges:

They take up physical space that could be used for other services.

They require specialized security and staffing.

They generate relatively little revenue.

They create liability and compliance obligations.

As branches become smaller and more digitally focused, dedicating square footage to vaults that see declining use is harder to justify.

Q: Why haven’t banks modernized safe deposit boxes instead?

A: Physical safe deposit boxes are limited by design. Even with improved security, they’re still tied to a specific location, restricted hours, and in-person access.

Modernizing them would require significant investment without solving the core problem: People no longer want information locked in a place they may not be able to reach when they need it.

Instead of updating an aging system, many banks have chosen to step away from it altogether.

What This Means for Consumers

Q: What happens if your bank no longer offers safe deposit boxes?

A: Consumers are often left with three options:

Keep an existing box but lose access if the branch closes.

Move contents to another bank that still offers boxes.

Find an alternative storage method.

This can be especially disruptive if important documents are involved and no one else knows where they’re stored.

When access matters — during emergencies, travel, or major life events — relying on a shrinking service model introduces risk.

Q: What are people using instead of safe deposit boxes?

A: Many people now turn to digital alternatives that offer secure storage and accessibility, such as Trustworthy's Family Operating System@, a digital vault.

Most people searching for a replacement aren’t looking for a novelty — they’re looking for what they’ve always expected from a safe deposit box, with fewer limitations.

For many families, a modern alternative to a safe deposit box means secure digital storage that can be accessed remotely, shared with trusted people, and updated as life changes.

Why Digital Alternatives Are Filling the Gap

Q: What advantages do digital safe deposit box alternatives offer?

A: Digital alternatives like Trustworthy address the core limitations of physical safe deposit boxes.

They typically provide:

Remote access from anywhere, anytime.

Secure authentication and encryption.

Structured organization by category or person.

Controlled sharing with specific individuals.

Redundancy in case of disaster or loss.

These features align more closely with how families actually use important documents today.

Q: Is this just about convenience, or something bigger?

A: It’s bigger than convenience.

The real shift is from information storage to information management. Physical safe deposit boxes were designed to lock things away.

Modern systems like Trustworthy's are designed to keep information protected and usable, especially during transitions like illness, relocation, or death.

That change reflects how financial, legal, and household responsibilities have evolved over time.

The Future of Document Protection

Q: Are safe deposit boxes becoming obsolete?

A: Not overnight, but their role is shrinking.

As banks continue to streamline physical branches and customers continue to expect digital-first access, the traditional safe deposit box is becoming less central to how people protect important information.

What’s replacing it isn’t just a digital replica of a vault, but systems designed around access, continuity, and real-world use.

Q: What should people consider when choosing an alternative?

A: Instead of asking where documents will live, it’s often more helpful to ask:

Who might need access later?

How quickly could they get access?

What happens if I’m not available to help?

Those questions point directly to why families are rethinking safe deposit boxes — and why digital solutions are increasingly part of the answer.

Final Thoughts

Banks aren’t abandoning safe deposit boxes without reason. The service no longer aligns with how most people manage information, share responsibilities, or handle emergencies. As physical access becomes more limited, the risks of relying on traditional boxes grow.

For many households, the shift away from safe deposit boxes has prompted a broader rethinking of document protection — one that prioritizes secure access, flexibility, and continuity over locked doors and limited hours.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.