Exploring Hospice Care: What’s Not Included?

March 5, 2024

|

Joel Lim

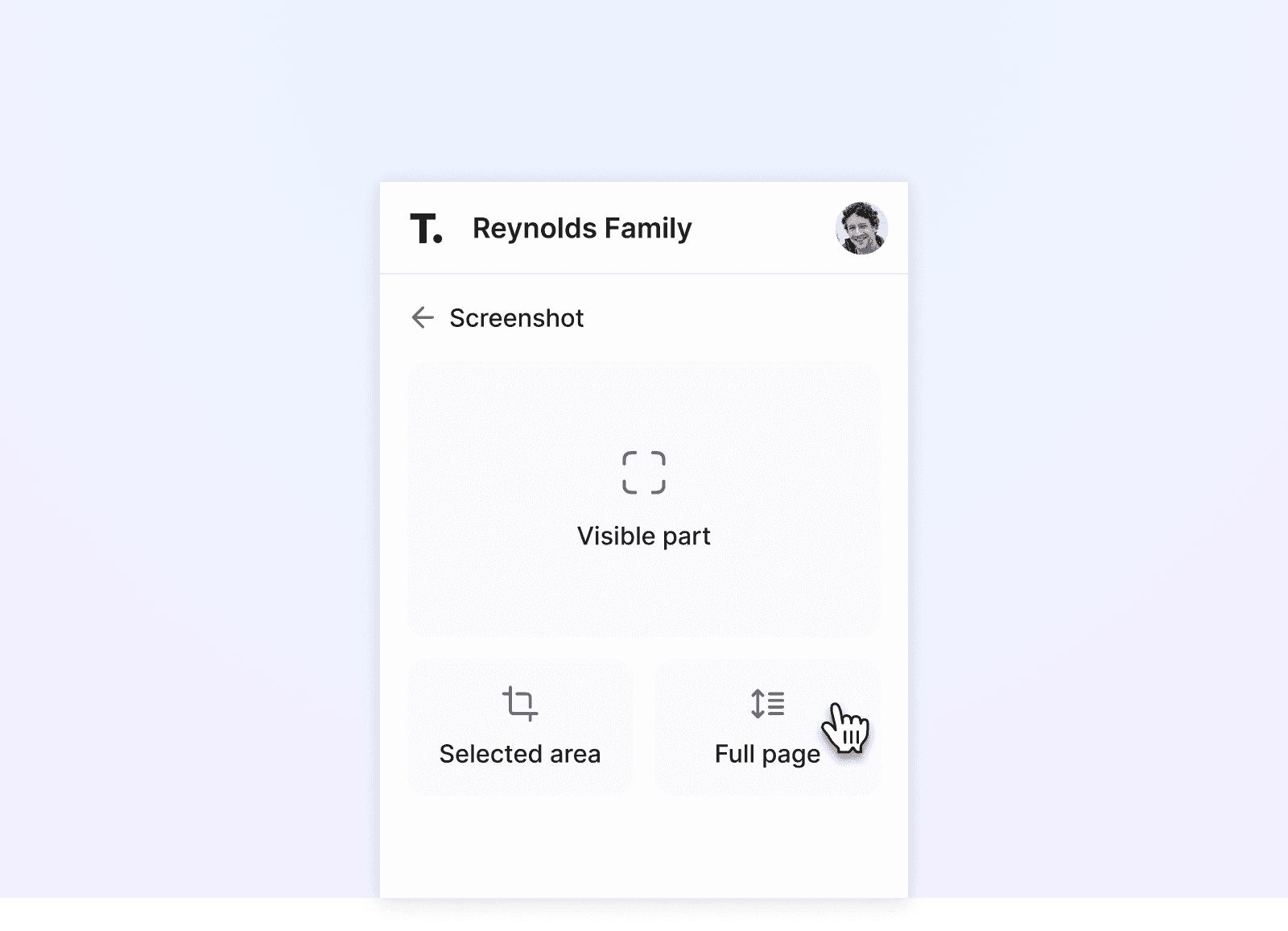

Trustworthy's digital family assistant keeps your important information secure, private, and accessible. Watch to learn more.

If a doctor recommends you or a loved one enter hospice care, it’s common to have a lot of questions. Many people often wonder if hospice is the right choice, and the decision can be overwhelming.

To help navigate this emotional time, we put together this helpful guide on the ins and outs of hospice care. We’ll explore what’s usually included and not included in hospice care and how to decide if it’s right for you. We’ll also share tips on choosing the right hospice for you or your loved one.

Key Takeaways

Hospice care does not usually include primary care, curative treatments, durable medical equipment, and medical transportation, among other things.

Hospice care usually includes nursing visits, symptom management medication, bathing and grooming.

When choosing whether hospice is right for you, consider your doctor's recommendations, cultural practices, and your family’s insights.

What Is Usually Not Included in Hospice Care?

Before deciding on hospice care, you and your family should first understand what’s typically not included. This can help avoid any unpleasant surprises later on. Keep this information in a secure location like Trustworthy in case you need it again.

Primary Care

While hospice care does not usually include primary care, some basic primary care is still offered. It’s focused on providing physical and emotional comfort for pain and other symptoms. This typically includes spiritual support, bereavement counseling, and guidance on making end-of-life decisions.

Other parts of primary care not included in hospice are medical equipment like feeding tubes, ventilators and oxygen tanks, unless this medical equipment is used to give patients comfort.

Curative Treatments

Hospice care intends to allow the patient to have a dignified passing, not to try and cure a terminal illness. So, while a hospice care plan will cater to medication if you are on it, there are certain curative medications or treatments it will not offer.

This includes medication that comes with unwanted side effects and symptoms that can affect the quality of a patient’s life during their final days in hospice care. Examples can include medications and treatments used for non-palliative care like cancer treatment, fertility treatments and organ transplants.

Each hospice makes its own decisions regarding what medication and treatments it offers. Depending on the circumstances, you may be able to arrange an alternative with the hospice and your doctor.

Certain Durable Medical Equipment

We briefly mentioned that hospice does not provide some medical equipment, which is known as durable medical equipment (DME).

DME includes equipment that can help improve a patient’s quality of life, like wheelchairs, oxygen tanks, walkers and hospital beds. Most hospices have this type of medical equipment. However, expensive equipment like motorized scooters, patient lifts, and sleep apnea machines are typically not covered by some hospice care facilities or may be deemed unnecessary by your medical insurance provider.

Smaller, important items that many people overlook are not covered either. This includes items like special bedding, mattresses and pressure cushions. If the equipment does not fit into the standard treatment plan, it’s very likely that hospice will not include it.

Caregiver

While hospice care typically includes the care provided by nurses, doctors, therapists, limited medical equipment, and pharmaceuticals, this does not include a caregiver. If you want 24/7 round-the-clock care, you will need to provide your own caregiver. This person can be a close family member or a friend.

If you or a family member is a caregiver, it’s wise to store all important medical documents and emergency plans in one secure location like Trustworthy. Trustworthy's Family Operating System® lets you collaborate with family members, with controlled access features. You can share important documents and information and rest assured that everything is safe.

Emergency Room Visits

The goal for many hospice care providers is to reduce hospitalizations as much as possible, so they do not include trips to the emergency room. Should the patient have difficulties or pick up an infection, the doctors and nurses within the hospice are contacted. If the illness or symptom is not related to the terminal illness a person is in hospice for, then a trip to the emergency room will be covered.

Medical Transportation

Hospice care does not usually include medical transportation, even though this is an essential part of care. Should you or your loved one need transport to medical appointments and treatments, paying for and providing transport is up to you. This, however, is dependent on the hospice.

What Does Hospice Care Usually Include?

Make a list of what is provided and is not provided in hospice on Trustworthy. You can use the permission features to share this list with other family members.

Karen Rubel, the president and CEO of Nathan Adelson Hospice in southern Nevada, says: “When a patient is receiving hospice care, this interdisciplinary group develops a plan of care. Using the plan, the team coordinates regular nursing visits, assistance with personal care such as bathing, as well as emotional, social, and spiritual support. Prescriptions related to pain and comfort are delivered to the home, along with durable medical equipment such as a hospital bed, nebulizers, walkers, and more.”

Let’s dive deeper into what hospice usually provides during a person’s stay.

Nursing Visits

Because hospice care comforts patients in their final days, nursing visits provide pain and symptom management rather than treatment. Nurses also provide basic training to the caregiver on how to administer medication and use medical supplies.

Medication to Reduce Symptoms

Only medication used to reduce symptoms and provide a better quality of life rather than curing the illness is provided. Patients are provided with medication to try and alleviate this pain to keep them comfortable.

Bathing & Grooming

Many patients who are in hospice are at the end stages of their life, and carrying out activities of daily living (ADL) can become too much. Hospice care will include personal care services like bathing, washing, and other personal hygiene and grooming.

Chaplain

Death can be scary for the patient and their family. Most hospice programs will include some form of spiritual support. This can bring comfort and alleviate the fear of the unknown for many people.

Basic Medical Equipment

We previously mentioned hospice care does not usually include durable medical equipment (DME). Still, sometimes exceptions are made for the basic equipment that provides a comfortable environment for the patient. These include canes, walkers, adult diapers, latex gloves, catheters and hospital beds. It depends on each hospice program.

How to Decide If Hospice Care Is Right for You

Choosing whether to enroll in a hospice care program is a big step in your health journey, and for many, it signifies that the end of life is near. Here are some things you need to consider before making your decision.

Doctor Recommendation & Prognosis

Before you contemplate anything else, assess your own needs first. Are you able to carry out ADL as you could before? Think about your quality of life. Will your illness severely impact this quality of life, and will you or your family members be equipped to deal with it?

If your doctor recommends hospice care, it’s a good indication it may be right for you.

With that said, Dr. Liz of Dr. Liz Geriatrics explains: “There are some doctors that push elders into hospice too quickly. … So, I think it’s good to sometimes get a second opinion.”

However, if you’re pondering whether hospice care is right for you, then usually, the answer is usually yes at that stage.

End-of-Life Cultural Practices

Consider all end-of-life cultural practices relevant to yourself and your family because each culture differs. For example, some cultures may not send their terminal family members to a hospice program. Instead, family members will act as the primary carer, replacing the need for hospice services.

Assess Needs for Symptom Management

Hospice care focuses on providing terminal patients with a comfortable and as pain-free as possible end of life. Consider the diagnosis and symptoms. Can you manage symptoms successfully? If you have a lot of pain, hospice care can help alleviate it effectively.

Review Insurance Coverage

Review your public and private coverage (including Medicare, Medicaid, and private insurance) to ensure hospice care is covered.

You may also have to meet certain requirements to qualify like with Medicare, and you must be aware of the limits outlined in your coverage. This will help you prepare financially and avoid any nasty surprises.

Use Trustworthy to file your insurance policies in a secure and organized location should your next of kin need these documents.

Listen to Loved Ones

You don’t have to make this decision on your own. Talk with your loved ones and find out what they feel about you going into hospice. Just remember, while it’s encouraged to listen to your family’s thoughts, fears, and opinions, the decision is ultimately yours.

How to Choose the Right Hospice for You

So, you’ve decided that you are ready to join a hospice care program, but how do you know which hospice to choose? We put together some helpful tips you can use to find the right hospice for you.

Assess Personal Needs

First, you need to assess your personal needs. Consider what services and care you will need and your symptoms. Are you at the point in your illness that you need assistance with ADL, counseling services or respite care? Choose a hospice that meets all your personal needs.

Gather Recommendations From Your Doctor

Chat with your doctor about which hospice they suggest. Your primary doctor knows you and has plenty of experience dealing with terminal illnesses, so they’ll usually have some appropriate recommendations you can trust.

Evaluate Hospice Credentials

Before you make your decision, you should check out the hospice credentials to see if they are reputable. If your medical insurance covers your stay at a certain hospice, this indicates a hospice with good credentials.

Evaluate Financial Considerations

Before you make your choice, consider your finances. Does your medical insurance provide coverage for hospice care? Are there any limits to coverage? Consider the out-of-pocket costs you may need to pay and any other costs you may incur.

Making the Final Choice

Consider all the above to make your final choice. However, when you make your final decision, just ensure you’re completely sure of your choice. Your stay in hospice is supposed to provide comfort and some level of peace as you live through your final days.

Frequently Asked Questions

What are the 3 disadvantages of hospice?

The three disadvantages of hospice care include the forgoing of curative treatment, and that there’s no caregiver or hospitalizations included.

Why would someone not want hospice?

For some, the fear of giving up curative treatments may prevent them from wanting hospice, while others may simply be unaware of the many benefits of hospice care.

Which is better, palliative care or hospice?

If you’re seeking a higher quality of life while receiving curative treatments, you may find that palliative care is better.

What is the step before hospice?

The first step before entering into hospice care is being certified by your doctor that you have six months or less to live.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.